Unlock true digital ownership! Ondo & LayerZero’s bridge revolutionizes onchain securities, bringing seamless cross-chain DeFi & Web3 interoperability.#CrossChain #TokenizedAssets #Web3DeFi

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Unlocking Cross-Chain Interoperability: Ondo and LayerZero’s Bridge for Onchain Securities

🎯 Difficulty: Advanced

💎 Core Value: Interoperability / Digital Ownership / Decentralization

👍 Recommended For: Blockchain developers, DeFi enthusiasts, institutional investors exploring tokenized assets

Lila: Jon, with the recent launch of Ondo and LayerZero’s cross-chain bridge for onchain securities on Ethereum and BNB Chain, I’m curious about the macro trends this fits into. How does this development tie into broader decentralization efforts and trust minimization in Web3?

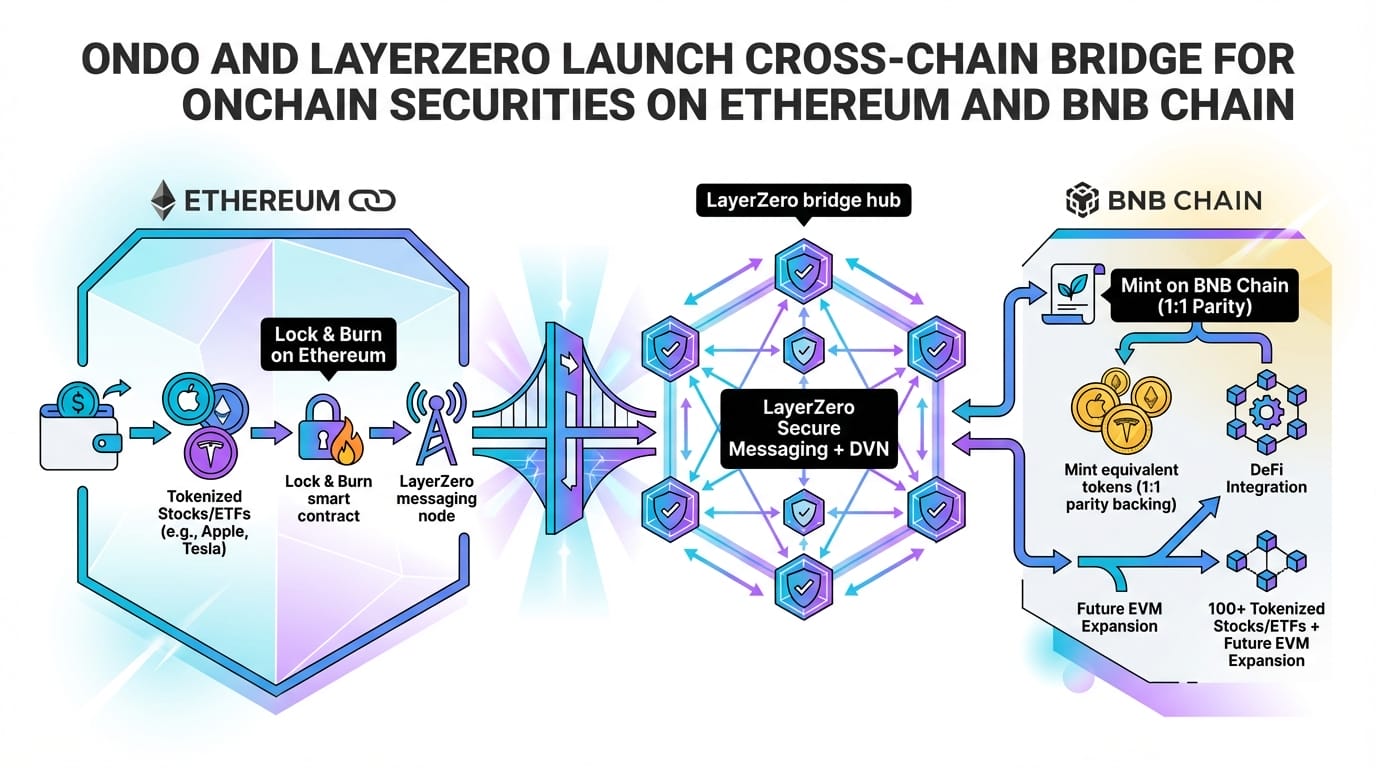

Jon: Absolutely, Lila. This bridge is a prime example of evolving macro trends in Web3 toward seamless interoperability across blockchains. At its core, decentralization minimizes trust by distributing control away from central authorities, relying instead on cryptographic proofs and consensus mechanisms. Trust minimization here means users don’t need to rely on intermediaries like banks for asset transfers; instead, protocols like LayerZero use secure messaging layers to verify transactions across chains. Ondo’s bridge, as reported in recent developments, enables native transfers of tokenized U.S. stocks and ETFs between Ethereum and BNB Chain, reducing fragmentation and enhancing liquidity in the tokenized real-world assets (RWA) space.

