GriffinAI’s Token Burn and Trend Mind Agent: Fueling Deflationary Tokenomics in AI-Driven DeFi

🎯 Difficulty: Degen Level (Requires understanding of tokenomics, DeFi utilities, and on-chain AI agents)

💎 Value Proposition: Utility-Driven Tokenomics with Deflationary Mechanisms for ROI Potential

👍 Recommended For: DeFi Investors, AI Enthusiasts in Web3, Tokenomics Analysts

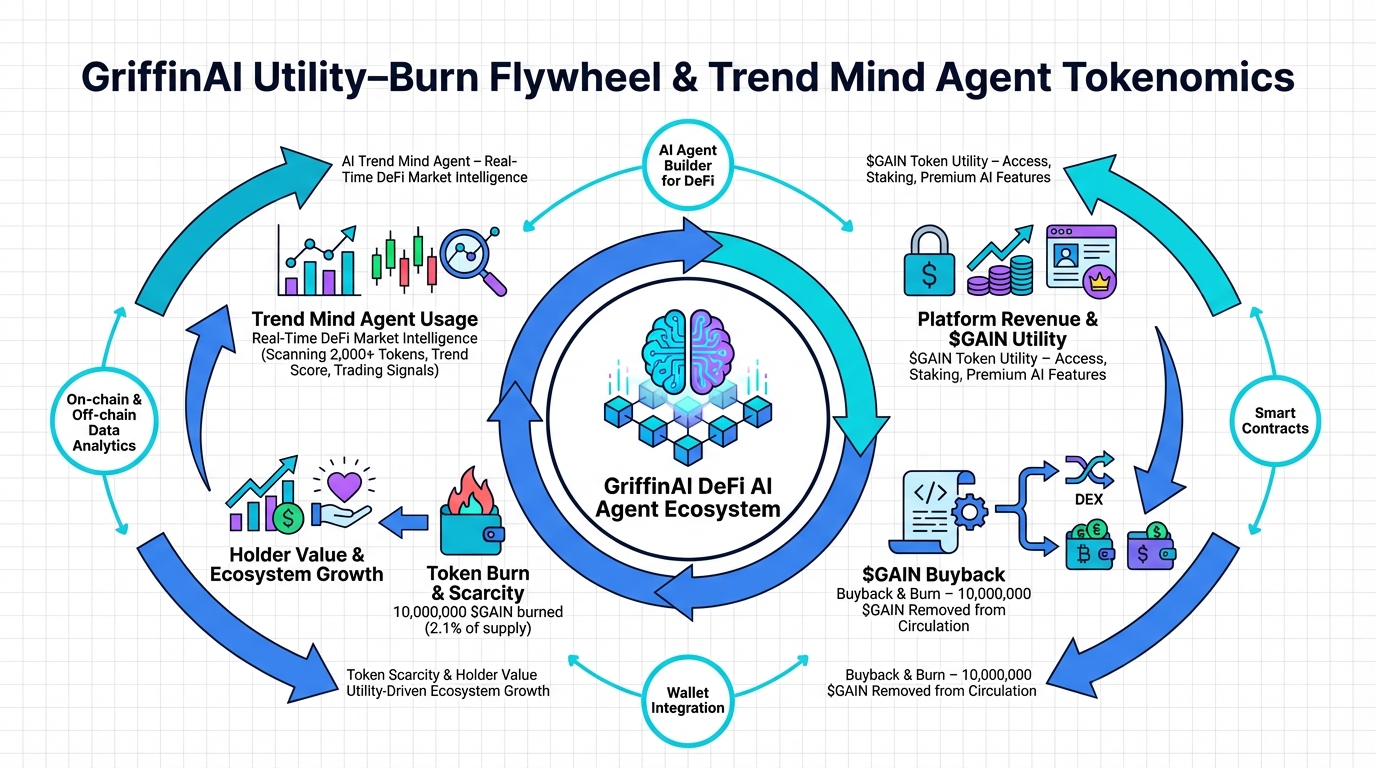

John: Alright, degens and alpha hunters, let’s cut through the noise in today’s crypto market. With DeFi liquidity pools drying up amid volatility and AI hype cycles inflating valuations without substance, GriffinAI is making moves that actually matter. They’ve just executed their first strategic token burn of 10 million $GAIN tokens while launching the Trend Mind Agent—a tool designed to spot market trends in real-time. This isn’t just fluff; it’s a calculated play to strengthen their utility-burn flywheel, where token usage directly leads to scarcity and potential value appreciation. For those deep-diving into whitepapers, I recommend using Genspark to analyze the project’s tokenomics docs—it’s like having an AI agent dissect the fine print for hidden gems.

Lila: John, you’re jumping straight into the alpha, but let’s bridge it for those not fully native yet. Think of the current market as a crowded highway with inefficient tolls—Web2 platforms hoard data and fees, leaving users with crumbs. GriffinAI’s approach flips this by embedding AI agents into DeFi, creating self-sustaining ecosystems where utility drives burns, reducing supply over time.

