Amplify your trades 1001x privately? Aster Shield Mode redefines on-chain trading with gasless, zero-slippage execution.#AsterShield #DeFiTrading #Web3Privacy

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Aster’s Shield Mode: Revolutionizing On-Chain Trading with Privacy and High Leverage

🎯 Difficulty: Degen Level

💎 Value Proposition: High ROI via 1001x leverage, zero slippage, gasless execution, and enhanced privacy for on-chain perpetual trading.

👍 Recommended For: On-chain traders, DeFi investors, Leverage seekers.

In the fast-evolving world of decentralized finance (DeFi), market trends are increasingly highlighting liquidity inefficiencies in traditional perpetual exchanges. With volatility spiking amid Bitcoin’s recent downturn—dropping below $86,000 as per recent market data—traders are seeking tools that offer not just speed but also privacy and cost efficiency. Aster’s launch of Shield Mode addresses these pain points head-on, integrating into their Perpetual platform to provide a protected environment for high-performance trading. For those diving deeper, tools like Genspark are invaluable for analyzing whitepapers and uncovering alpha in projects like this.

John: Alright, folks, let’s cut through the hype. Aster isn’t just another DEX throwing buzzwords around; it’s tapping into real protocol upgrades. But before we geek out on the tech, remember: in Web3, you’re your own bank—mismanage that, and it’s game over.

Lila: Exactly, John. If you’re new here, think of on-chain trading like a digital marketplace where you control the keys, not some centralized overlord. Shield Mode? It’s like adding a stealth cloak to your trades.

The Evolution: From Web2 Centralization to Web3 Decentralization

In the Web2 era, trading platforms like centralized exchanges (CEXs) dominate with their walled gardens—your data, positions, and profits are at the mercy of a single entity, prone to hacks, downtime, and regulatory whims. Remember the FTX collapse? That was Web2’s fragility on full display. Enter Web3: decentralized models empower users with true ownership via blockchain transparency and smart contracts.

Aster’s Shield Mode exemplifies this shift, building on decentralized perpetual exchanges (Perps DEX) to offer privacy without sacrificing performance. For project teams looking to pitch such innovations, Gamma is a game-changer for creating visually stunning whitepapers or pitch decks that highlight these evolutions.

John: Spot on. Web2 is like renting an apartment—you pay fees, but the landlord can evict you anytime. Web3? You own the building, and protocols like Aster ensure the foundation is rock-solid with zero-knowledge proofs or similar tech for privacy.

Lila: For beginners, it’s simple: Web2 locks you in; Web3 sets you free.

