This Week’s News Digest from MetaverseTrendsHub

The convergence of blockchain technology, artificial intelligence, and the metaverse continues to reshape our digital landscape at an unprecedented pace. This week, MetaverseTrendsHub has delivered a comprehensive look at the most significant developments spanning from NFT art monetization to billion-dollar franchise blockchain integration. In this detailed digest, we explore the ten most recent articles that are defining the future of Web3, DeFi, and digital creative economies.

💡 Watch the video to find out more!

Before diving into this week’s deep dive on blockchain and Web3 breakthroughs, watch our video summary for a quick overview of all the major highlights.

It’s the fastest way to catch up on the trends, stories, and analysis featured in this digest!

🎧 Listen to the audio too!

Enjoy our new podcast episode, inspired by this week’s blog article!

Join John and Lila as they dive into the hottest Web3 and blockchain news in an engaging, dialogue-style format.

Listen in for lively discussions, fresh insights, and fun moments before you read the details below!

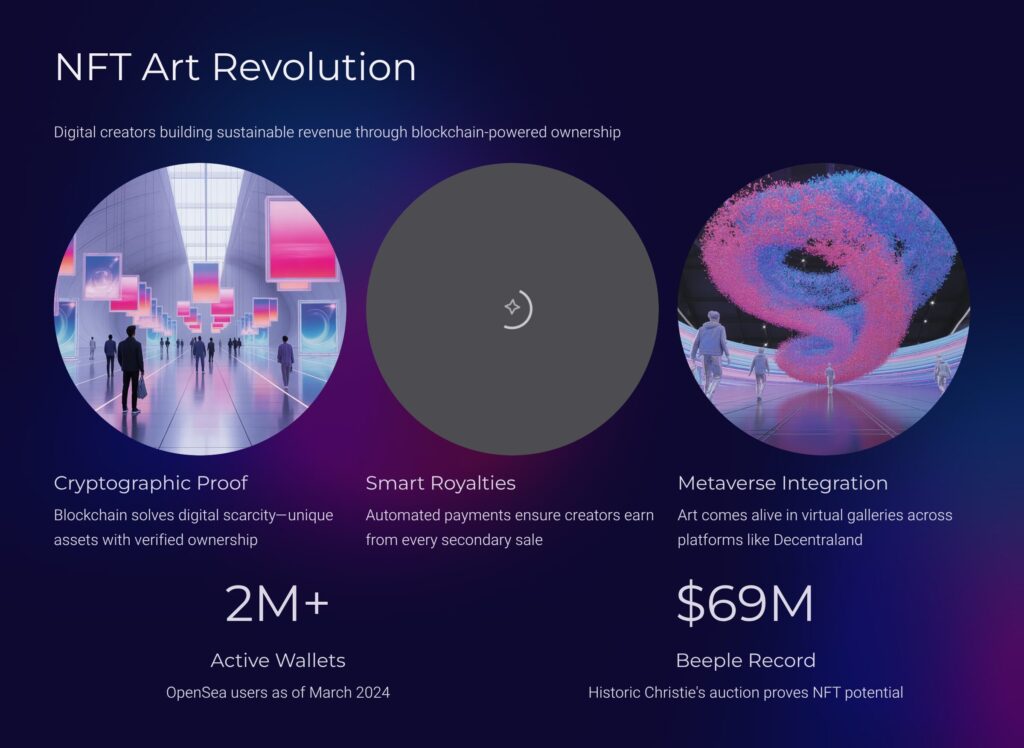

1. NFT Art Revolution: Empowering Digital Creators with Blockchain Monetization

The NFT art space has evolved dramatically since its explosive introduction to mainstream consciousness in 2021, when Beeple’s historic $69 million Christie’s auction demonstrated the revolutionary potential of blockchain-based digital art ownership. Today’s landscape reveals a more mature ecosystem where creators are building sustainable revenue streams through sophisticated tokenization strategies.

The foundation of this revolution rests on blockchain technology’s ability to solve the fundamental problem of digital scarcity. Traditional digital art could be endlessly copied without attribution or compensation to creators. NFTs provide cryptographic proof of ownership and authenticity, creating unique digital assets that can be bought, sold, and traded while ensuring creators receive royalties on secondary sales.