From Web2 Limitations to Web3 Evolution

Lila: That makes sense, but let’s step back. How does this bridge highlight the evolution from centralized Web2 systems to decentralized Web3 ones? What key advantages does it offer in terms of ownership and resistance to censorship?

Jon: Great question. In Web2, assets like stocks are managed by centralized platforms—think brokerage firms controlling custody, transfers, and even access, which can lead to censorship or single points of failure. Web3 flips this by emphasizing user ownership through blockchain-based tokens. Ondo’s bridge leverages LayerZero’s omnichain fungible token (OFT) standards to enable cross-chain transfers without intermediaries, ensuring censorship resistance via decentralized validation. This composability allows assets to interact across ecosystems, like using tokenized securities as collateral in DeFi protocols on different chains, fostering a more open financial system.

Core Mechanisms: Technical Architecture

Lila: Diving deeper, can you break down the core mechanisms? How do smart contracts and interoperability protocols like LayerZero actually work in this context, especially for something as regulated as securities?

Jon: Certainly. At the heart are smart contracts—self-executing code on blockchains like Ethereum, governed by standards such as ERC-20 for fungible tokens or ERC-721 for unique assets. Ondo tokenizes securities into compliant tokens, backed by real-world assets, and LayerZero provides the interoperability layer using a decentralized oracle network and relayers for cross-chain messaging. This avoids traditional bridges’ vulnerabilities, like wrapped tokens, by enabling native transfers. Consensus mechanisms, such as Ethereum’s proof-of-stake, ensure transaction finality, while BNB Chain’s architecture adds speed for high-volume trades. The ecosystem role here is bridging siloed liquidity pools, potentially integrating with over 100 EVM-compatible chains soon.

Lila: What about the decentralization logic? How does this setup minimize trust and handle potential risks in token design?

Jon: Token design in Ondo’s system focuses on compliance and security; tokens represent fractional ownership of securities, with built-in KYC/AML checks via smart contracts to meet regulatory standards. Decentralization logic comes from distributing validation across nodes, reducing reliance on any single entity. LayerZero’s architecture uses endpoint contracts on each chain, verified by decentralized verifiers, minimizing trust in oracles. However, risks like smart contract bugs or chain-specific exploits remain, which is why audits and modular designs are crucial.

Practical Use Cases in Web3

Lila: Let’s make this concrete. What are some specific use cases where this cross-chain bridge could be applied, beyond just transferring assets?

Jon: First, in decentralized finance (DeFi), users could collateralize tokenized stocks on Ethereum for loans on BNB Chain, accessing lower fees while maintaining asset exposure. This enhances capital efficiency across ecosystems. Second, for institutional adoption, asset managers might use the bridge for portfolio diversification, seamlessly moving RWAs between chains to optimize for yield or regulatory environments. Third, in metaverse or gaming economies, tokenized securities could integrate with virtual worlds, allowing players to stake real-world assets for in-game rewards, blending traditional finance with decentralized applications.

Web2 vs. Web3 Comparison

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized custody of assets by brokers, vulnerable to hacks or shutdowns. | User-owned wallets with cross-chain bridges enabling self-custody and interoperability. |

| Intermediaries control transfers, often with high fees and delays. | Direct peer-to-peer transfers via smart contracts, minimizing fees through efficient chains like BNB. |

| Limited composability; assets siloed in platforms. | High composability, allowing assets to interact in DeFi, gaming, or metaverses across blockchains. |

| Prone to censorship by authorities or companies. | Censorship-resistant through decentralized networks and immutable ledgers. |

| Data and value controlled by corporations. | User sovereignty over data and assets, empowered by protocols like LayerZero. |

Wrapping Up: Enables and Risks

Lila: This has been insightful. To conclude, what does this technology ultimately enable, and what unresolved risks should we keep in mind?

Jon: In summary, Ondo and LayerZero’s bridge enables a more interconnected Web3 ecosystem, where tokenized securities flow freely, boosting liquidity, accessibility, and innovation in finance. It minimizes trust through decentralized protocols, paving the way for global, borderless asset management. However, unresolved risks include regulatory uncertainties around tokenized RWAs, potential oracle failures in cross-chain systems, and the need for robust security audits to prevent exploits. The key is ongoing evolution in standards like those from LayerZero to address these.

Lila: One last thought—how can readers best approach learning more about these developments without jumping into risks blindly?

Jon: Focus on education: Study protocol docs, follow reputable blockchain analyses, and observe ecosystem trends. Build literacy through open-source resources, not rushed actions.

References & Further Reading

- Ondo And LayerZero Launch Cross-Chain Bridge For Onchain Securities On Ethereum And BNB Chain

- Ondo Finance Launches Ethereum Bridge with LayerZero

- Ondo and LayerZero launch bridge for tokenized stocks

- Ondo brings cross-chain transfers for over 100 tokenized securities