In my view, the Coinbase 2026 outlook signals a shift toward structural maturity.#Coinbase #regulation

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Decoding Coinbase’s 2026 Crypto Market Outlook: Regulation, Tech, and Trends

🎯 Difficulty: Advanced

💎 Core Value: Decentralization / Institutional Adoption / Regulatory Clarity

👍 Recommended For: Crypto investors tracking macro trends, Blockchain developers interested in ecosystem evolution, Policy analysts focusing on digital assets

Lila: Jon, I’ve been reading about Coinbase Institutional’s 2026 Crypto Market Outlook, and it seems to highlight major shifts in regulation, technology, and market trends. As someone experienced in Web3, what are the macro trends this outlook is pointing to, and how do they tie into decentralization and trust minimization?

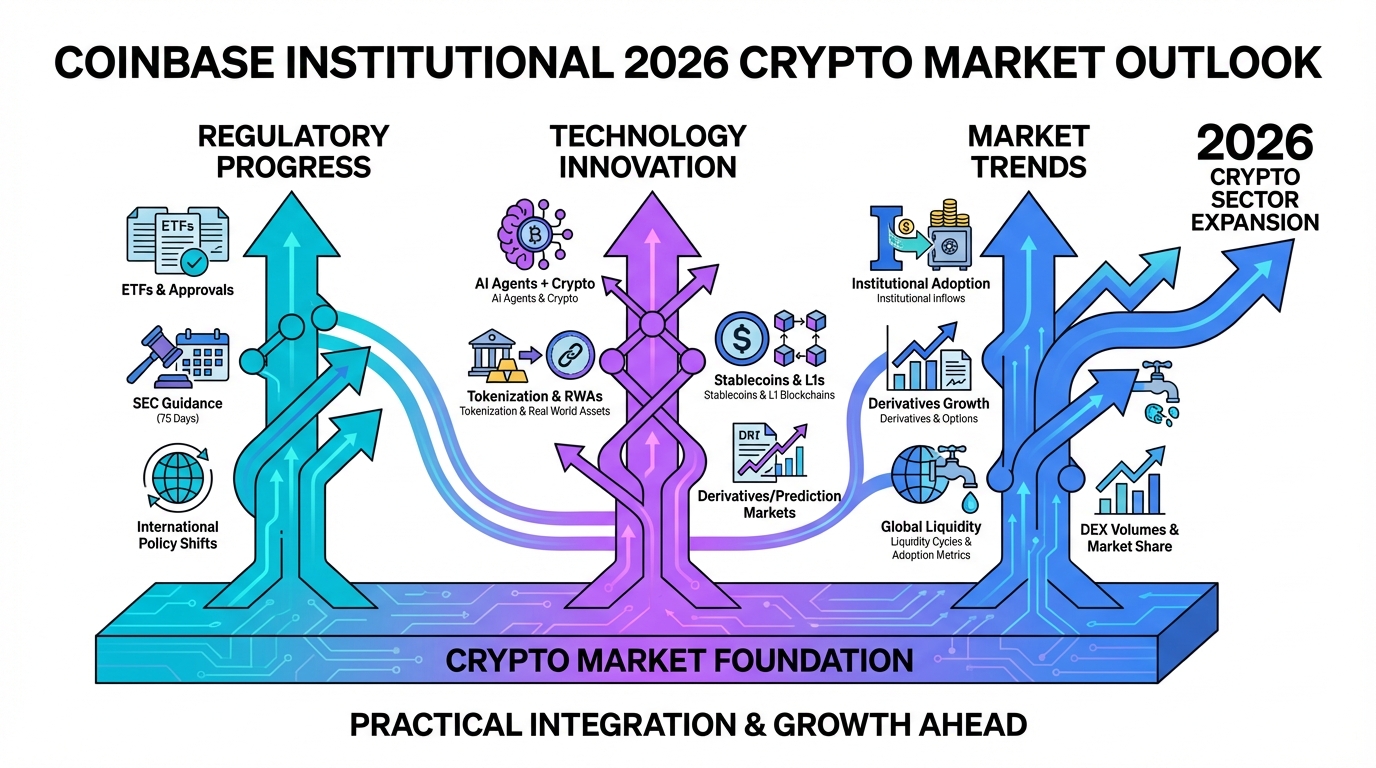

Jon: Absolutely, Lila. The Coinbase report, as detailed in sources like CoinDesk and Cointelegraph, forecasts 2026 as a pivotal year where crypto moves from speculative cycles to structural maturity. Key macro trends include regulatory clarity, especially in the US with potential stablecoin rules and SEC reforms, institutional adoption via ETFs and tokenization, and technological advancements like perpetual futures and on-chain financial services. At its core, this emphasizes decentralization—distributing control away from central entities to networks of nodes—and trust minimization, where protocols rely on cryptographic proofs rather than intermediaries, reducing counterparty risks in systems like DeFi.