Current market dynamics show over 2 million active wallets on platforms like OpenSea as of March 2024, with partnerships between major platforms enhancing creator visibility and accessibility. The integration of layer-2 solutions like Polygon has dramatically reduced transaction costs, making NFT creation and trading accessible to a broader creator base.

The technological architecture supporting this revolution includes Ethereum’s ERC-721 standard for unique tokens, smart contracts that automate royalty distributions, and emerging cross-chain bridges that enable asset portability across different blockchain networks. Metaverse integration has added another dimension, allowing NFT art to function as virtual gallery pieces in platforms like Decentraland and The Sandbox.

For creators entering this space, the pathway involves choosing appropriate minting platforms, connecting digital wallets, setting royalty percentages, and building community engagement. Success stories demonstrate that consistent quality output combined with strategic community building often outperforms one-time viral releases.

Source: NFT Art Revolution: Making a Living as a Digital Creator

2. Bitcoin’s Digital Gold Narrative: Unpacking the Store of Value Proposition

Bitcoin’s evolution from experimental digital currency to “digital gold” represents one of the most significant financial narratives of the 21st century. This transformation stems from Bitcoin’s fundamental scarcity model—a hard cap of 21 million coins enforced by its underlying code—which mirrors gold’s finite supply on Earth.

The digital gold narrative gained prominence during Bitcoin’s price surge in 2017, but its roots trace back to the first halving event on November 28, 2012, which reduced mining rewards and emphasized scarcity. This deflationary mechanism, repeated every four years, creates supply shocks that historically correlate with significant price appreciation.

Bitcoin’s technological foundations support its store of value proposition through decentralization, proof-of-work consensus, and cryptographic security. Unlike traditional assets controlled by central authorities, Bitcoin operates on a distributed network where no single entity can manipulate supply or demand artificially.

Recent developments include the approval of Bitcoin ETFs in January 2024, marking institutional acceptance of Bitcoin as a legitimate asset class. The integration of second-layer solutions like the Lightning Network addresses scalability concerns while maintaining the base layer’s security and decentralization properties.

Market dynamics show Bitcoin’s correlation with traditional risk assets has decreased during periods of economic uncertainty, supporting its role as a hedge against inflation and currency debasement. However, volatility remains a significant factor, with Bitcoin experiencing both dramatic rallies and sharp corrections throughout its history.

The growing institutional adoption includes corporate treasury holdings, pension fund allocations, and integration into traditional financial products. This institutional embrace represents a maturation of the digital gold narrative from retail speculation to institutional asset allocation.

Source: Bitcoin: Unpacking the “Digital Gold” Narrative

3. CoinPoker’s PLO Revolution: World’s First Cash Game Championship

The intersection of cryptocurrency and online gaming reaches a new milestone with CoinPoker’s announcement of the world’s first Pot-Limit Omaha (PLO) Cash Game World Championship. This groundbreaking event, running from October 6 to November 2, 2025, represents a significant evolution in crypto-powered online poker platforms.

Pot-Limit Omaha differs from traditional Texas Hold’em by dealing four hole cards to each player instead of two, requiring exactly two hole cards to be used with three community cards. This creates more complex decision-making and typically results in larger pots and more action-packed gameplay.

CoinPoker’s platform leverages blockchain technology to ensure transparent and secure gameplay through decentralized verification systems. The use of cryptocurrency for deposits, bets, and withdrawals eliminates traditional banking limitations while providing global accessibility for players in jurisdictions where online poker is legal.

The championship features rake-free tables at $500 and $2,000 buy-ins, meaning no house fees are deducted from pots, significantly increasing player value. Over $55,000 in total prizes includes a $15,000 Rolex watch for the overall champion, with weekly prizes and VIP experiences for top leaderboard performers.

The event’s format as a cash game championship rather than a tournament structure allows players to join and leave tables at will, with performance tracked through comprehensive leaderboards measuring factors like hands played, profits, and consistency. Live streaming provides transparency and entertainment value for the broader poker community.

This innovation reflects the broader trend of traditional gaming industries adopting blockchain technology for enhanced security, transparency, and global accessibility. The success of this championship could establish a precedent for future crypto-powered gaming events across various disciplines.

Source: CoinPoker Announces World’s First PLO Cash Game World Championship!

