Unlocking Alpha in Crypto Listings: MEXC’s November Report Reveals 1,329% Average Peak Returns on Top New Tokens

🎯 Difficulty: Degen Level (Requires market analysis skills and risk tolerance)

💎 Value Proposition: High-ROI Opportunities through Early Token Listings and Market Narratives

👍 Recommended For: Token Investors, Day Traders, DeFi Yield Farmers

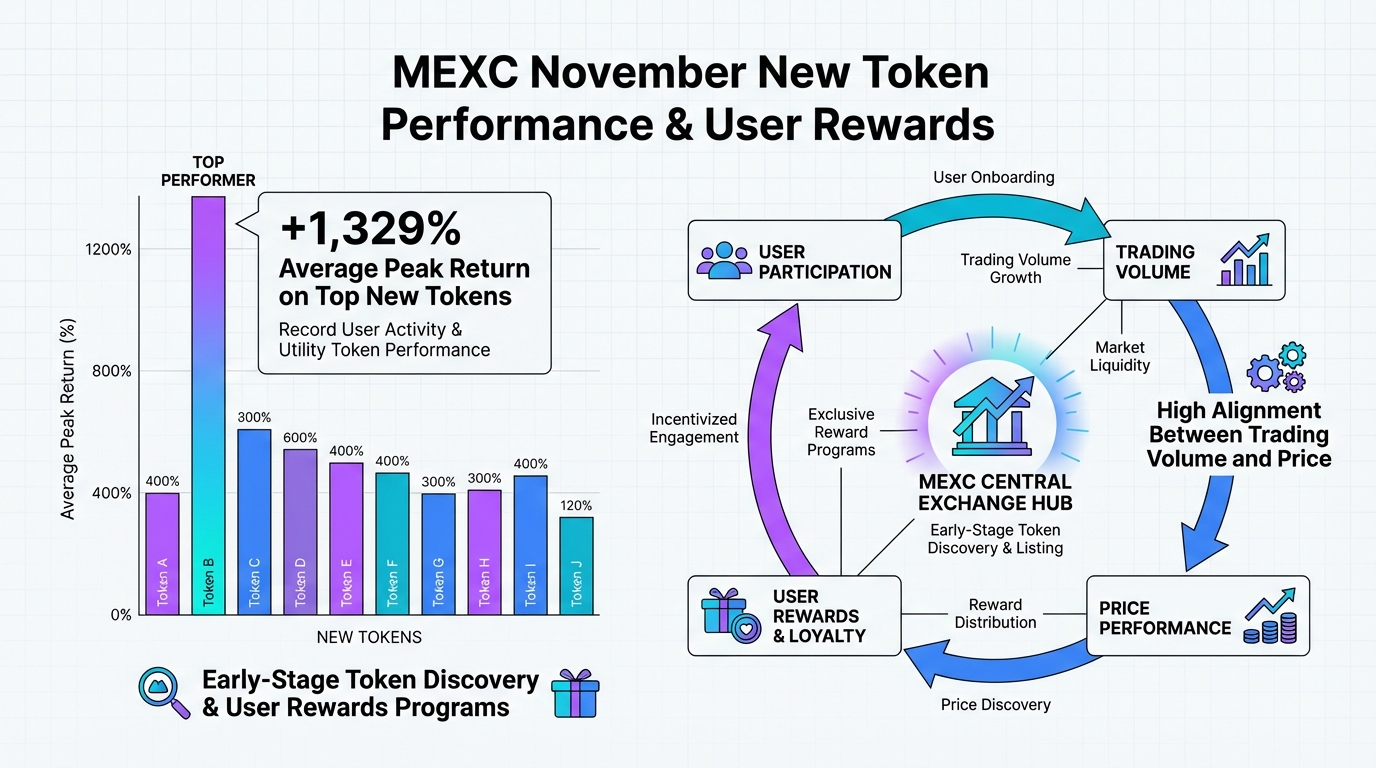

In the volatile world of cryptocurrency, where liquidity inefficiencies can make or break fortunes, exchanges like MEXC are carving out a niche by dominating early-stage token listings. Recent reports highlight how MEXC’s November 2025 data shows an astonishing 1,329% average peak return across top new tokens, underscoring trends in AI, MEME, and DeFi sectors. This isn’t just hype; it’s backed by a correlation between trading volume and price performance hitting 80%—the highest in 2025. For investors seeking alpha, tools like Genspark are invaluable for deep-dive whitepaper analysis, helping you dissect tokenomics before the crowd piles in.

John: Alright, folks, let’s cut through the noise. As a battle-hardened blockchain architect, I’ve seen exchanges promise the moon and deliver dust. But MEXC’s numbers? They’re the real deal—1,329% peak returns on average for top November tokens. That’s not luck; it’s strategic listing in high-growth narratives like AI agent economies.

Lila: John, you’re jumping straight into the deep end. For our readers bridging from basics, think of token listings as the IPOs of crypto—early access can yield massive ROI, but you need to understand the market trends first.

