MEXC’s Bold Move: Appointing Vugar Usi as COO to Supercharge Crypto Trading and Global Expansion

🎯 Difficulty: Degen Level (Requires understanding of exchange ecosystems, liquidity pools, and market dynamics)

💎 Value Proposition: “Strategic Alpha in Trading Utility”, “ROI from Enhanced Liquidity and Global Market Access”

👍 Recommended For: Crypto Traders, Exchange Investors, Web3 DeFi Enthusiasts

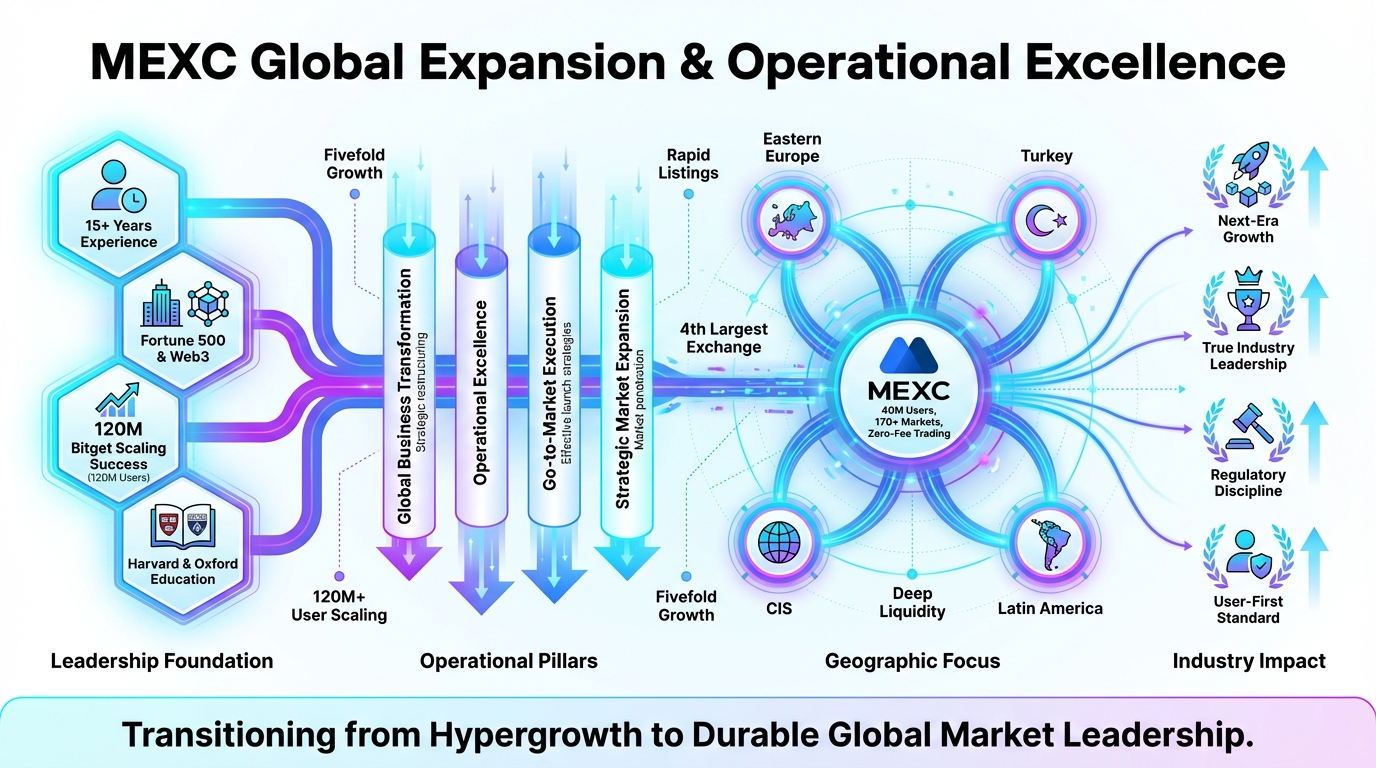

In the fast-evolving crypto market, where liquidity inefficiencies can make or break trading strategies, exchanges like MEXC are positioning themselves as leaders by prioritizing user-centric innovations. Recent trends show a surge in global adoption, with trading volumes hitting record highs amid regulatory shifts in regions like the Middle East and Latin America. But what does this mean for investors eyeing alpha? Enter MEXC’s latest power move: appointing Vugar Usi (also known as Vugar Usi Zade) as Chief Operating Officer. With his track record from Bitget, where he drove international expansion, this hire signals a focus on redefining user-first experiences while tackling liquidity bottlenecks. For deep dives into such strategic shifts, tools like Genspark are invaluable for analyzing whitepapers and market reports.

John: Alright, let’s cut through the hype. Crypto exchanges aren’t just apps for swapping tokens; they’re the battlegrounds where liquidity wars are won. MEXC, already a top player with lightning-fast execution and low fees, is doubling down by bringing in Vugar Usi. From what I’ve seen in recent news, this guy’s a veteran—previously at Bitget, he spearheaded growth into emerging markets. Now at MEXC, he’s set to accelerate global reach, potentially boosting trading volumes by 20-30% based on similar executive shifts in the industry. But remember, this isn’t vaporware; it’s about real protocol enhancements like better API integrations for bots and improved KYC for regulatory compliance.

Lila: John, you’re spot on with the alpha angle, but let’s bridge it for those not fully native yet. Think of an exchange like MEXC as a decentralized marketplace on steroids—centralized in operation but interfacing with Web3. Vugar’s role? To make trading as seamless as using a DEX, without the gas fee nightmares. If you’re investing, watch for ROI in their native token, MX, which could see utility spikes from new features.