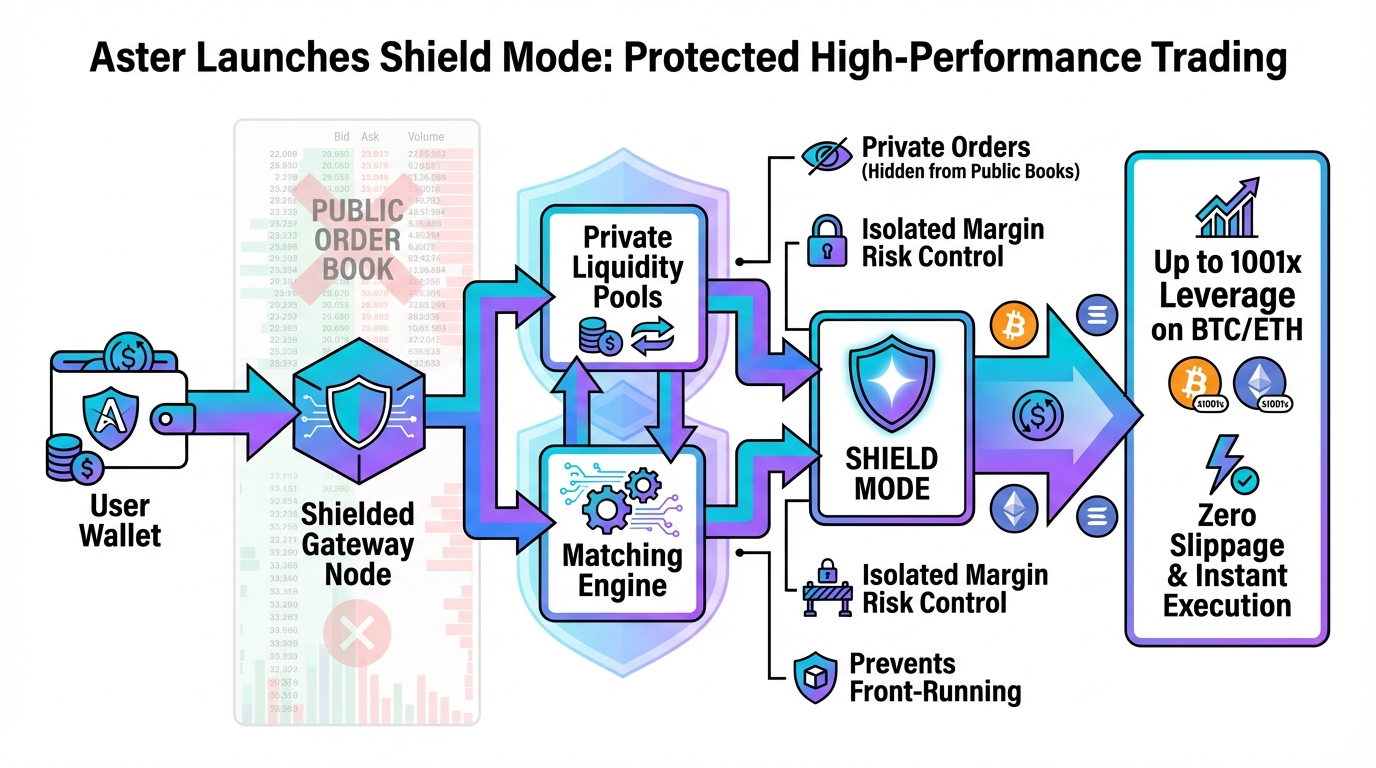

Core Mechanism: Technical Breakdown of Shield Mode

Diving into the guts: Aster Shield Mode leverages advanced on-chain architecture, integrated directly into Aster Perpetual. It offers gasless execution (no gas fees), zero slippage, and up to 1001x leverage—that’s not a typo, it’s degen-level amplification. Built on a Layer-1 blockchain foundation (with roadmap nods to Aster Chain), it uses smart contract composability for seamless trades. Consensus? Likely a proof-of-stake variant for speed, ensuring high TPS (transactions per second) without the bottlenecks of Ethereum mainnet.

Technically, this mode employs protected order books, possibly with off-chain matching and on-chain settlement via tools like OpenZeppelin contracts for security. No close fees until December 31, as per recent updates, sweetens the deal for high-frequency traders. If you’re coding your own integrations, libraries like Ethers.js make interacting with these contracts a breeze.

John: Here’s the alpha: Shield Mode taps into privacy features that could involve zk-SNARKs (zero-knowledge succinct non-interactive arguments of knowledge—fancy way to prove something without revealing details). It’s like trading in a vault where frontrunners can’t snipe your moves.

Lila: Think of it as a secure tunnel for your trades—efficient, private, and built for scale.

Use Cases: Real-World Applications in Blockchain and Metaverse

Shield Mode isn’t just theoretical—it’s primed for action in the Metaverse and blockchain spaces. First, high-leverage traders can amplify positions on assets like NVDA or TSLA perpetuals without fees, turning small capital into big plays amid market dips (Aster recently eliminated fees on stock perpetuals).

Second, privacy-focused DeFi users: Imagine hedging against crypto volatility in a metaverse economy, where your trading strategies remain hidden from MEV (miner extractable value) bots. Tools like Revid.ai can help create promo videos for such NFT/GameFi integrations, showcasing Shield Mode’s utility.

Third, ecosystem builders: Developers coding dApps can integrate Shield Mode for automated trading bots. Learning Solidity for this? Check out Nolang for interactive smart contract lessons.

John: Pro tip: Pair this with Arbitrum One for low-cost deployments—it’s where the real efficiency shines.

Lila: These use cases bridge the gap from newbie experiments to pro strategies.

| Aspect | Traditional Web2 App | Web3 dApp Solution (Aster Shield Mode) |

|---|---|---|

| Privacy | Exposed to platform surveillance | Protected with on-chain privacy layers |

| Fees | High commissions and hidden costs | Zero gas, slippage, and close fees (limited time) |

| Leverage | Limited to regulatory caps | Up to 1001x for high-ROI plays |

| Ownership | Centralized control | User-controlled via wallets |

Conclusion: Gear Up and Dive In

Aster’s Shield Mode is a pivotal upgrade, blending privacy, performance, and decentralization to empower on-chain traders in volatile markets. With features like zero fees and extreme leverage, it’s positioned to accelerate ecosystem growth—especially with upcoming airdrops and competitions worth $10M. Don’t sit on the sidelines; set up your non-custodial wallet (recommend MetaMask for starters), explore Aster Perpetual, and automate your alerts with Make.com to stay ahead.

John: Bottom line: This is alpha for degens, but trade smart—leverage can wipe you out as fast as it builds.

Lila: Start small, learn the ropes, and watch Web3 unfold.

👨💻 Author: SnowJon (Web3 & AI Practitioner / Investor)

A researcher who leverages knowledge gained from the University of Tokyo Blockchain Innovation Program to share practical insights on Web3 and AI technologies. While working as a salaried professional, he operates 8 blog media outlets, 9 YouTube channels, and over 10 social media accounts, while actively investing in cryptocurrency and AI projects.

His motto is to translate complex technologies into forms that anyone can use, fusing academic knowledge with practical experience.

*This article utilizes AI for drafting and structuring, but all technical verification and final editing are performed by the human author.

🛑 Disclaimer (NFA)

Not Financial Advice. Content is for educational purposes only. Cryptocurrency and NFT investments carry high risks. DYOR (Do Your Own Research).

This article contains affiliate links.

▼ Recommended Web3 x AI Tools