4. MEXC and Falcon Finance: $1 Million USDf Campaign Launch

The collaboration between MEXC exchange and Falcon Finance for their USDf campaign represents a significant development in the stablecoin ecosystem, particularly in the realm of real-world asset (RWA) tokenization. The campaign, launched October 3, 2025, with a substantial $1 million prize pool, aims to promote adoption of USDf through innovative incentive structures.

USDf represents a new generation of stablecoins backed by the Universal Collateralization Infrastructure developed by Falcon Finance. Unlike traditional stablecoins backed solely by fiat currencies or crypto assets, USDf can be collateralized using tokenized real-world assets, creating a bridge between physical and digital value storage.

The technical innovation lies in Falcon Finance’s overcollateralization model, where users must deposit assets worth more than the USDf they mint. This approach provides stability buffers against market volatility while enabling diverse asset backing, from traditional cryptocurrencies to tokenized real estate or commodities.

Campaign features include zero-fee trading on specific pairs (FF/USDT, FF/USDf, BTC/USDf, ETH/USDf, USDC/USDf, and USDf/USDT), high-yield staking opportunities with up to 200% APR, and exclusive rewards for both new and existing users. The distribution includes trading rewards up to 150,000 USDT, new user bonuses totaling 100,000 tokens, and additional airdrops and lottery events.

The partnership leverages MEXC’s global exchange infrastructure with over 10 million users and Falcon Finance’s innovative collateralization technology. This combination provides the liquidity and user base necessary for successful stablecoin adoption while demonstrating real-world utility for tokenized assets.

Regulatory considerations remain important, as stablecoin regulations vary significantly across jurisdictions. Users must verify compliance with local laws before participating, particularly regarding stablecoin usage and DeFi protocol interactions.

Source: MEXC & Falcon Finance Launch $1M USDf Campaign: Win Big!

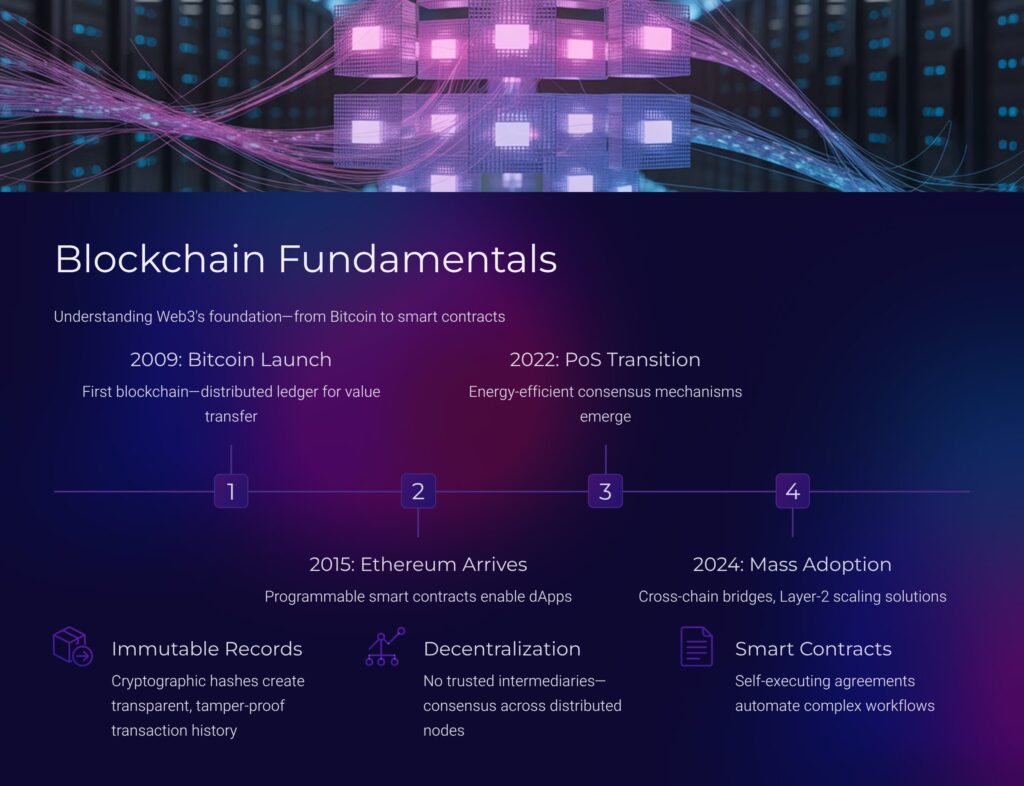

5. Blockchain Fundamentals: A Comprehensive Beginner’s Guide to Web3 Foundation

Understanding blockchain technology remains crucial for anyone seeking to navigate the Web3 ecosystem effectively. As the foundational technology underlying cryptocurrencies, NFTs, DeFi, and the metaverse, blockchain represents a paradigm shift from centralized to decentralized digital systems.

