What if you truly owned your digital rewards? Discover how Aster Crystal Drops makes Web3 trading and asset ownership safe for beginners.#AsterDrops #Web3Trading #CryptoRewards

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Decoding Aster’s Crystal Weekly Drops: A Beginner’s Guide to Web3 Trading Campaigns and Rewards

🎯 Difficulty: Beginner Friendly / Wallet Required

💎 Core Value: Digital Ownership / Interoperability / DAO Governance

👍 Recommended For: New Web3 enthusiasts exploring DeFi, casual traders interested in rewards, and community members curious about token airdrops

Lila: I’ve been hearing a lot about this Aster ‘Crystal Weekly Drops’ campaign with $12 million in prizes, but as someone new to Web3, I’m stuck on why these things even exist. In Web2, we have giveaways on social media, but they feel controlled by big companies. What’s the real limitation there, and how does something like Aster change that?

Jon: Great question, Lila. Let’s start with the basics using a simple metaphor. Imagine Web2 as a giant amusement park owned by a single company – think Facebook or Twitter. You buy a ticket to enter, but the company controls everything: the rides, the rules, and even what you can take home. If they decide to shut down a ride or ban you, you’re out of luck, and any ‘prizes’ you win are just digital points they can revoke. That’s the limitation: centralized control means no true ownership for users. Now, Web3 is like a community-built park where everyone owns a piece through blockchain tokens. Aster’s campaign, as detailed in that Metaverse Post article, is a decentralized trading competition on a perpetuals exchange, rewarding users with real, transferable tokens. It’s not just hype; it’s about giving you actual control over your digital assets, like owning a share of the park itself.

Lila: That metaphor helps, but I’m still worried about safety. How do I even get started without losing everything? And what makes Web3’s version of ownership better than Web2’s?

Jon: Safety first – that’s key for beginners. Think of your Web3 wallet as a digital backpack: it’s yours to carry, but you must guard the key (your private seed phrase) like a treasure map. Never share it, and start with a non-custodial wallet to practice. In Web2, your data and assets are stored on company servers, vulnerable to hacks or shutdowns – remember when platforms like MySpace vanished? Web3 evolves this by using blockchain, a public ledger where transactions are transparent and immutable. Ownership means you truly control your tokens or NFTs; no one can censor or seize them without your permission. Composability adds magic: assets from one project, like Aster’s ASTER tokens, can plug into others seamlessly, building a interconnected ecosystem. Censorship resistance ensures campaigns like Crystal Weekly Drops run on decentralized networks, not beholden to any single entity.

Understanding the Core Mechanisms

Lila: Okay, the ownership angle is intriguing, but break down how something like Aster’s campaign actually works. Is it just free money, or is there more to it?

