Personally, these 2026 crypto trends suggest a move toward automated and trustless infrastructure.#Web3 #DeFi

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

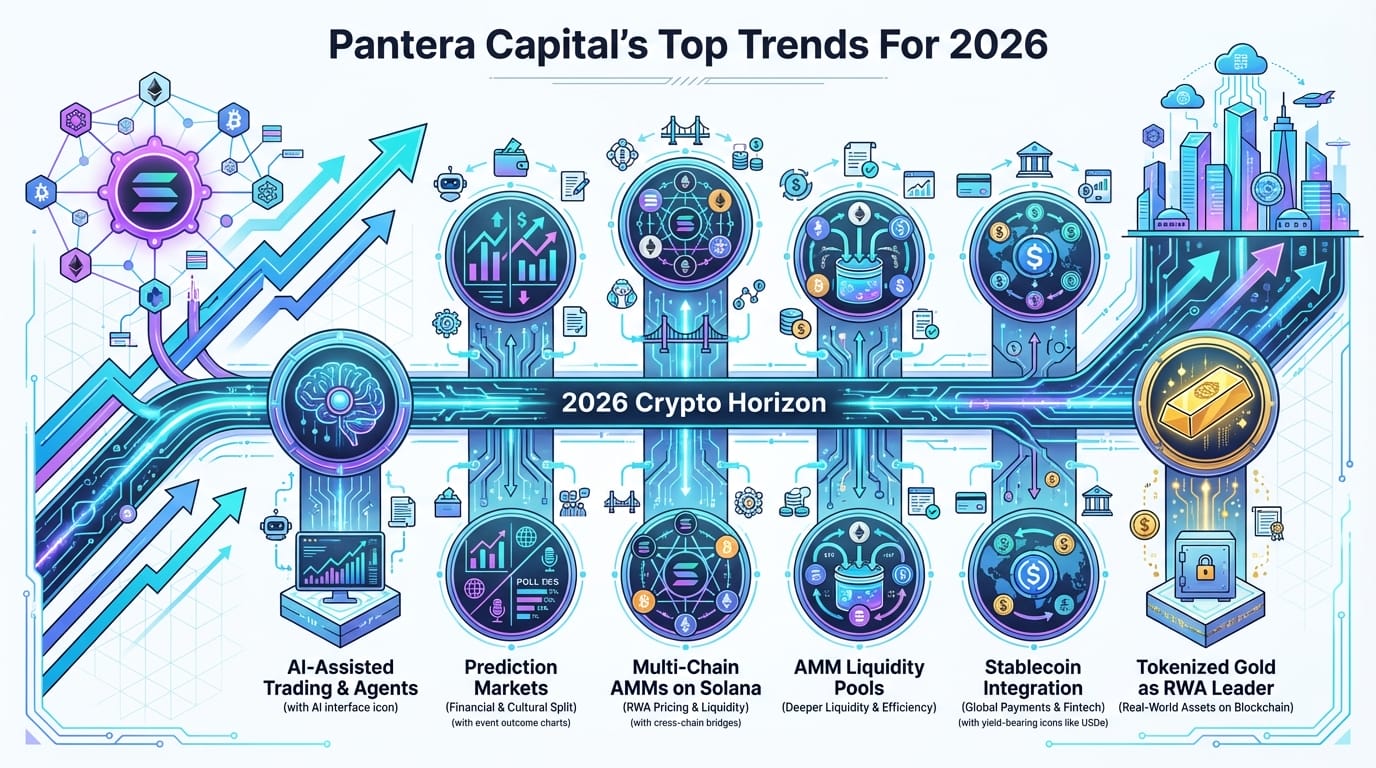

Decoding Pantera Capital’s 2026 Crypto Trends: Prediction Markets, Multi-Chain AMMs, and Stablecoin Integration

🎯 Difficulty: Advanced

💎 Core Value: Decentralization / Interoperability / Tokenized Ecosystems

👍 Recommended For: DeFi Enthusiasts, Blockchain Developers, Crypto Investors Seeking Architectural Insights

Lila: Jon, I’ve been following Pantera Capital’s latest predictions for 2026, focusing on prediction markets, multi-chain AMMs, and stablecoin integration. As someone experienced in Web3, I’m curious about the macro trends here. How do these fit into the broader shift toward decentralization and trust minimization in crypto?

Jon: Absolutely, Lila. Pantera’s outlook, as detailed in their recent analysis, highlights a maturing crypto ecosystem where these elements drive efficiency and scalability. At its core, decentralization minimizes trust by distributing control across networks, reducing reliance on central authorities. Prediction markets, for instance, leverage this to create decentralized betting platforms on real-world events, using smart contracts to enforce outcomes without intermediaries. Multi-chain AMMs extend automated market makers across blockchains, enhancing liquidity through cross-chain bridges and protocols like LayerZero or Wormhole. Stablecoin integration ties it all together, providing stable value rails for seamless transactions. This isn’t hype—it’s about architectural evolution toward composable, trustless systems.

