In my view, these collaborations prove that Web3 adoption relies on practical integration.#Web3 #Ripple

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Unlocking Crypto Partnerships: How Ripple, BlackRock, and SoFi Are Shaping Web3 Adoption

🎯 Difficulty: Beginner Friendly

💎 Core Value: Enterprise Adoption / Regulated Infrastructure / Real-World Integration

👍 Recommended For: First-time Web3 explorers, crypto curious newcomers, and traditional finance enthusiasts looking to understand blockchain partnerships

Lila: I’ve been reading about these big crypto partnerships, like the one with Ripple, BlackRock, and SoFi in December 2025. But as someone new to Web3, I’m confused—why do these matter? In Web2, companies partner all the time without much fuss. What makes this different in a decentralized world?

Jon: Great question, Lila. Let’s start by addressing those Web2 limitations you mentioned. In Web2, platforms like social media or banking apps control everything—your data, your transactions, even your access. It’s like renting an apartment: you live there, but the landlord can change the rules or evict you anytime. Web3 flips this with decentralization, where blockchain acts as a shared, tamper-proof ledger that no single entity owns. These partnerships, as highlighted in the December 2025 news, are bridges from traditional finance to this new system. Ripple’s tech for cross-border payments, BlackRock’s asset management muscle, and SoFi’s consumer banking tools are teaming up to make crypto more accessible and regulated, essentially onboarding everyday users without the usual chaos.

From Web2 Limitations to Web3 Possibilities

Lila: Okay, that metaphor helps. But can you break down how these partnerships evolve us from centralized Web2 systems? I worry about things like data privacy or getting locked out of my accounts.

Jon: Absolutely. In Web2, centralization means companies like banks or tech giants hold all the power—your money, data, and interactions are at their mercy, vulnerable to hacks, censorship, or arbitrary decisions. Web3 emphasizes user ownership, where you control your digital assets via cryptographic keys. Censorship resistance ensures no one can block your transactions, and composability lets different protocols snap together like Lego bricks. The Ripple-BlackRock-SoFi partnerships exemplify this evolution: Ripple’s blockchain for fast payments integrates with BlackRock’s ETF expertise and SoFi’s user-friendly apps, creating hybrid systems that blend Web2 reliability with Web3 freedom. It’s not just hype; it’s about building trust through regulation while preserving decentralization.