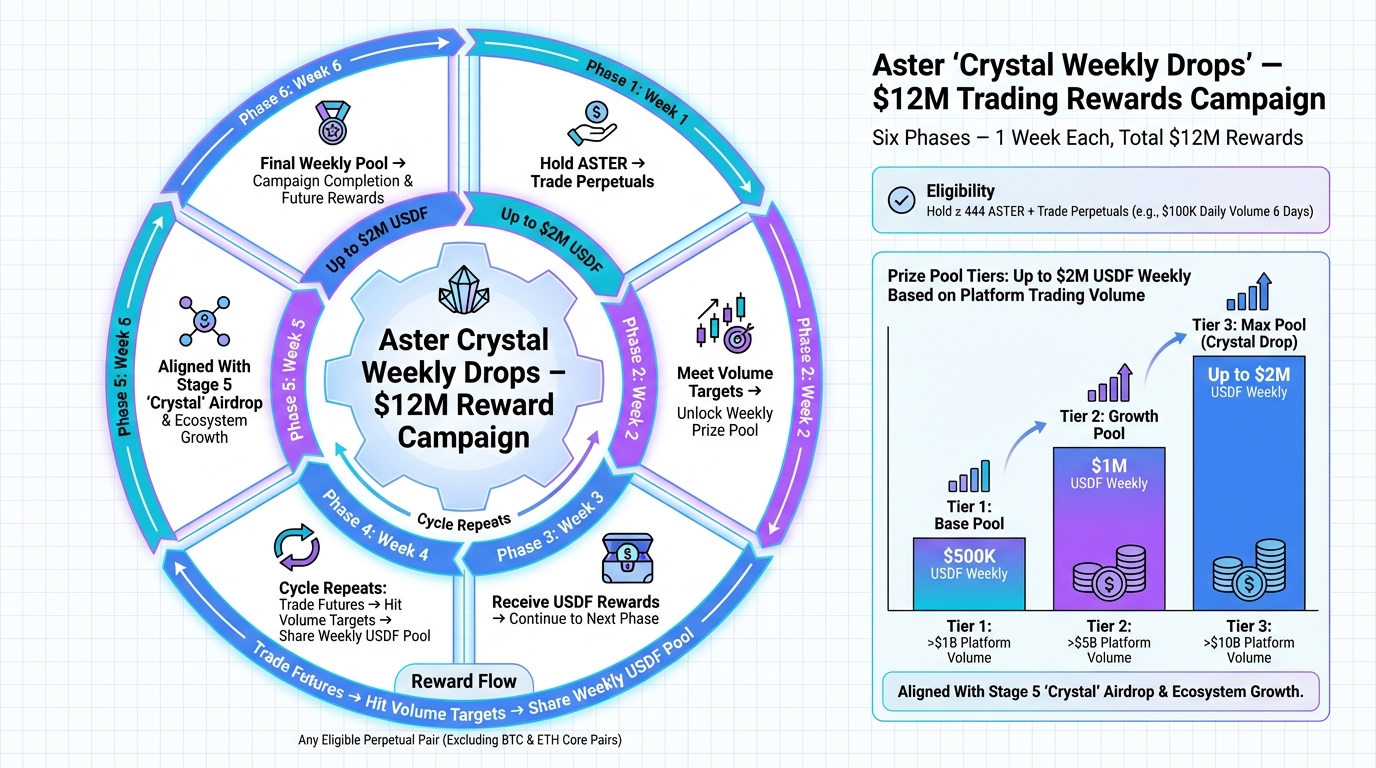

Jon: Not free money – think of it as a merit-based treasure hunt in a digital world. Aster is a decentralized perpetuals exchange, like a 24/7 stock market for crypto without expiration dates. The Crystal Weekly Drops is a six-phase competition where qualified holders of ASTER tokens participate in trading to earn rewards from a $12 million pool. Using metaphors: your wallet is the backpack, the blockchain is the unchangeable rulebook, and smart contracts are automated vending machines that dispense prizes fairly without a middleman. For beginners, start by understanding that you need a wallet to hold ASTER, then engage in trades on the platform. Safety tip: only use what you can afford to lose, and enable two-factor authentication. This setup ensures real-world meaning: rewards aren’t just points; they’re tokens you own, trade, or use across Web3 ecosystems.

Lila: That sounds practical. Can you give me some real examples of how this applies in everyday life?

Jon: Absolutely. Let’s look at three concrete use cases. First, in gaming: Web3 campaigns like Aster’s are similar to in-game rewards, but instead of company-controlled loot, you get NFTs or tokens you can sell or use in other games – true digital ownership. Second, in finance: Traditional banks offer promotions, but Web3 DeFi lets you earn yields through staking or trading competitions without needing approval from a bank. Aster’s setup rewards active traders, teaching financial literacy in a decentralized way. Third, in community building: Airdrops, like Aster’s Stage 5 distribution of 1.2% of supply, foster loyalty by giving tokens to participants, turning users into stakeholders. It’s like a co-op where everyone benefits from growth, not just executives.

Web2 vs. Web3: A Side-by-Side Comparison

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized giveaways controlled by platforms, revocable rewards | Decentralized campaigns like Aster’s, with immutable token rewards via smart contracts |

| User data owned by companies, prone to breaches | User-controlled wallets, enhancing privacy and security |

| Limited interoperability; assets stuck on one site | Composability allows tokens to move across ecosystems |

| Censorship possible by platform owners | Censorship-resistant through blockchain consensus |

| Rewards often in fiat or points, taxable and regulated heavily | Token-based rewards, enabling global, peer-to-peer value transfer |

Lila: This comparison really highlights the differences. But with all this potential, what risks should I watch out for?

Jon: In summary, technologies like Aster’s campaign enable true digital empowerment: ownership of assets, fair participation in economies, and resilient communities without central gatekeepers. However, unresolved risks include volatility – token values can fluctuate wildly – and security threats like phishing scams. Always verify sources and use hardware wallets for larger holdings. The key is education: observe, learn the basics, and engage mindfully.

Lila: Thanks, Jon. This makes me want to learn more without jumping in blindly. What’s the best next step for someone like me?

References & Further Reading

- Aster Kicks Off ‘Crystal Weekly Drops’ Campaign With $12M In Prizes

- Ethereum Glossary: Basic Web3 Terms

- Blockchain.com Learning Portal