At its core, blockchain functions as a distributed ledger technology where transactions are recorded across multiple computers in a network. Each block contains transaction data, timestamps, and cryptographic hashes linking it to previous blocks, creating an immutable chain of records. This structure ensures transparency, security, and decentralization without requiring trusted intermediaries.

The evolution from Bitcoin’s original implementation in 2009 to today’s sophisticated smart contract platforms like Ethereum demonstrates blockchain’s expanding capabilities. The introduction of programmable contracts in 2015 enabled decentralized applications (dApps) and automated agreement execution, vastly expanding blockchain utility beyond simple value transfer.

Current architectural developments focus on scalability solutions including layer-2 networks, sharding, and alternative consensus mechanisms. Proof-of-stake networks like those adopted by Ethereum in September 2022 offer energy efficiency improvements while maintaining security properties. Cross-chain bridges and interoperability protocols enable asset and data transfer between different blockchain networks.

Use cases extend far beyond cryptocurrency into supply chain management, digital identity, voting systems, and intellectual property protection. In gaming, blockchain enables true asset ownership and cross-platform item portability. Healthcare applications include secure patient data management and pharmaceutical supply chain verification.

The community ecosystem includes millions of developers contributing to open-source projects, with thousands of active GitHub repositories and regular conferences like Devcon fostering collaboration and innovation. Governance through decentralized autonomous organizations (DAOs) allows community-driven protocol development and decision-making.

Source: Blockchain Explained: A Beginner’s Guide to Web3’s Foundation

6. VS1 Launch: Institutional DeFi Revolution on XRP Ledger

The launch of VS1 as a comprehensive institutional DeFi hub on the XRP Ledger marks a significant milestone in bridging traditional finance with decentralized protocols. This development, announced October 2, 2025, represents the first institutional-grade DeFi platform specifically designed for the XRPL ecosystem.

VS1’s architecture integrates artificial intelligence-driven trading strategies and risk management systems tailored for institutional requirements. The platform combines the XRP Ledger’s inherent advantages of speed, low costs, and energy efficiency with sophisticated financial tools previously available only in traditional markets.

The XRP Ledger’s institutional DeFi roadmap, unveiled in February 2025, includes automated market makers (AMMs), price oracles, and tokenization frameworks for real-world assets. VS1 builds upon this foundation by providing a comprehensive suite of services including yield generation, risk controls, and compliance tools necessary for regulated financial institutions.

Key features include AI-optimized trading algorithms that analyze market data for automated decision-making, yield farming opportunities that generate returns through various DeFi protocols, and institutional-grade security measures including multi-signature controls and audit trail capabilities. The platform’s integration with XRPL’s native features enables rapid settlement and minimal transaction costs.

The timing coincides with growing institutional interest in DeFi protocols, driven by the potential for higher yields and operational efficiency compared to traditional financial systems. Recent data shows over $1 billion in monthly stablecoin volumes on XRPL, indicating strong institutional adoption momentum.

Regulatory compliance remains paramount, with VS1 incorporating features designed to meet various jurisdictional requirements. The platform’s development aligns with Ripple’s broader strategy of fostering regulated blockchain adoption in traditional financial institutions.

The launch positions XRPL as a serious contender in the institutional DeFi space, competing with established platforms like Ethereum and newer purpose-built networks. The combination of technical capabilities, regulatory focus, and institutional features addresses many barriers that have prevented traditional finance adoption of DeFi protocols.

