It seems the 20x growth in crypto cards signals a major shift toward practical utility.#DeFi #Stablecoins

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Crypto Cards: The Strategic Bridge in Expanding Stablecoin Adoption – Insights from Artemis DeFi Study

🎯 Difficulty: Advanced

💎 Core Value: Decentralization / Interoperability / Financial Inclusion

👍 Recommended For: DeFi enthusiasts, blockchain developers, fintech innovators

Lila: Jon, I’ve been reading about this Artemis DeFi study on crypto cards and stablecoin adoption. The title suggests they’re still strategically important even as stablecoins grow. As someone tracking macro trends in Web3, what do you make of this shift? How does it tie into broader decentralization and trust minimization in financial systems?

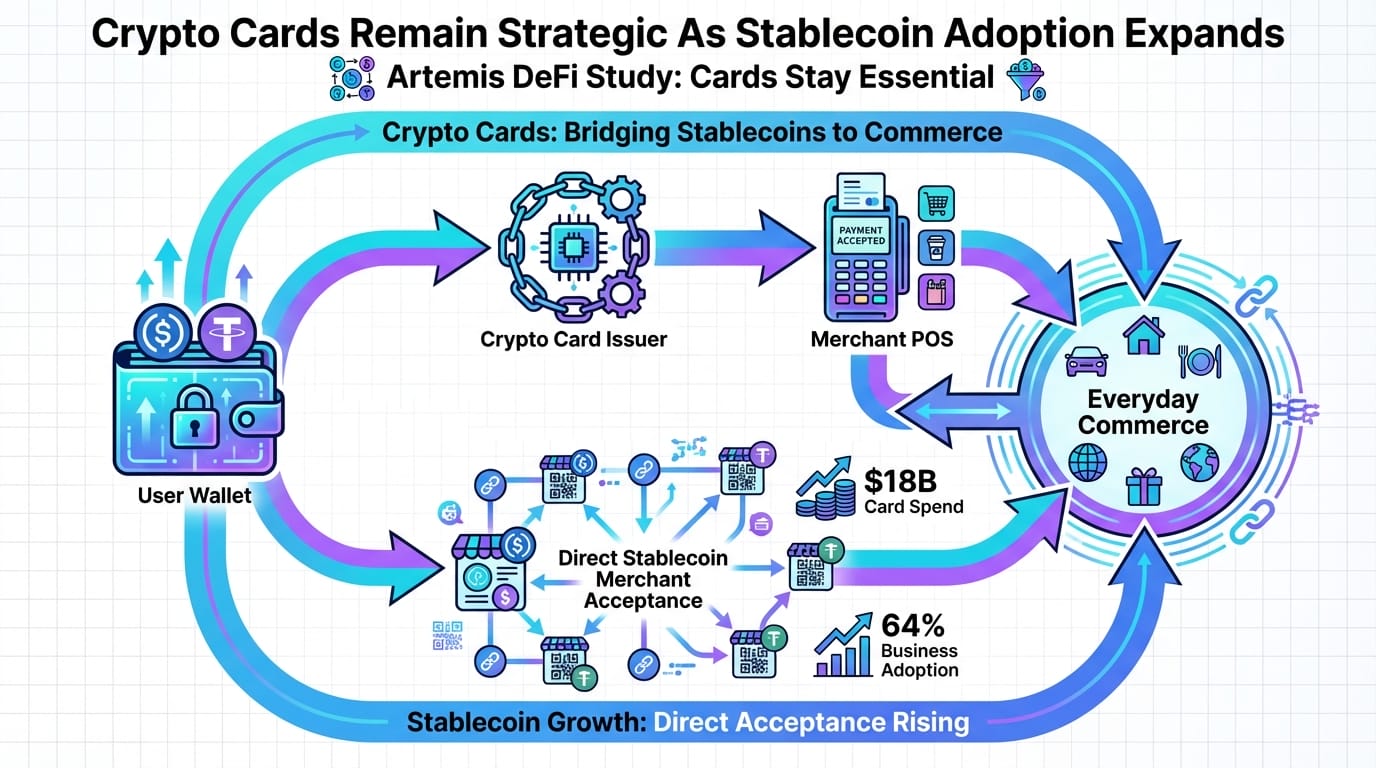

Jon: Absolutely, Lila. This study from Artemis highlights a pivotal macro trend in DeFi: the convergence of stablecoins with real-world payment infrastructure. In a decentralized ecosystem, trust minimization is key—stablecoins like USDC or USDT reduce volatility by pegging to fiat, while crypto cards act as on-ramps to legacy systems like Visa or Mastercard. The report notes crypto cards growing 20x faster than direct stablecoin transfers, driven by emerging market adoption. This isn’t just hype; it’s about architectural composability, where blockchain layers (like Ethereum’s L2s) integrate with centralized rails for efficiency, minimizing reliance on single points of failure.

From Web2 Limitations to Decentralized Financial Architectures

Lila: That makes sense on a high level, but let’s contrast this with traditional systems. How do centralized Web2 payment platforms stack up against these emerging Web3 solutions in terms of ownership and resistance to censorship?

Jon: Great point. In Web2, platforms like PayPal or traditional banks control user funds, enabling censorship—think account freezes or transaction blocks based on arbitrary policies. Web3 flips this with self-custodial wallets, where users hold private keys, ensuring true ownership. Crypto cards bridge this by converting stablecoin holdings into spendable fiat at point-of-sale, leveraging decentralized ledgers for settlement. The Artemis study emphasizes how this composability—combining stablecoins with card networks—enhances censorship resistance, as users can bypass intermediaries. It’s not perfect; hybrid models still touch centralized points, but they reduce trust requirements through cryptographic proofs.

