From experience, USD+ stablecoin shows assets can be productive in Web3 without lockups or centralized control.

—#DeFi #Stablecoin

—

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Decoding USD+: Streamflow’s Yield-Bearing Stablecoin and Its Role in DeFi Architecture

🎯 Difficulty: Advanced

💎 Core Value: Yield Generation / Decentralized Finance / Tokenized Real-World Assets

👍 Recommended For: DeFi developers building treasury solutions, Web3 treasury managers optimizing idle capital, Blockchain architects exploring stablecoin designs

Lila: Jon, with all the buzz around stablecoins evolving in 2025, especially ones backed by real-world assets like U.S. Treasuries, what macro trends are driving innovations like Streamflow’s USD+? How does it fit into the broader push for trust-minimized financial systems?

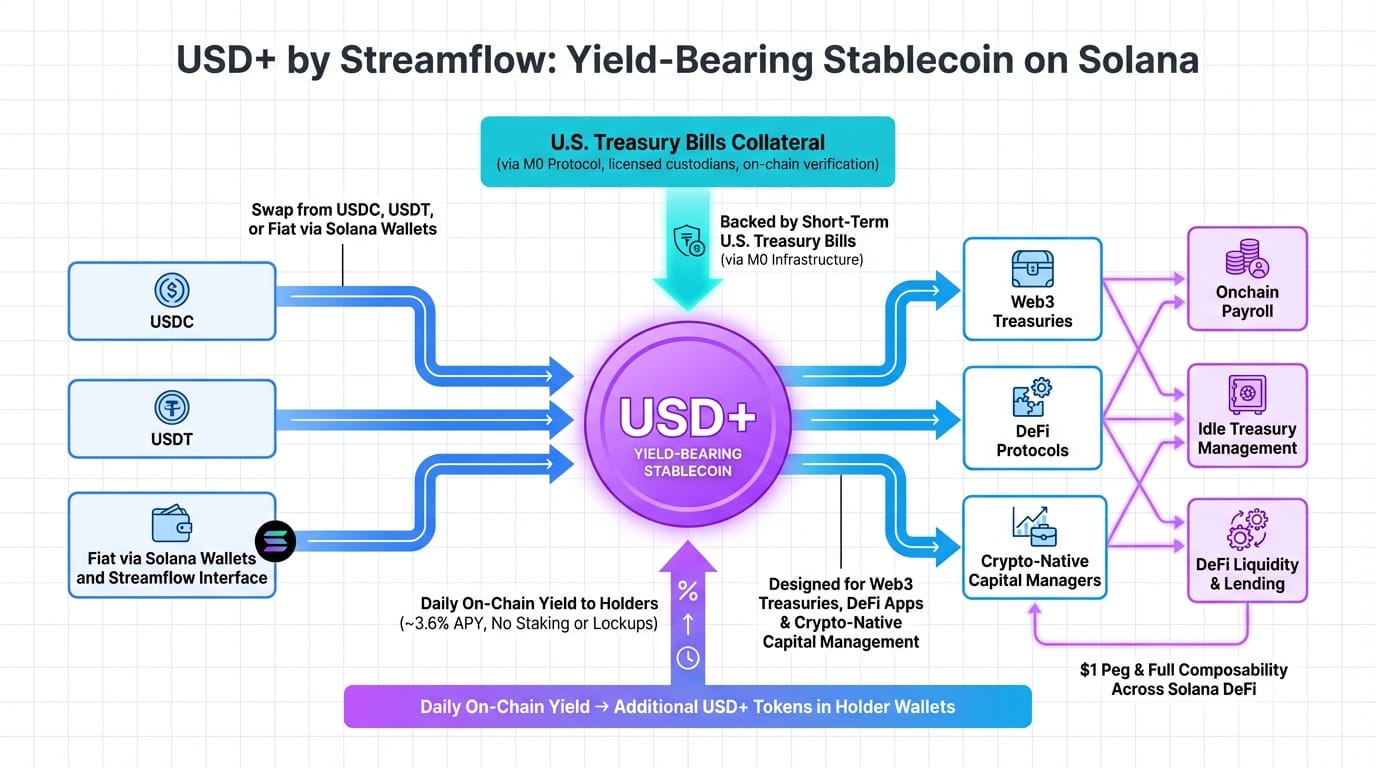

Jon: Excellent starting point, Lila. In the macro landscape of DeFi as we enter 2026, we’re seeing a convergence of traditional finance and blockchain infrastructure. Stablecoins have ballooned to a $314 billion market cap, but the real shift is toward yield-bearing variants that minimize trust in centralized issuers. USD+, launched by Streamflow on Solana, exemplifies this by tokenizing short-term U.S. Treasury Bills, distributing daily yields on-chain without requiring staking or lockups. This design reduces counterparty risk through trust minimization—relying on verifiable blockchain mechanics rather than opaque custodians. It positions stablecoins not just as value stores, but as productive assets in Web3 treasuries and DeFi protocols, aligning with institutional inflows that hit $31 billion in Bitcoin and Ethereum ETFs last year.