Source: VS1 Launches: Institutional DeFi Revolution on the XRP Ledger

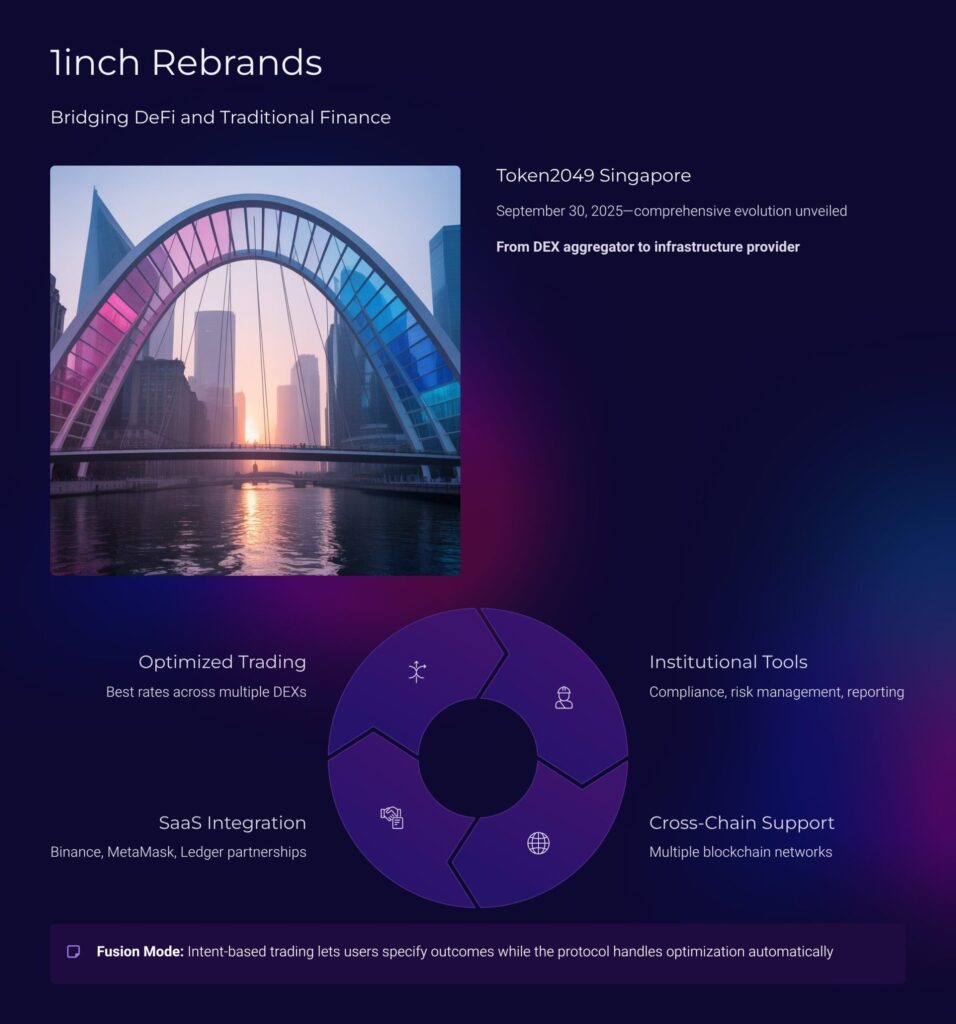

7. 1inch Rebranding: Bridging DeFi and Traditional Finance

The comprehensive rebranding of 1inch, unveiled at Token2049 Singapore on September 30, 2025, signals the platform’s evolution from a decentralized exchange aggregator to a comprehensive infrastructure provider bridging DeFi and traditional finance. This strategic repositioning addresses the growing need for seamless integration between decentralized and centralized financial systems.

Since its 2019 launch, 1inch has established itself as a leading DEX aggregator, optimizing trades across multiple decentralized exchanges to ensure users receive the best possible rates. The platform’s technical innovation includes pathfinding algorithms that split orders across multiple liquidity sources and advanced routing that minimizes slippage and maximizes efficiency.

The rebranding encompasses a complete visual identity overhaul, streamlined user interfaces, and enhanced messaging focused on accessibility for both retail and institutional users. The new design philosophy emphasizes simplicity and usability, addressing common barriers that prevent mainstream adoption of DeFi protocols.

1inch’s software-as-a-service (SaaS) model has gained significant traction, with integrations into major platforms including Binance, MetaMask, and Ledger. This B2B approach allows other companies to incorporate 1inch’s aggregation technology without building complex trading infrastructure from scratch.

