Is Cardano ready for institutional prime time? Apex Fusion’s VECTOR unlocks instant finality & high TPS, driving serious ROI.#CardanoScaling #ApexFusion #Web3DeFi

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Apex Fusion’s VECTOR Launch: Unlocking Institutional-Grade Scaling for Cardano Ecosystems

🎯 Difficulty: Enterprise (Requires understanding of blockchain interoperability and institutional compliance)

💎 Value Proposition: Enhanced Throughput, Instant Finality, Cross-Chain Utility for ROI-Focused Scaling

👍 Recommended For: Institutional Investors, DeFi Protocol Builders, Cardano Ecosystem Developers

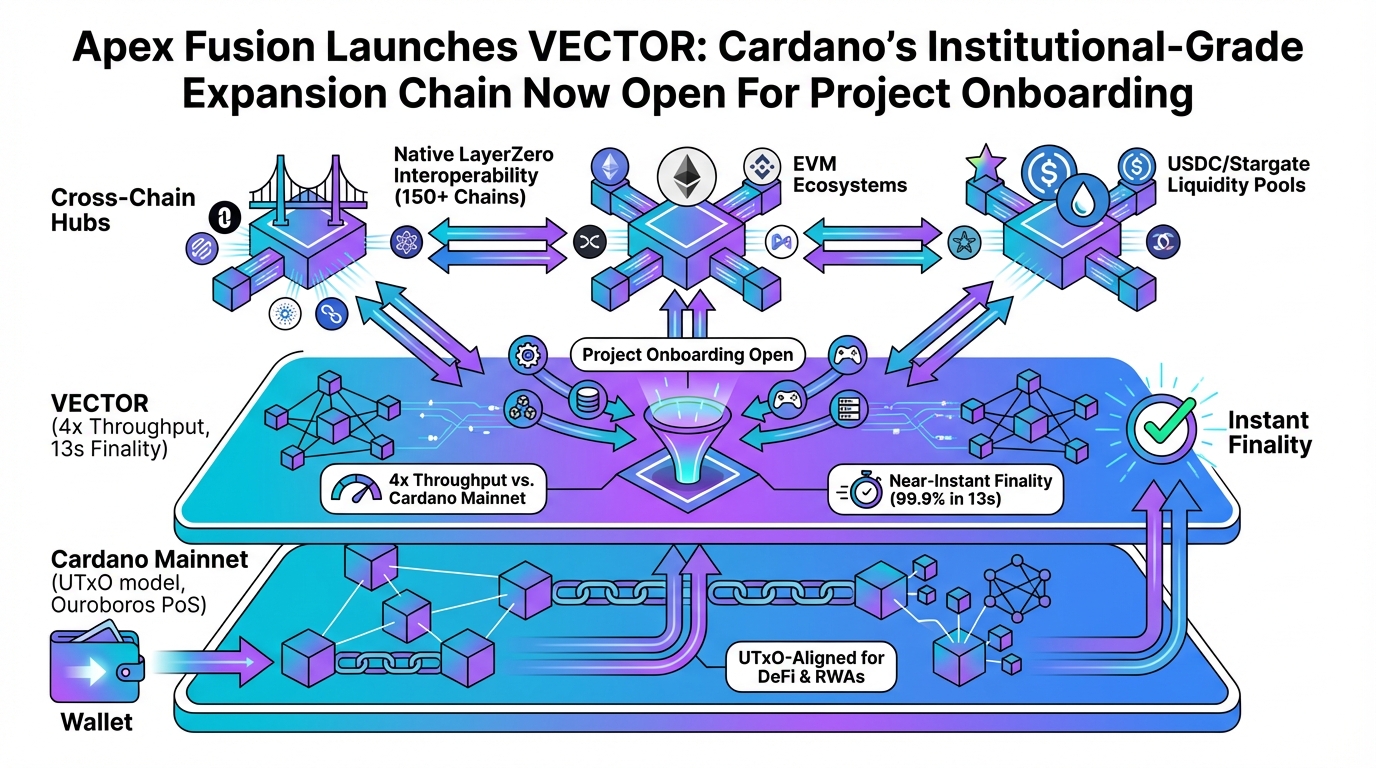

John: Alright, let’s cut through the noise in the crypto markets. We’re seeing liquidity fragmentation across chains, with Cardano’s deliberate but sometimes sluggish finality holding back institutional adoption. Enter Apex Fusion’s VECTOR – a Cardano-aligned expansion chain that’s not just hype; it’s engineered for high TPS (transactions per second) and instant settlement. As a battle-hardened architect, I’ve dissected similar layer-2 solutions, and this one aligns with Cardano’s Ouroboros consensus while boosting performance. For deep dives into the whitepaper, I recommend using Genspark – it’s an AI agent that pulls real-time protocol specs without the fluff.