The Evolution: From Web2 Centralization to Web3 Decentralization

John: Remember how Web2 giants like centralized exchanges control your assets, with arbitrary fees and data silos? That’s the old guard—efficient on the surface but riddled with single points of failure and zero user ownership. Enter Web3: decentralized protocols where you own your keys, and smart contracts enforce rules transparently. GriffinAI exemplifies this shift by building on BNB Chain, using tools like OpenZeppelin for secure token contracts. Their $GAIN token isn’t just a meme; it’s utility-backed, powering AI agents that execute trades or analyze trends autonomously. For visualizing this evolution in your own projects, check out Gamma to create stunning whitepapers or pitch decks that contrast these models.

Lila: Exactly, John. In Web2, you’re renting space in someone else’s database; in Web3, you’re the landlord with blockchain as your unforgeable deed. GriffinAI’s burn mechanism? It’s like recycling waste to fuel a engine—token usage (e.g., via agents) triggers buybacks and burns, creating a deflationary spiral that rewards holders.

Core Mechanism: Technical Breakdown of GriffinAI’s Utility-Burn Flywheel

John: Diving into the tech: GriffinAI’s ecosystem runs on BNB Chain for low gas fees—think under 0.1 BNB per transaction compared to Ethereum’s spikes. The utility-burn flywheel is genius: $GAIN tokens are used to access premium agents like Trend Mind, which leverages on-chain data for trend analysis. Revenue from usage funds buybacks, then burns tokens permanently via smart contracts compliant with ERC-20 standards (extended for burns). This creates composability—pair it with Arbitrum for scaling or Ethers.js for custom integrations. Post-exploit (they had a mint-and-dump issue in September 2025, but re-launched with Binance support), they’ve activated a $2.5M buy-back fund, slashing circulating supply by 10M tokens already. ROI potential? If adoption hits, we’re looking at deflationary pressure boosting token value, with current TVL (Total Value Locked) signaling growth.

Lila: For the builders: The Trend Mind Agent uses consensus from decentralized oracles to pull real-time data, ensuring no central point of failure. It’s built with open-source LLaMA models, allowing composability with other agents via GriffinAI’s playground. Deploying something similar? Use Hardhat for testing your smart contracts before going live.

Use Cases: Real-World Applications in the Metaverse and Blockchain

John: Let’s get concrete. First, for DeFi traders: Use Trend Mind to scan 2,000+ tokens for trends, pairing with Analyst Agent for deep dives—imagine automating entries at 5% below market dips, all powered by $GAIN. Second, in metaverse gaming: Integrate agents for NFT marketplaces, where burns from transactions reduce token supply, enhancing rarity and value. Promote your GameFi project with slick videos via Revid.ai—it’s a game-changer for teasers. Third, for investors in DAOs: $GAIN qualifies for governance tiers, letting you vote on burns or new agents, fostering decentralization.

Lila: And if you’re coding your own agents, learn Solidity with Nolang—it’s interactive and ties directly into building on BNB Chain like GriffinAI does.

| Aspect | Traditional Web2 App | Web3 dApp Solution (e.g., GriffinAI) |

|---|---|---|

| Token Supply Management | Centralized inflation with no user input | Deflationary burns via smart contracts, utility-driven |

| User Ownership | Platform controls data and assets | Self-custody with on-chain agents |

| Revenue Model | Subscription fees to centralized entity | Token utility funding buybacks and burns |

| Scalability & Fees | High costs from intermediaries | Low gas on BNB Chain, TPS up to 100+ |

Conclusion: Time to Dive into GriffinAI’s Ecosystem

John: Wrapping this up: GriffinAI’s token burn and Trend Mind launch are textbook alpha—deflationary mechanics meeting AI utility in DeFi. With a post-exploit recovery fund and community-built agents (over 15,000 already), this could be your entry to sustainable ROI. Don’t sleep on it; stake some $GAIN, deploy an agent, or join their DAO for governance perks.

Lila: Absolutely—start by setting up alerts for burns or trends using Make.com to automate your Discord ops. DYOR, but this flywheel has real momentum.

👨💻 Author: SnowJon (Web3 & AI Practitioner / Investor)

A researcher who leverages knowledge gained from the University of Tokyo Blockchain Innovation Program to share practical insights on Web3 and AI technologies. While working as a salaried professional, he operates 8 blog media outlets, 9 YouTube channels, and over 10 social media accounts, while actively investing in cryptocurrency and AI projects.

His motto is to translate complex technologies into forms that anyone can use, fusing academic knowledge with practical experience.

*This article utilizes AI for drafting and structuring, but all technical verification and final editing are performed by the human author.

🛑 Disclaimer (NFA)

Not Financial Advice. Content is for educational purposes only. Cryptocurrency and NFT investments carry high risks. DYOR (Do Your Own Research).

This article contains affiliate links.

▼ Recommended Web3 x AI Tools