The expanded mission focuses on creating interoperability between DeFi and traditional finance systems. This includes developing tools that enable institutional participation in DeFi while maintaining compliance with regulatory requirements. The platform’s cross-chain capabilities support multiple blockchain networks, reducing friction for users operating across different ecosystems.

Security enhancements include improved smart contract auditing, bug bounty programs, and partnerships with leading security firms. The platform’s Fusion Mode introduces intent-based trading, where users specify desired outcomes rather than specific execution paths, with the protocol handling optimization automatically.

Future developments may include additional institutional-grade features such as compliance reporting, advanced risk management tools, and integration with traditional banking systems. The rebranding positions 1inch to capitalize on the growing convergence of DeFi and traditional finance.

Source: 1inch’s Rebrand: DeFi’s Bridge to Global Finance

8. ANYBODY’s Vietnam Expansion: Asia AIGC Summit and Headquarters Launch

The Asia AIGC Summit held in Ho Chi Minh City on September 20, 2025, combined with ANYBODY’s Vietnam headquarters grand opening, represents a significant milestone in the convergence of artificial intelligence and creative industries across the Asian market. The event attracted over 1,000 attendees from 20 countries, highlighting the region’s growing importance in AI-generated content innovation.

AIGC (AI-Generated Content) represents the next evolution in digital content creation, where artificial intelligence tools can produce images, videos, music, and text from simple user prompts. This technology democratizes content creation by reducing technical barriers and enabling rapid iteration and experimentation.

ANYBODY’s platform has established itself as a comprehensive ecosystem for AIGC applications, providing tools that bridge the gap between complex AI technologies and practical creative applications. The Vietnam headquarters opening positions Southeast Asia as a strategic hub for AI innovation, leveraging the region’s growing tech talent pool and increasing investment in AI infrastructure.

The summit showcased practical applications of AIGC in entertainment, marketing, and media production. Demonstrations included AICEAN Studio, which enables users to create professional-quality videos, images, and music through natural language prompts. These tools represent a significant advancement in accessibility, allowing creators without technical backgrounds to produce sophisticated content.

Integration with Web3 technologies adds another dimension to AIGC applications. Blockchain-based ownership verification ensures creators maintain rights to their AI-generated content, while NFT marketplaces provide monetization opportunities for unique AI-generated assets. This combination addresses concerns about intellectual property and compensation in the AI era.

The choice of Vietnam as a regional headquarters reflects the country’s strategic advantages: a young, tech-savvy population, government support for digital transformation initiatives, and competitive operational costs. Ho Chi Minh City’s emerging status as a regional tech hub provides access to both local talent and international markets.

Future implications include expanded AIGC adoption across Asian creative industries, increased collaboration between AI researchers and content creators, and potential standardization of AI-generated content ownership and attribution systems.

Source: ANYBODY Drives the Future: Asia AIGC Summit & Vietnam HQ Launch

9. Solo Leveling’s Blockchain Evolution: Billion-Dollar Franchise Goes Onchain

The partnership between Solo Leveling and Story Protocol, announced October 1, 2025, marks a groundbreaking moment in the integration of traditional entertainment franchises with blockchain technology. This collaboration demonstrates how billion-dollar intellectual properties can leverage Web3 infrastructure to enhance fan engagement and create new revenue streams.

Solo Leveling’s journey from Korean webnovel to global phenomenon illustrates the power of digital-first entertainment. Since its 2016 debut, the franchise has accumulated over 14 billion global views, expanded into anime that broke Crunchyroll viewership records, and generated over $70 million from game launches. The Netflix series adaptation further solidifies its position as a premier global entertainment property.

Story Protocol represents a revolutionary approach to intellectual property management on blockchain. Rather than simply tokenizing existing assets, the protocol enables programmable IP that can be licensed, remixed, and monetized through smart contracts. This creates new possibilities for fan-generated content while maintaining rights holders’ control and compensation structures.

The technical implementation involves tokenizing select Solo Leveling IP elements as programmable assets on the blockchain. This enables automatic royalty distribution when fans create derivative works, ensuring original creators benefit from community-driven content expansion. Smart contracts handle licensing agreements, eliminating intermediaries and reducing friction for legitimate fan creations.