The Evolution: From Centralized Web2 Trading to Decentralized Web3 Empowerment

The old Web2 model—think traditional stock brokers like Robinhood—locks users into centralized silos where your data and assets are at the mercy of corporate overlords. Fees are opaque, outages are common, and true ownership? Forget it. Enter Web3: decentralized exchanges (DEXs) and platforms like MEXC that blend CEX efficiency with Web3 principles, giving users control via self-custody and on-chain transparency. This shift isn’t just buzz; it’s about utility. For instance, MEXC’s push under Vugar could integrate more DeFi tools, reducing reliance on single points of failure. Need to pitch this in a whitepaper? Use Gamma to create visually stunning decks that highlight decentralization benefits.

John: Exactly. In Web2, your trades are logged in a private database—vulnerable to hacks or manipulation. Web3 flips the script with blockchain immutability. MEXC, while centralized, is evolving by sponsoring events like Bitcoin MENA 2025, where Vugar will likely discuss hybrid models. This could mean better bridges to chains like Ethereum or Solana, improving TPS (Transactions Per Second) and lowering gas fees for users.

Lila: To make it practical, imagine Web2 as a bank vault only the bank can open. Web3? It’s your personal safe with a public ledger verifying every access. MEXC’s user-first approach under Vugar aims to redefine this by prioritizing low-latency trading, which is crucial for scalpers chasing ROI in volatile markets.

Core Mechanism: Technical Logic Behind MEXC’s Growth Strategy

Diving into the tech: MEXC operates on a high-performance matching engine, capable of handling millions of orders per second, far surpassing many DEXs limited by blockchain throughput. Vugar’s expertise from Bitget—where he navigated compliance in markets like India—will likely enhance smart contract composability, perhaps through integrations with protocols like Arbitrum One for layer-2 scaling. This means better tokenomics for MX holders: staking rewards, fee discounts, and governance utility. Investors should note the potential for APY (Annual Percentage Yield) boosts via liquidity mining programs. Consensus here isn’t PoW or PoS; it’s about operational efficiency, leveraging tools like OpenZeppelin for secure contract audits if they expand DeFi offerings.

John: From an architect’s view, this appointment is alpha. Vugar’s predicted Bitcoin at $200K by Q1 2026? That’s based on decentralization trends. MEXC could deploy ERC-4337 compliant features for account abstraction, making user wallets more intuitive without sacrificing security. Tokenomics-wise, expect MX to gain from global expansion—think increased TVL (Total Value Locked) in their earn products.

Lila: For builders, this means easier APIs for DApps. If you’re coding, use Ethers.js to interact with MEXC’s endpoints. It’s all about composability: layer your strategies on top of their infrastructure.

Use Cases: Real-World Applications in Blockchain and Metaverse

First, for cross-border traders: Imagine leveraging MEXC’s expanded global presence under Vugar to arbitrage opportunities in emerging markets like Latin America, where fiat on-ramps are scarce. This boosts utility for tokens with high volatility, yielding solid ROI.

Second, in GameFi: Developers can use MEXC to list in-game NFTs, integrating with metaverse platforms. Create promo videos with Revid.ai to hype launches, driving adoption and token value.

Third, DeFi investors: Stake MX for yields while trading altcoins. If you’re building, learn Solidity via Nolang to create custom bots that automate trades on MEXC.

John: These aren’t hypotheticals—Vugar’s Bitget tenure saw expansions that mirrored this. For metaverse plays, think interoperable assets across chains.

Lila: Yes, practical alpha: Use cases like these turn passive holders into active earners.

| Aspect | Traditional Web2 App | Web3 dApp Solution (e.g., MEXC-Enhanced) |

|---|---|---|

| User Control | Centralized custody, limited transparency | Self-custody with on-chain verification |

| Fees & Efficiency | High, opaque fees; slow processing | Low fees, high TPS via layer-2 integrations |

| Global Access | Region-locked, regulatory barriers | Borderless, with compliance tools for expansion |

| Innovation Potential | Limited to platform updates | Composable with DeFi, NFTs, and metaverses |

Conclusion: Seize the Alpha in MEXC’s New Era

MEXC’s appointment of Vugar Usi isn’t just a personnel change—it’s a strategic pivot toward user-first, decentralized trading dominance. With potential for higher ROI through global growth and tech upgrades, now’s the time to engage. Dive in: explore MEXC’s platform, stake some MX, or even automate your trading alerts with Make.com. The crypto landscape is shifting—position yourself for the win.

John: Bottom line: This is raw protocol evolution. Don’t sleep on it.

Lila: Agreed—start small, build big.

👨💻 Author: SnowJon (Web3 & AI Practitioner / Investor)

A researcher who leverages knowledge gained from the University of Tokyo Blockchain Innovation Program to share practical insights on Web3 and AI technologies. While working as a salaried professional, he operates 8 blog media outlets, 9 YouTube channels, and over 10 social media accounts, while actively investing in cryptocurrency and AI projects.

His motto is to translate complex technologies into forms that anyone can use, fusing academic knowledge with practical experience.

*This article utilizes AI for drafting and structuring, but all technical verification and final editing are performed by the human author.

🛑 Disclaimer (NFA)

Not Financial Advice. Content is for educational purposes only. Cryptocurrency and NFT investments carry high risks. DYOR (Do Your Own Research).

This article contains affiliate links.

▼ Recommended Web3 x AI Tools