Diving into Core Mechanisms

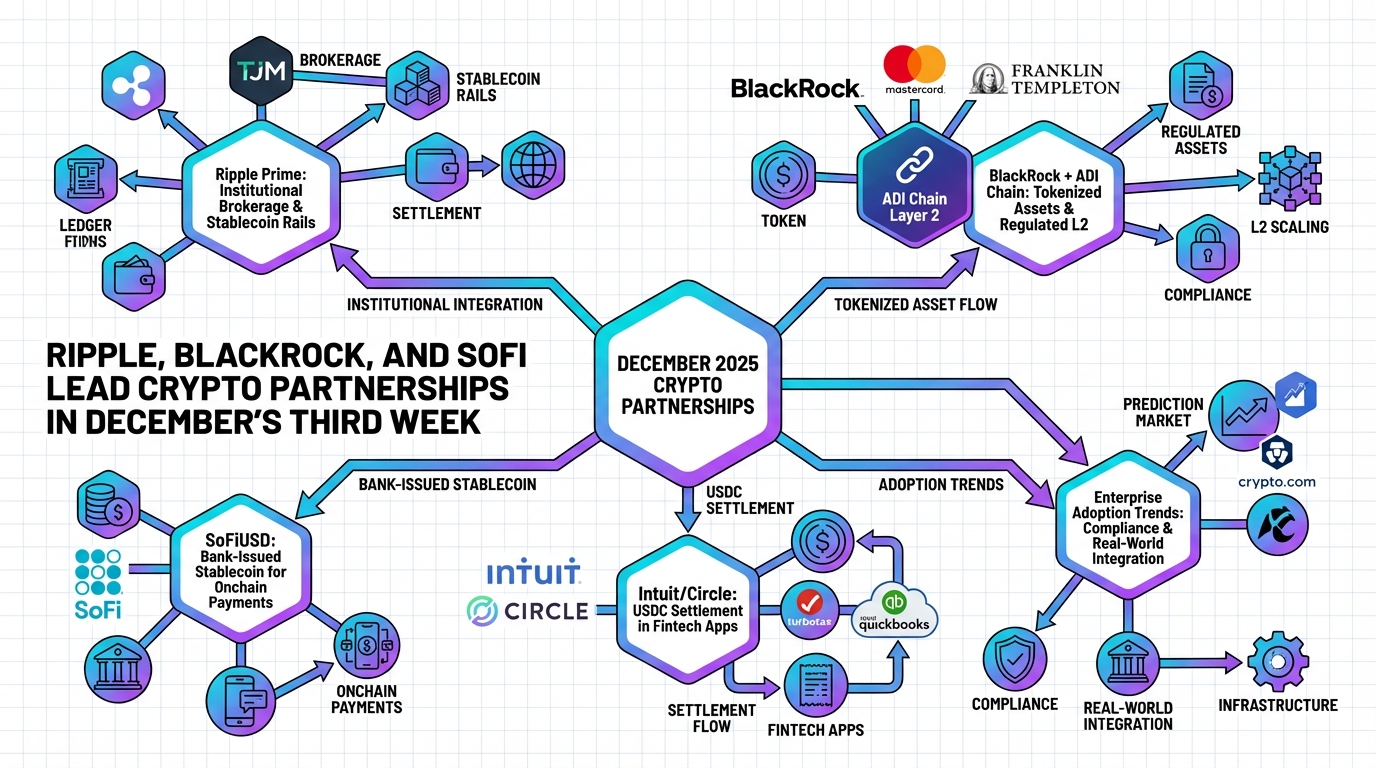

Lila: The diagram looks helpful, but terms like “blockchain” and “partnerships” still feel abstract. Can you explain the core mechanisms here using simple analogies? How do these companies actually work together in Web3?

Jon: Sure, let’s use metaphors to make it concrete. Think of a blockchain as a public notebook where everyone can write and verify entries, but no one can erase them— that’s the foundation of Ripple’s XRP Ledger, designed for quick, cheap global payments like sending money across borders without a middleman bank. A wallet is your digital backpack: it holds your keys to access and control assets securely. In these partnerships, BlackRock acts like a trusted vault keeper, bringing institutional-grade security to crypto ETFs, while SoFi is the friendly guide helping beginners pack their backpacks with easy-to-use tools. Together, they’re not just linking systems; they’re enabling real-world utility, like tokenized assets where an NFT represents ownership of a real stock or bond, much like a digital deed to a house.

Real-World Use Cases in Action

Lila: That makes sense for safety and basics. But what are some concrete applications? How do these partnerships apply to everyday life or bigger systems?

Jon: Let’s explore three key use cases. First, in finance: Ripple’s partnerships with SoFi enable seamless cross-border remittances—imagine sending money to family overseas instantly, without high fees, using blockchain as an invisible highway. Second, asset management: BlackRock’s involvement could mean tokenized funds where users own fractions of investments directly, like holding a piece of a communal pie you can trade anytime, fostering true digital ownership. Third, community building: These collaborations support decentralized finance (DeFi) platforms where users govern decisions via voting tokens, turning passive consumers into active participants, much like a neighborhood co-op deciding its rules. The December 2025 news underscores how these drive enterprise adoption, making Web3 practical for regulated sectors like banking.

Comparing Web2 and Web3 Approaches

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized control by companies (e.g., banks dictating transaction rules) | Decentralized networks where users control assets via wallets and smart contracts |

| Data owned by platforms, prone to breaches and censorship | User-owned data with cryptographic security and resistance to tampering |

| Partnerships limited to closed ecosystems with high intermediaries | Open composability, allowing seamless integration like Ripple-BlackRock-SoFi for global payments |

| Slow, costly international transfers via traditional banking | Fast, low-cost transactions on blockchain ledgers with real-time verification |

| Limited user agency; platforms can freeze accounts | Empowered users with self-custody, reducing reliance on third parties |

Lila: The table really highlights the differences. It seems Web3 offers more freedom, but are there risks? Like, what if I lose my wallet keys?

Jon: You’re right to raise that—Web3’s strengths come with responsibilities. Losing keys is like misplacing your house keys forever; there’s no central authority to bail you out, emphasizing the need for backups and education. These partnerships mitigate some risks by adding regulatory layers, like compliant stablecoins or insured products, but they don’t eliminate volatility or scams. Always prioritize learning secure practices over rushing in.

Wrapping Up: What This Enables and What’s Next

Jon: In summary, these Ripple, BlackRock, and SoFi partnerships enable a more inclusive Web3 ecosystem—bridging traditional finance with decentralized tech for better access, efficiency, and ownership. They resolve some Web2 pain points but introduce new challenges like key management and regulatory hurdles. The core takeaway is empowerment through understanding, not just tech hype.

Lila: That leaves me optimistic yet cautious. If someone’s intrigued by this, what’s a good next step without diving into risks blindly?

Jon: Observe and learn: Read reputable sources, experiment with free simulations of wallets, and follow how these partnerships unfold. It’s about building literacy for a decentralized future, not hasty actions.

References & Further Reading

- Ripple, BlackRock, And SoFi Lead Crypto Partnerships In December’s Third Week

- CoinDesk – General Crypto News and Analysis

- Ethereum Glossary – Basic Web3 Concepts

- Ripple Official Documentation on XRP Ledger