Did you know 84% of founders plan team growth? CoinFund forecasts huge blockchain startup expansion in 2026. Explore Web3‘s maturing tech.

—#BlockchainGrowth #Web3Forecast #StartupExpansion

—

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Decoding CoinFund’s 2026 Forecast: Blockchain Startups Gear Up for Expansion and Maturity

🎯 Difficulty: Advanced

💎 Core Value: Decentralization Logic / Ecosystem Roles / Token Design

👍 Recommended For: Web3 Founders, Blockchain Investors, Tech Developers

Lila: Jon, I’ve come across this CoinFund forecast predicting strong growth for blockchain startups in 2026, with plans for team expansions, fundraising, and even public listings. As someone tracking macro trends in Web3, what does this signal about the evolving blockchain ecosystem? Is this just hype, or is there real architectural maturity driving it?

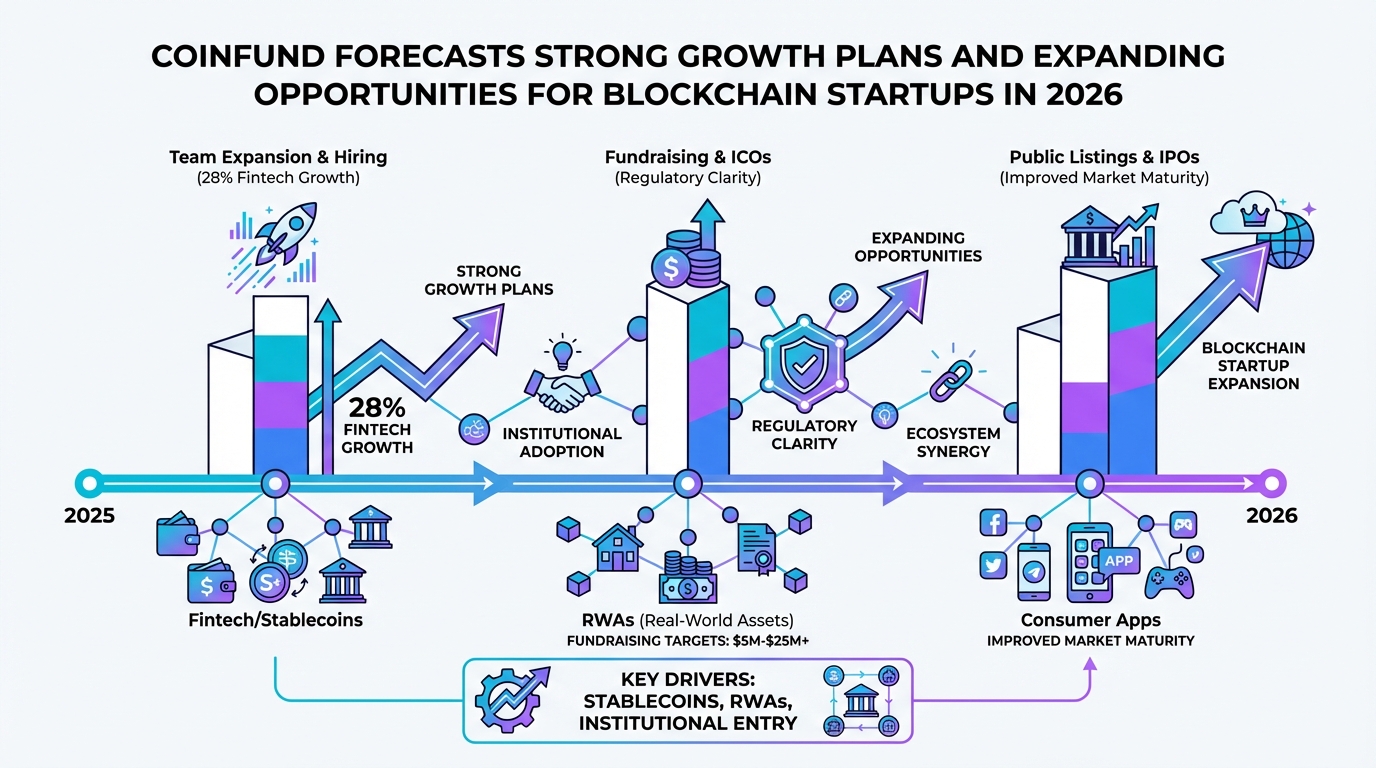

Jon: Lila, the CoinFund 2026 Founders’ Forecast is a data-driven snapshot of blockchain founders’ intentions, based on surveys showing 84% planning team growth, alongside pursuits in fundraising and listings. Analytically, this points to a maturing market where regulatory clarity—such as clearer U.S. frameworks post-2025 elections—is reducing barriers to entry. From a decentralization logic perspective, we’re seeing ecosystems shift from speculative token launches to sustainable models emphasizing token design with utility, like governance tokens in DAOs that enable community-driven decisions. This isn’t hype; it’s a response to improved trust minimization through protocols like layer-2 scaling solutions, which lower costs and enhance interoperability across chains.