The Evolution: From Web2 Centralization to Web3 Decentralization

In the Web2 era, centralized platforms like traditional stock exchanges control listings, liquidity, and data, often leading to inefficiencies and gatekeeping. Users have little ownership—your investments are siloed, and returns are capped by bureaucratic hurdles. Enter Web3: decentralized exchanges (DEXs) and platforms like MEXC blend CeFi speed with DeFi principles, offering true digital ownership via blockchain. Here, tokenomics drive value through utility, scarcity, and community governance, not corporate whims. For crafting your own project analyses or whitepapers, Gamma is a game-changer—create visually stunning pitch decks in minutes to visualize these shifts.

John: Spot on, Lila. Web2 is like a bank vault where the manager holds the keys; Web3 hands you the combination. MEXC’s report shows how decentralization amplifies returns—top tokens saw 2,933% average gains in Q3 alone, per TokenInsight data.

Lila: To make it relatable, imagine Web2 as renting an apartment (you pay fees, no equity), versus Web3 as owning a digital plot in the metaverse—your tokens appreciate with the ecosystem.

Core Mechanism: Technical Breakdown of MEXC’s Token Listing Dynamics

Diving into the technical logic, MEXC operates as a centralized exchange (CEX) with DeFi-inspired features, leveraging smart contract composability for seamless listings. Tokenomics here revolve around supply mechanics (e.g., fixed caps for scarcity), utility (staking for yields), and decentralization via on-chain governance. For instance, using Ethers.js and OpenZeppelin libraries, projects deploy on chains like Arbitrum One for low gas fees—under 0.01 ETH per tx—enabling high TPS (transactions per second) of up to 4,000. Consensus mechanisms like Proof-of-Stake ensure security, while ROI is driven by liquidity pools and trading volume spikes. MEXC’s Launchpad, as seen in the MON campaign with 125% returns, integrates ERC-20 standards for fair token distribution.

John: Here’s the alpha: MEXC lists 680 tokens in Q3, with trading volume up 97% QoQ. That’s composability in action—smart contracts allowing tokens to interact across protocols, boosting ROI through network effects.

Lila: Technically, it’s like Lego blocks: each token’s smart contract (written in Solidity) snaps into DeFi ecosystems, creating compounded value. If you’re coding your own, check Nolang for interactive Solidity lessons.

Use Cases: Real-World Applications in the Metaverse and Blockchain

First, for AI-driven investments: Imagine deploying capital into an AI agent token listed on MEXC, where utility includes governance in decentralized AI networks—yielding 1,625% surges as per October reports. Promote your involvement with videos via Revid.ai.

Second, MEME coin trading: Traders flip volatile MEME tokens for quick gains, leveraging MEXC’s high liquidity (11% global spot share). Utility comes from community DAOs, turning fun into decentralized finance.

Third, DeFi yield farming: Stake new tokens in protocols built on ERC-4337 for account abstraction, earning passive ROI while contributing to network security. Automate alerts with Make.com.

John: These aren’t hypotheticals—MEXC’s data shows MEME tokens comprising 50% of February listings, with averages soaring to 4,770% in March.

Lila: And for metaverse builders, these mechanisms enable virtual economies where your NFT land generates real yields.

Web2 vs. Web3: A Side-by-Side Comparison

| Aspect | Traditional Web2 App | Web3 dApp Solution |

|---|---|---|

| Ownership | Platform controls assets and data | User-owned via wallets and NFTs |

| Returns & ROI | Limited by regulations; average 5-10% yields | High volatility; up to 1,329% peak returns via token listings |

| Liquidity | Gatekept by brokers; slow settlements | Instant via DEXs; 97% volume growth QoQ |

| Governance | Centralized decisions | DAO voting with token utility |

Conclusion: Seize the Opportunity in Web3 Investments

MEXC’s November report isn’t just stats—it’s a blueprint for alpha in Web3. With 1,329% average peaks, focusing on tokenomics and decentralization can supercharge your portfolio. Dive in: Analyze a new listing, stake for yields, or join a DAO. Automate your crypto ops with Make.com for Discord alerts and more. The future is decentralized—don’t miss out.

John: Remember, this is high-risk alpha. DYOR and position size wisely.

Lila: Start small, learn the ropes, and build from there.

👨💻 Author: SnowJon (Web3 & AI Practitioner / Investor)

A researcher who leverages knowledge gained from the University of Tokyo Blockchain Innovation Program to share practical insights on Web3 and AI technologies. While working as a salaried professional, he operates 8 blog media outlets, 9 YouTube channels, and over 10 social media accounts, while actively investing in cryptocurrency and AI projects.

His motto is to translate complex technologies into forms that anyone can use, fusing academic knowledge with practical experience.

*This article utilizes AI for drafting and structuring, but all technical verification and final editing are performed by the human author.

🛑 Disclaimer (NFA)

Not Financial Advice. Content is for educational purposes only. Cryptocurrency and NFT investments carry high risks. DYOR (Do Your Own Research).

This article contains affiliate links.

▼ Recommended Web3 x AI Tools

References & Further Reading

- MEXC Reports 1,329% Average Peak Return Across Top New Tokens in November | The Manila Times

- MEXC Q3 2025 Report Highlights Market Leadership Across New Listings, Security, and Ecosystem Growth

- MEXC Dominates Early-Stage Token Growth: AI, MEME, and DeFi Drive +1625% Performance Surge