Want to know how blockchain is evolving? Circle’s Arc Builders Fund is fueling the next wave of Web3 innovation and decentralized finance.#ArcFund #Web3 #Blockchain

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Decoding Circle’s Arc Builders Fund: Fueling the Next Wave of Blockchain Innovation

🎯 Difficulty: Advanced

💎 Core Value: Interoperability

👍 Recommended For: Blockchain developers, Web3 investors, Enterprise architects

Lila: Jon, I’ve been hearing about Circle’s latest move with the Arc Builders Fund. As someone experienced in Web3, what macro trends does this tap into, especially regarding decentralization and trust in blockchain ecosystems?

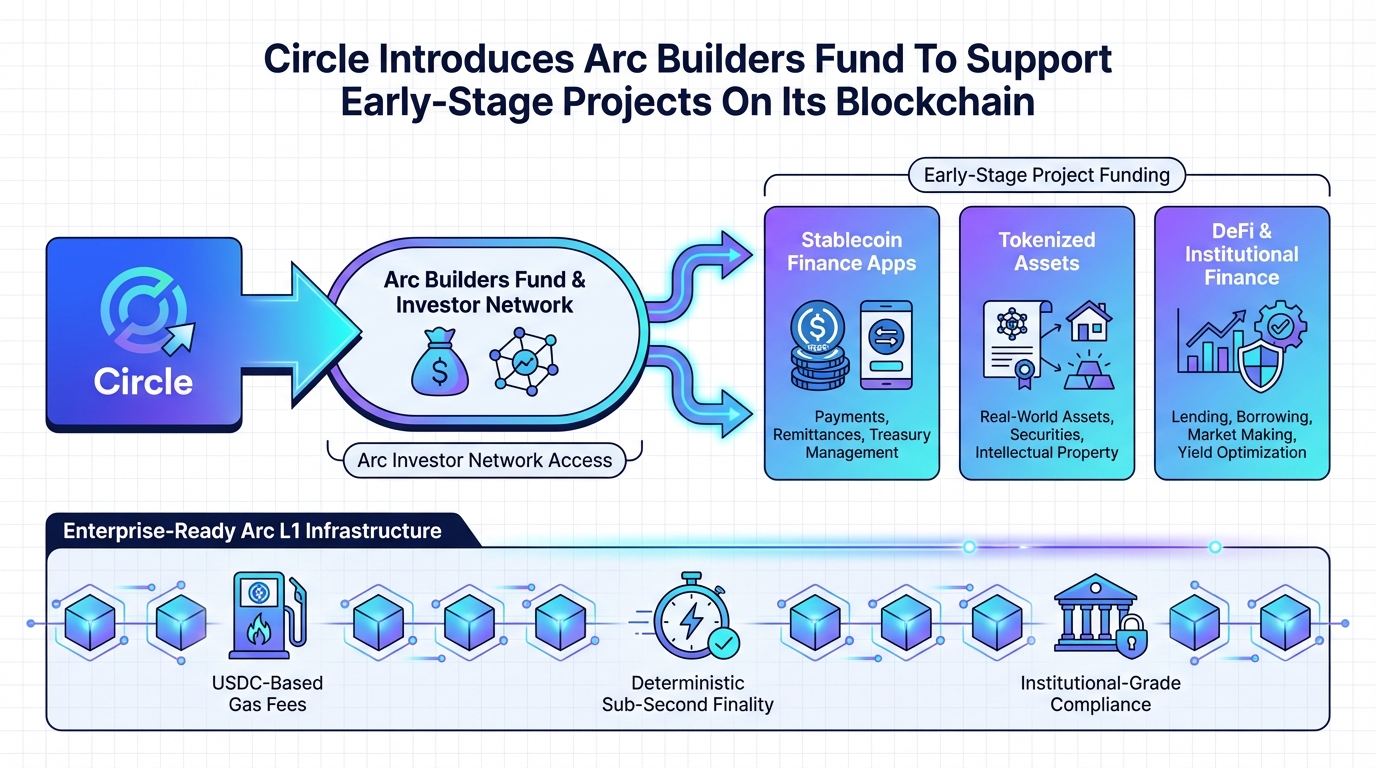

Jon: Absolutely, Lila. Circle’s introduction of the Arc Builders Fund is a strategic play in the evolving landscape of blockchain infrastructure. At its core, this fund supports early-stage projects building on Circle’s Arc blockchain, which is designed as an enterprise-ready layer for institutional finance and stablecoin ecosystems. Macro trends here include the shift toward trust-minimized systems, where decentralization reduces reliance on central intermediaries. Think of it as moving from traditional banking silos to open, verifiable networks. Circle, known for USDC stablecoin, is leveraging this to foster interoperability across chains, minimizing trust by using cryptographic proofs and smart contracts to ensure secure, automated transactions.

Lila: That makes sense on a high level, but how does this evolve from Web2 models? What makes Arc’s approach stand out in terms of ownership and resistance to censorship?

Jon: Great question. In Web2, platforms like traditional banks or social media giants control data and transactions centrally, leading to vulnerabilities like single points of failure or censorship. Arc, as a blockchain infrastructure, emphasizes decentralized ownership, where users and developers control assets via private keys, not corporate databases. This provides censorship resistance—transactions can’t be arbitrarily blocked—and composability, allowing protocols to build on each other like Lego blocks. The Builders Fund accelerates this by providing capital and networks to innovators, potentially creating a more robust ecosystem compared to Web2’s walled gardens.

Lila: Diving deeper, can you break down the core mechanisms? How does the fund interact with Arc’s technical architecture, like its consensus or smart contract layers?

Jon: Sure. Arc is built as a layer-1 blockchain optimized for stablecoin settlements and cross-chain operations, incorporating elements like the Cross-Chain Transfer Protocol (CCTP) for seamless asset movement. The Builders Fund targets early-stage projects by offering funding and investor networks, focusing on token design that incentivizes participation—perhaps through governance tokens or yield mechanisms. Decentralization logic here involves proof-of-stake consensus for security, reducing energy use compared to proof-of-work, while smart contracts handle automated funding disbursement. Ecosystem roles include developers as builders, Circle as the facilitator, and institutions as adopters, all tied together for scalable, interoperable finance.