Lila: That makes sense, but let’s contrast this with Web2. In traditional systems, everything is centralized—think social media platforms controlling data. How does Web3’s approach to ownership and censorship resistance change the game for these trends?

Jon: Great point. In Web2, centralized servers handle data, making them vulnerable to censorship or single-point failures. Web3 flips this with blockchain’s distributed ledgers, ensuring immutable ownership via cryptographic proofs. For prediction markets, this means users own their stakes directly, resistant to platform shutdowns. Composability allows protocols to interoperate—like an AMM pulling liquidity from multiple chains—fostering innovation without permission. Pantera notes this leads to differentiated competition, where ecosystems compete on efficiency rather than monopoly control.

Core Mechanisms: Technical Breakdown

Lila: Diving deeper, can you explain the core mechanisms? For multi-chain AMMs, what’s the technical architecture that enables this, and how does it tie into stablecoins?

Jon: Sure. Multi-chain AMMs build on the AMM model, like Uniswap’s constant product formula (x * y = k), but extend it across chains using interoperability protocols. This involves cross-chain messaging standards, such as those in Cosmos’ IBC or Ethereum’s rollup bridges, allowing liquidity pools to sync without centralized oracles. Token design here is crucial—often using wrapped assets or synthetic tokens to maintain pegs. Stablecoin integration, as Pantera predicts, acts as the payment infrastructure, with assets like USDC or USDT providing low-volatility bridges. Decentralization logic ensures trust minimization through consensus mechanisms like Proof-of-Stake, where validators secure transactions across chains. Ecosystem roles include liquidity providers earning yields and developers building modular layers for scalability.

Lila: And for prediction markets? How does their token design and architecture promote fair, decentralized outcomes?

Jon: Prediction markets, like those on Augur or Polymarket, use oracle networks (e.g., Chainlink) for real-world data feeds, combined with smart contracts for resolution. Token design often incorporates governance tokens for dispute resolution, ensuring decentralization. The architecture relies on game-theoretic incentives—users stake tokens on outcomes, with winners claiming losers’ stakes post-resolution. This minimizes trust by aligning incentives, but requires robust anti-manipulation measures, like time-weighted voting. Pantera sees growth here due to capital-efficient designs, integrating with multi-chain setups for broader participation.

Lila: What about use cases? Can you outline three concrete applications where these trends could play out?

Jon: First, in decentralized finance (DeFi), multi-chain AMMs enable seamless cross-chain swaps, reducing fees and improving liquidity for global trading. Imagine a user swapping assets from Ethereum to Solana without custodians—stablecoins facilitate this as the stable denominator. Second, in AI-assisted trading, as Pantera forecasts, prediction markets integrate with AI agents for probabilistic forecasting, like betting on market events with automated strategies. This creates ecosystem roles for data providers and AI developers. Third, in real-world asset (RWA) tokenization, stablecoin integration allows tokenized gold or securities to trade via prediction markets, predicting asset prices with multi-chain liquidity ensuring efficient markets.

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized exchanges control liquidity and user funds, prone to hacks or shutdowns. | Multi-chain AMMs distribute liquidity across blockchains, user-controlled via wallets. |

| Betting platforms rely on trusted intermediaries for outcomes and payouts. | Prediction markets use smart contracts and oracles for trustless resolution. |

| Fiat payments involve banks with high fees and borders. | Stablecoin integration enables borderless, low-cost transactions on-chain. |

| Data silos limit interoperability between platforms. | Composability allows protocols to build on each other, enhancing ecosystem efficiency. |

Lila: These comparisons highlight the advantages, but what risks remain unresolved in this 2026 vision?

Jon: Pantera’s predictions enable scalable, interoperable systems that empower users with true ownership and efficient markets. However, risks like quantum computing threats to cryptography persist—hence the ‘quantum panic’ they mention, pushing for post-quantum upgrades. Oracle failures in prediction markets or bridge exploits in multi-chain setups could lead to losses. Privacy concerns also loom, with calls for better frameworks. Overall, this fosters a differentiated crypto landscape, but architectural robustness is key.

Lila: Reflecting on this, how should readers approach these trends—to observe and learn rather than rush in?

Jon: Precisely. Focus on understanding the protocols, explore open-source code, and observe ecosystem developments. It’s about building literacy in decentralization, not speculation.

References & Further Reading

- Pantera Capital’s Top Trends For 2026: Prediction Markets, Multi-Chain AMMs, And Stablecoin Integration

- The Year of Structural Progress | Pantera Blockchain Letter

- Pantera Capital Researcher Jay Yu Forecasts 12 Crypto Market Predictions for 2026 – Blockonomi