Lila: That makes sense for advanced readers, but let’s break down how this outlook contrasts Web2’s centralized models with Web3’s decentralized ones. What specific evolutions does it predict in terms of ownership and censorship resistance?

Jon: The report underscores a shift from Web2’s platform-controlled ecosystems to Web3’s user-centric models. In Web2, data and assets are owned by corporations like social media giants, vulnerable to censorship or arbitrary changes. Web3, however, leverages blockchain for true digital ownership—think NFTs as verifiable proofs of scarcity—and censorship resistance through distributed ledgers that no single entity can alter. Coinbase predicts this will accelerate with tokenization, turning real-world assets into composable on-chain elements, enhancing composability where protocols interoperate seamlessly, like Lego blocks in a financial system.

Lila: Interesting. Diving deeper into the core mechanisms, how does the outlook describe the technical architecture behind these trends, such as consensus mechanisms or smart contracts?

Jon: Coinbase’s analysis focuses on maturing architectures. For consensus, it implicitly nods to proof-of-stake (PoS) systems like Ethereum’s, which minimize trust by staking economic incentives for network security, contrasting Web2’s trusted servers. Smart contracts, self-executing code on blockchains, enable automated, tamper-proof agreements—key for stablecoins and prediction markets highlighted in the report. Interoperability comes via standards like ERC-20 for tokens or cross-chain bridges, allowing value to flow between ecosystems without centralized gateways. The outlook sees this reducing reliance on four-year Bitcoin halving cycles, shifting to drivers like ETF flows and staking yields.

Lila: Can you elaborate on concrete use cases? The report mentions areas like stablecoins and tokenization—how do these apply in real-world scenarios within Web3?

Jon: Certainly. First, in finance, stablecoins like USDC are positioned for cross-border payments, enabling instant, low-cost transfers without banks, as Coinbase notes the US facing competition from China’s digital yuan. This uses blockchain’s permissionless nature for global access. Second, tokenization of assets—real estate or art turned into fractional, on-chain tokens—fosters liquidity and accessibility, with institutional forces reshaping markets per the report. Third, prediction markets, built on decentralized oracles and smart contracts, allow event-based betting with minimized manipulation, evolving from retail hype to institutional tools for risk hedging.

Lila: To visualize the differences, how would you compare traditional Web2 services to these Web3 solutions in the context of the 2026 outlook?

Jon: Let’s structure that comparison clearly.

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized banking for payments, with high fees and borders | Stablecoins for borderless, low-cost transfers via decentralized networks |

| Platform-owned user data, prone to breaches and censorship | User-controlled ownership through wallets and NFTs, resistant to single-point failures |

| Traditional ETFs managed by intermediaries with limited access | Crypto ETFs and tokenized assets for direct, composable institutional participation |

| Centralized prediction platforms with regulatory hurdles | Decentralized prediction markets using oracles for trustless outcomes |

| Innovation siloed by corporate control | Open composability enabling ecosystem-wide innovation and interoperability |

Lila: The outlook also touches on risks, like regulatory uncertainties or technological challenges. How should we think about those in a decentralized context?

Jon: Precisely. While the report is optimistic about regulatory frameworks driving adoption, unresolved risks include scalability issues in layer-1 blockchains, where high transaction volumes could lead to congestion without layer-2 solutions like rollups. There’s also the threat of quantum computing to current cryptography, though Grayscale’s related analysis suggests it’s overblown short-term. Decentralization minimizes trust but doesn’t eliminate smart contract vulnerabilities or market manipulations, emphasizing the need for robust auditing and governance in DAOs.

Lila: Wrapping up, what does this 2026 outlook ultimately enable for the Web3 ecosystem, and what risks remain? It leaves me wondering how individuals can stay informed without getting caught in the hype.

Jon: In summary, Coinbase’s outlook enables a more integrated financial system where crypto becomes core infrastructure, driven by regulation for legitimacy, technology for efficiency, and trends like institutional inflows for stability. It empowers true decentralization, reducing reliance on central authorities and fostering innovation in areas like tokenization and stablecoins. However, risks persist: regulatory backlash, technological exploits, and economic volatility. The key is observing protocol developments critically, understanding architectural trade-offs, and prioritizing literacy over speculation.

References & Further Reading

- Coinbase Institutional Releases 2026 Crypto Market Outlook Highlighting Regulation, Technology, And Market Trends

- Crypto market predictions for 2026: Coinbase Institutional highlights the next big things

- Coinbase: Regulation, Stablecoins May Reshape Crypto in 2026

- Coinbase Details Bitcoin and Crypto Market Outlook for 2026