Lila: That makes sense for the big picture, but let’s zoom in on the evolution from Web2 to Web3. How does USD+ highlight the differences in centralized versus decentralized systems, especially regarding ownership and composability?

Jon: Precisely. In Web2, financial systems are centralized silos—think banks holding your funds, controlling yields, and imposing fees with little transparency. Ownership is illusory; you don’t truly control assets, and censorship can occur via account freezes. Web3 flips this with decentralization: assets like USD+ are user-controlled via self-custodial wallets, resistant to censorship through distributed ledgers like Solana’s high-throughput blockchain. Composability shines here—USD+ can seamlessly integrate into DeFi apps as collateral or liquidity, enabling “money Legos” where protocols build atop each other without permission. For instance, its yield accrues directly to holders’ wallets, fostering ecosystem interoperability that Web2 can’t match due to proprietary barriers.

Core Mechanisms of USD+

Lila: Diving deeper into the tech, can you break down USD+’s token design and architecture? What makes it yield-bearing, and how does it handle decentralization?

Jon: Absolutely. USD+ is engineered as an ERC-20-like token on Solana, backed by tokenized U.S. Treasury Bills managed through regulated channels. Its core mechanism is automatic yield distribution: interest from Treasuries is tokenized and airdropped daily to holders’ wallets via Streamflow’s infrastructure, which specializes in token vesting and streaming. This avoids the need for manual claims or centralized oracles, leveraging Solana’s fast settlement (sub-second finality) for efficiency. Decentralization comes from on-chain transparency—yields are verifiable via blockchain explorers, minimizing trust in issuers. Architecturally, it uses a rebasing model where the token balance increases automatically, akin to Ampleforth but stabilized by real-world assets. Trade-offs include Solana’s occasional network congestion, but this is mitigated by its Proof-of-History consensus for high TPS (transactions per second), making it ideal for DeFi composability.

Lila: Interesting— so it’s not just a stablecoin but a tool for real utility. What are some concrete use cases where USD+ could play a key role in Web3 ecosystems?

Jon: Let’s outline three applications. First, in Web3 treasuries: DAOs or crypto-native firms often hold idle stablecoins; USD+ allows them to earn Treasury-backed yields passively, optimizing capital efficiency without active management. Second, within DeFi apps: It serves as collateral in lending protocols like Aave on Solana, where yields compound automatically, enhancing liquidity pools and reducing opportunity costs. Third, for ecosystem roles in payments and remittances: Crypto investors can use USD+ for cross-border transfers with embedded yields, bridging traditional finance with blockchain’s borderless nature, all while maintaining peg stability through over-collateralization with low-risk assets.

Web2 vs. Web3 Comparison

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized custody of funds in banks, yields controlled by institutions with hidden fees. | User-controlled assets via wallets, yields distributed on-chain transparently (e.g., USD+ daily accruals). |

| Limited interoperability; siloed apps require permissions for integration. | High composability; tokens like USD+ plug into DeFi protocols seamlessly (e.g., as collateral in lending). |

| Vulnerable to censorship and single points of failure (e.g., account freezes). | Censorship-resistant through decentralized networks like Solana, with verifiable ownership. |

| Yields often require lockups or minimum balances, managed off-chain. | Passive, no-lockup yields from real-world assets, automated via smart contracts. |

Lila: The comparison really highlights the advantages, but what about potential downsides? How does Jon see the risks and future of designs like USD+?

Jon: Fair question—nothing’s without trade-offs. USD+ enables efficient yield in DeFi, fostering true asset ownership and composable finance, but risks include regulatory scrutiny on tokenized securities, smart contract vulnerabilities (though audited), and market volatility if Treasury yields fluctuate. It also depends on Solana’s network reliability. Unresolved challenges are scaling to institutional levels without compromising decentralization. Overall, it advances Web3 toward mature, utility-driven systems, but users should focus on understanding protocols deeply rather than rushing in.

Lila: Wrapping up, if someone’s intrigued by USD+ and similar innovations, what’s the best mindset for exploring this space further?

Jon: Approach it with curiosity and caution—study the architecture, experiment with testnets, and observe ecosystem developments. Remember, Web3’s power lies in empowerment through knowledge, not speculation.

References & Further Reading

- USD+ Introduced By Streamflow: A Yield-Bearing Stablecoin For Web3 Treasuries And DeFi Apps

- Streamflow Announces USD+, a Yield-Bearing Solana Stablecoin Backed by U.S. Treasury Bills – Chainwire

- 2026 Institutional Crypto Outlook | The Block