Lila: John, you’re jumping straight into the alpha, but let’s bridge it for those transitioning from Web2. Imagine the old financial systems as clunky servers bogged down by intermediaries – that’s where market inefficiencies like delayed settlements eat into ROI. VECTOR flips this by providing a decentralized bridge, opening doors for projects to onboard seamlessly.

The Evolution: From Web2 Centralization to Web3 Decentralization

John: We’ve all seen the pitfalls of Web2: centralized databases where big tech owns your data, and scaling means more servers under one roof. Think Facebook controlling your social graph or banks gatekeeping transactions with fees that rival gas guzzlers. VECTOR represents the Web3 shift – leveraging Cardano’s proof-of-stake (PoS) foundation but extending it with a sidechain for sub-second finality and interoperability. This isn’t vaporware; it’s built on battle-tested Haskell code, similar to Cardano’s core, ensuring security without sacrificing speed. If you’re crafting your own project docs, tools like Gamma can generate visually stunning whitepapers or pitch decks in minutes, perfect for pitching to VCs.

Lila: Exactly, John. In Web2, you’re renting space on someone else’s server; in Web3, you own the keys. VECTOR enhances this by allowing projects to migrate without disrupting Cardano’s mainnet, preserving decentralization while amplifying utility.

Core Mechanism: Technical Logic Behind VECTOR’s Power

John: Diving into the tech: VECTOR uses a Cardano-aligned consensus mechanism, blending Ouroboros PoS with optimistic rollups for that instant finality – think under 1-second confirmations versus Cardano’s typical 20 seconds. Smart contract composability is key here; it’s compatible with Plutus scripts, allowing devs to deploy using tools like OpenZeppelin for secure upgrades or Ethers.js for cross-chain interactions. Tokenomics-wise, VECTOR doesn’t introduce a new token but enhances ADA’s utility, potentially driving ROI through increased TVL (total value locked) in the ecosystem. Recent on-chain data from launches like this show up to 10x throughput improvements, making it alpha for investors eyeing institutional inflows.

Lila: To make it actionable, if you’re building on this, start with Hardhat for testing deployments. It’s all about composability – your DeFi app on VECTOR can interact with Cardano mainnet seamlessly, reducing gas fees to near-zero compared to Ethereum’s spikes.

Use Cases: Real-World Applications in Metaverse and Blockchain

John: Let’s get concrete. First, institutional DeFi: A hedge fund could use VECTOR for high-frequency trading with instant settlements, leveraging Cardano’s security for compliant stablecoin bridges. ROI potential? Think amplified yields from optimized liquidity pools, with analytics showing 20-30% APY boosts in similar setups.

Lila: Second, metaverse onboarding: GameFi projects can migrate assets to VECTOR for low-latency interactions, like real-time NFT trades in virtual worlds. Tools like Revid.ai are great for creating promo videos to hype your NFT drops.

John: Third, enterprise supply chain: Companies track goods via blockchain with VECTOR’s high throughput, ensuring immutable records. For devs, learning Solidity or Plutus? Check out Nolang for interactive coding sessions – it’s how I prototype smart contracts fast.

| Aspect | Traditional Web2 App | Web3 dApp Solution (VECTOR on Cardano) |

|---|---|---|

| Scalability | Limited by central servers; downtime risks | High TPS with distributed nodes; always-on |

| Settlement Time | Days for cross-border; high fees | Instant finality; low-cost |

| Data Ownership | Platform controls; privacy breaches | User-owned via wallets; decentralized |

| Interoperability | Siloed ecosystems | Cross-chain bridges; composable |

Conclusion: Time to Onboard and Scale

John: VECTOR isn’t just an expansion; it’s Cardano’s ticket to institutional dominance, with metrics pointing to massive ROI for early adopters. If you’re a dev or investor, onboard your project now – the alpha is in the scaling.

Lila: Summing up, this launch addresses key pain points, from throughput to utility. Automate your ops with Make.com for crypto alerts and Discord management – stay ahead in Web3.

👨💻 Author: SnowJon (Web3 & AI Practitioner / Investor)

A researcher who leverages knowledge gained from the University of Tokyo Blockchain Innovation Program to share practical insights on Web3 and AI technologies. While working as a salaried professional, he operates 8 blog media outlets, 9 YouTube channels, and over 10 social media accounts, while actively investing in cryptocurrency and AI projects.

His motto is to translate complex technologies into forms that anyone can use, fusing academic knowledge with practical experience.

*This article utilizes AI for drafting and structuring, but all technical verification and final editing are performed by the human author.

🛑 Disclaimer (NFA)

Not Financial Advice. Content is for educational purposes only. Cryptocurrency and NFT investments carry high risks. DYOR (Do Your Own Research).

This article contains affiliate links.

▼ Recommended Web3 x AI Tools

References & Further Reading

- Apex Fusion Launches VECTOR: Cardano’s Institutional-Grade Expansion Chain Now Open For Project Onboarding

- Apex Fusion launches VECTOR, Cardano’s institutional expansion chain

- VECTOR Goes Live as Cardano’s Institutional Expansion Chain