Lila: Interesting. What are some concrete use cases where this fund could make a real impact? Let’s say in finance, identity, or community building.

Jon: Let’s outline three key applications. First, in decentralized finance (DeFi), projects could build on Arc to create stablecoin-based lending platforms with enhanced interoperability, allowing seamless USDC transfers across chains without high fees or trust issues. Second, for digital identity, funded projects might develop self-sovereign identity solutions using Arc’s infrastructure, where users control verifiable credentials via NFTs or zero-knowledge proofs, reducing reliance on centralized ID providers. Third, in community governance, the fund could support DAOs that leverage Arc for transparent voting and treasury management, enabling global communities to collaborate on projects with minimized central control.

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized funding via venture capital firms, with control retained by investors. | Decentralized funds like Arc Builders, distributing capital via smart contracts for community-driven projects. |

| Data silos in proprietary databases, prone to breaches. | Distributed ledgers ensuring transparency and user ownership. |

| Interoperability limited by platform APIs. | Cross-chain protocols enabling seamless asset and data flow. |

| Censorship by central authorities possible. | Censorship-resistant networks via decentralization. |

Lila: Wrapping this up, what does all this enable in the bigger picture, and what risks should we watch for?

Jon: In summary, the Arc Builders Fund enables a more inclusive blockchain ecosystem by funding innovative projects that enhance interoperability, decentralization, and trust minimization. It could accelerate real-world adoption in finance and beyond. However, unresolved risks include regulatory uncertainties around stablecoins, potential smart contract vulnerabilities, and scalability challenges during high network demand. The key is observing how these projects evolve while prioritizing security audits and community governance.

Lila: Thanks, Jon. It leaves me wondering: How can readers stay informed without getting lost in the hype?

References & Further Reading

- Circle Introduces Arc Builders Fund To Support Early-Stage Projects On Its Blockchain

- Circle’s Arc Blockchain: A New Infrastructure Play in Institutional Finance and Stablecoin-Driven Ecosystems

- Circle Ventures Launches Arc Builders Fund for Internet Economy Innovation