Potential applications include fan-driven story remixing, where community members can create official alternate storylines using established characters and settings. Blockchain-based gaming integration could enable cross-platform item portability and verified asset ownership. Digital collectibles and metaverse experiences could provide immersive fan engagement opportunities.

The Solo Leveling franchise previously explored Web3 through a 2024 Avalanche partnership that created the “Solo Leveling: Unlimited” NFT platform. The Story Protocol collaboration represents a more sophisticated approach, focusing on IP programmability rather than simple collectible tokenization.

This partnership could establish a blueprint for how major entertainment properties can integrate blockchain technology meaningfully. Success could inspire other billion-dollar franchises to explore similar blockchain-based fan engagement and monetization strategies.

Source: Solo Leveling Goes Onchain: How a Billion-Dollar Franchise is Revolutionizing Storytelling

10. Market Analysis: BlockDAG’s F1 Sponsorship vs. Aave’s DeFi Dominance vs. Bitcoin’s $126K Prediction

The cryptocurrency market continues to present diverse investment narratives, with BlockDAG’s Formula 1 sponsorship, Aave’s DeFi market leadership, and Bitcoin’s ambitious price predictions representing three distinct approaches to blockchain value creation. Each presents unique risk-reward profiles and market positioning strategies.

BlockDAG’s multi-year sponsorship with BWT Alpine F1 Team, announced September 30, 2025, represents a significant marketing investment aimed at mainstream audience exposure. The directed acyclic graph (DAG) technology underlying BlockDAG promises faster transaction processing compared to traditional linear blockchain architectures. The project has raised over $415 million in presale funding, indicating strong initial investor interest.

The F1 sponsorship strategy follows successful precedents set by crypto companies like Crypto.com, which gained significant brand recognition through sports partnerships. Formula 1’s global audience of hundreds of millions provides exposure beyond typical cryptocurrency demographics, potentially driving mainstream adoption and user base expansion.

Aave has established itself as the dominant force in decentralized finance lending, commanding approximately 70% market share in flash loans and maintaining strong positions across multiple blockchain networks. The protocol’s success stems from innovative features like variable interest rates, flash loans, and comprehensive risk management systems.

The platform’s expansion to multiple blockchain networks including Ethereum, Polygon, and Avalanche provides users with options for different cost and speed requirements. Aave’s governance token (AAVE) enables community participation in protocol development and fee structure decisions, creating alignment between users and token holders.

Bitcoin’s $126K price prediction, based on technical analysis including cup-and-handle patterns identified by analysts like Gert van Lagen, represents the continuation of Bitcoin’s store-of-value narrative. The prediction relies on historical patterns and cycle theory, though cryptocurrency markets remain inherently unpredictable.

Comparing these opportunities reveals different investment philosophies: BlockDAG focuses on technological innovation and marketing reach, Aave provides utility-driven value through DeFi services, and Bitcoin offers potential large-scale appreciation based on adoption and scarcity. Each requires different risk tolerances and time horizons for optimal outcomes.

Source: Bitcoin Soars to $126K? BlockDAG’s F1 Sponsorship vs. DeFi’s Aave: Profit Potential?

Conclusion: Navigating the Web3 Evolution

This week’s digest from MetaverseTrendsHub reveals a cryptocurrency and blockchain ecosystem in rapid maturation. From NFT art monetization and institutional DeFi platforms to billion-dollar franchise blockchain integration, the industry continues expanding beyond speculative trading toward practical utility and mainstream adoption.

The recurring themes include the democratization of previously exclusive financial services, the convergence of traditional entertainment with blockchain technology, and the ongoing development of user-friendly interfaces that reduce technical barriers to Web3 participation. These developments suggest a future where blockchain technology becomes seamlessly integrated into daily life rather than remaining a specialized technical domain.

The success stories highlighted—from 1inch’s institutional bridging efforts to Solo Leveling’s IP tokenization—demonstrate that sustainable blockchain applications focus on solving real problems rather than creating artificial scarcity or speculation. The emphasis on compliance, security, and user experience reflects an industry learning from past mistakes and building for long-term stability.

As we continue monitoring these developments, the key to successful Web3 participation appears to lie in understanding fundamental technologies, maintaining security best practices, and focusing on utility-driven rather than hype-driven opportunities. The blockchain revolution is transitioning from promise to practice, creating genuine value for users willing to engage thoughtfully with emerging technologies.