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized control by corporations (e.g., banks dictating transaction rules) | Decentralized protocols with user sovereignty (e.g., stablecoins on blockchain for peer-controlled value transfer) |

| High fees and slow cross-border settlements | Low-cost, instant transfers via stablecoins, enhanced by cards for real-world use |

| Data silos and privacy risks | Pseudonymous transactions with optional zero-knowledge proofs for privacy |

| Limited interoperability between platforms | Cross-chain composability (e.g., stablecoins bridging Ethereum and Solana ecosystems) |

Lila: The comparison really highlights the evolution. Diving deeper into the core mechanisms, how do these crypto cards actually work architecturally? The study mentions them as infrastructure for stablecoin payments—can you break down the technical layers involved?

Jon: Sure. At the protocol level, crypto cards rely on stablecoin smart contracts—typically ERC-20 tokens on Ethereum or compatible chains like Polygon for scalability. When you load a card, it’s essentially a bridge: your wallet authorizes a transfer to a custodian (often regulated), which issues fiat equivalent via Visa/Mastercard APIs. The Artemis report points to $18B annual run rates, driven by this hybrid architecture. Trust minimization comes from on-chain verifiability; settlements use oracles for peg stability, and some implementations incorporate account abstraction (EIP-4337) for gasless user experiences. Decentralization logic here minimizes single-entity control—unlike Web2 cards, where issuers hold all power, Web3 versions allow users to switch providers without losing asset ownership.

Lila: Fascinating. With adoption expanding, as per the study, what about token design? How do stablecoins and cards fit into ecosystem roles, especially in terms of incentives and governance?

Jon: Token design is crucial. Stablecoins like USDT use collateralized models (fiat reserves) or algorithmic ones (though riskier, as seen in past failures). Crypto cards extend this by creating liquidity pools for instant conversions, often governed by DAOs for fee structures. In the broader ecosystem, they play a role in DeFi composability—integrating with lending protocols (e.g., Aave) or yield farms. The study notes cards overtaking P2P transfers, signaling a shift to merchant acceptance. Governance-wise, decentralization ensures no central authority can alter rules unilaterally; proposals via tokens like those in MakerDAO for DAI maintain pegs through community votes.

Lila: Let’s talk applications. The report focuses on everyday spending, but how does this extend to other use cases in Web3, like finance or cross-border scenarios?

Jon: Excellent question. First, in decentralized finance (DeFi), crypto cards enable seamless on-ramping: users can spend stablecoin yields directly, bypassing exchanges. The Artemis data shows $1.5B monthly volumes, reshaping global commerce by reducing remittance costs—think migrants using cards for instant, low-fee transfers. Second, for identity and cross-border trade, cards integrate with self-sovereign identity protocols (e.g., via DID standards), allowing verified, censorship-resistant payments in sanctioned regions. Third, in community-driven economies like DAOs, cards facilitate treasury spending—converting governance tokens to stablecoins for real-world operations, enhancing interoperability across ecosystems.

Lila: Those use cases show real potential. But Jon, what about the risks? The study is optimistic, but are there unresolved challenges in this architecture?

Jon: Indeed, while enabling financial inclusion and trustless transactions, risks persist. Regulatory uncertainty could impact card issuers, as seen with varying stablecoin laws. Technically, oracle failures might disrupt pegs, and hybrid models introduce centralization vectors—e.g., custodians as attack surfaces. Scalability on base layers like Ethereum requires L2s, but congestion remains. The key is observing protocol evolution without rushing in; focus on understanding these trade-offs for informed literacy.

Lila: Wrapping up, if readers want to explore this further, what’s the takeaway on why crypto cards remain strategic amid stablecoin growth?

Jon: In summary, they bridge decentralized assets to legacy systems, enabling widespread adoption without full infrastructure overhaul. As stablecoins hit mainstream, cards provide the interoperability layer, minimizing trust while maximizing utility. Risks like centralization hybrids exist, but the architecture points to a more inclusive financial future. I’d encourage observing trends through reputable studies—dive deeper, stay curious, but prioritize learning over speculation.

References & Further Reading

- Crypto Cards Remain Strategic As Stablecoin Adoption Expands, Says New Artemis DeFi Study

- Crypto Cards Are Growing 20× Faster Than Stablecoin Transfers: Here’s Why | Live Bitcoin News

- Crypto Cards Hit $18B Market, Bringing Stablecoins to Everyday Spending – DailyCoin

- Stablecoin Payments at Scale: How Cards Bridge Digital Assets and Global Commerce

▼ AI tools to streamline research and content production (free tiers may be available)

Free AI search & fact-checking

👉 Genspark

Recommended use: Quickly verify key claims and track down primary sources before publishing

Ultra-fast slides & pitch decks (free trial may be available)

👉 Gamma

Recommended use: Turn your article outline into a clean slide deck for sharing and repurposing

Auto-convert trending articles into short-form videos (free trial may be available)

👉 Revid.ai

Recommended use: Generate short-video scripts and visuals from your headline/section structure

Faceless explainer video generation (free creation may be available)

👉 Nolang

Recommended use: Create narrated explainer videos from bullet points or simple diagrams

Full task automation (start from a free plan)

👉 Make.com

Recommended use: Automate your workflow from publishing → social posting → logging → next-task creation

※Links may include affiliate tracking, and free tiers/features can change; please check each official site for the latest details.