Lila: That makes sense on the macro level, but how does this forecast tie into the core differences between centralized Web2 systems and decentralized Web3 architectures? Founders seem optimistic, but what decentralization principles are enabling this expansion?

Jon: Excellent question. In Web2, platforms like social media giants centralize control, owning user data and dictating terms, which often leads to censorship or single points of failure. Web3, conversely, leverages blockchain’s distributed ledger technology for censorship resistance and true ownership—users control assets via cryptographic keys. The CoinFund data suggests startups are capitalizing on this by building composable systems, where protocols can interoperate seamlessly, like DeFi apps stacking on Ethereum’s base layer. Ecosystem roles are evolving too: founders are focusing on tokenomics that incentivize long-term participation, such as staking mechanisms that align incentives without central intermediaries. This fosters expanding opportunities, as regulatory tailwinds make it feasible for startups to scale without the overhang of legal uncertainty.

Lila: So, if Web3 is about decentralization and trust minimization, how does that play out in the technical architecture these startups might adopt for 2026 growth? The forecast mentions maturing markets—does that mean more robust protocol designs?

Jon: Precisely. At the architectural core, blockchain startups are likely prioritizing smart contracts—self-executing code on networks like Ethereum or Solana—that automate agreements without trusted third parties. For expansion, we’re seeing emphasis on scalability via rollups (e.g., optimistic or zk-rollups), which batch transactions off-chain while settling on the mainnet, reducing fees and enabling high-throughput applications. Token design is key here: many will incorporate ERC-20 standards for fungible tokens or ERC-721 for NFTs, with governance layers using mechanisms like quadratic voting to minimize plutocracy. The forecast’s optimism stems from this: with 2026’s expected regulatory clarity, startups can design ecosystems where roles—validators, developers, users—are decentralized, promoting resilience and innovation over Web2’s monolithic structures.

Lila: Interesting. Could you break down some concrete use cases where this growth could manifest? The report talks about hiring and listings, but how might that translate to real-world blockchain applications in areas like finance or community building?

Jon: Let’s examine three concrete applications. First, in decentralized finance (DeFi), startups could expand by building protocols for real-world asset (RWA) tokenization, where physical assets like real estate are represented as on-chain tokens. This uses smart contracts for automated lending, with token designs that include yield-bearing mechanisms, fostering growth as institutional capital flows in per 2026 predictions. Second, in identity systems, blockchain enables self-sovereign identity (SSI) via protocols like those on Polygon or Cosmos, where users control verifiable credentials without central databases—startups here might fundraise to integrate with metaverse platforms, enhancing privacy and interoperability. Third, in community governance, DAOs (decentralized autonomous organizations) could see proliferation, with token holders voting on treasury allocations. The forecast indicates public listings for such entities, shifting from informal groups to structured ecosystems with legal wrappers, driven by clearer regulations.

Lila: To visualize the shift, how do traditional Web2 services stack up against these Web3 solutions, especially in the context of startup opportunities?

Jon: A comparison highlights the architectural advantages. Here’s a structured overview:

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized data ownership by platforms (e.g., user profiles on Facebook) | User-controlled assets via wallets and NFTs, enabling portability across metaverses |

| Intermediary-dependent transactions (e.g., banks for payments) | Peer-to-peer via smart contracts, with composability for DeFi stacking |

| Vulnerable to censorship and single failures (e.g., server outages) | Censorship-resistant through distributed nodes and consensus algorithms |

| Limited ecosystem roles (users as consumers) | Diverse roles in DAOs, with token incentives for governance and validation |

| Growth constrained by regulatory silos | Expansion via global interoperability and 2026’s regulatory clarity |

Lila: This forecast paints a promising picture, but what about the risks? Startups planning expansions sound great, but in a decentralized space, are there unresolved challenges that could temper this growth?

Jon: Absolutely, balance is crucial. The CoinFund insights enable scalable, user-centric ecosystems through decentralized architectures, potentially leading to widespread adoption in finance, identity, and governance. However, risks persist: scalability bottlenecks in high-traffic scenarios, regulatory shifts that could impose new compliance burdens, and security vulnerabilities in smart contracts, as seen in past exploits. Token designs must carefully address centralization creep, ensuring true decentralization. Overall, this maturation signals a shift toward utility-driven blockchain, but it requires ongoing innovation in areas like zero-knowledge proofs for privacy.

Lila: Reflecting on all this, Jon, what should readers do to stay informed about these evolving opportunities without getting lost in the noise?

Jon: Focus on learning the underlying protocols and observing ecosystem developments through reputable sources. Engage with technical whitepapers and community discussions to build literacy—it’s about understanding the architecture, not chasing trends.

References & Further Reading

- CoinFund Forecasts Strong Growth Plans And Expanding Opportunities For Blockchain Startups In 2026

- Future of crypto: 5 crypto predictions for 2026

- 17 things we’re excited about for crypto in 2026 – a16z crypto

- 2025 Crypto Regulatory Round-Up