Personally, real crypto adoption in 2026 focuses on efficiency rather than speculation.#Web3 #Blockchain

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Traditional Businesses and Crypto Adoption: What to Expect in 2026

🎯 Difficulty: Advanced

💎 Core Value: Institutional Adoption / Regulatory Clarity / Decentralized Finance

👍 Recommended For: Web3 natives, business leaders exploring blockchain integration, tech analysts tracking macro trends

Lila: Jon, with all the buzz around crypto entering 2026, I’m curious about the macro trends shaping adoption by traditional businesses. How do you see decentralization and trust minimization playing into this shift?

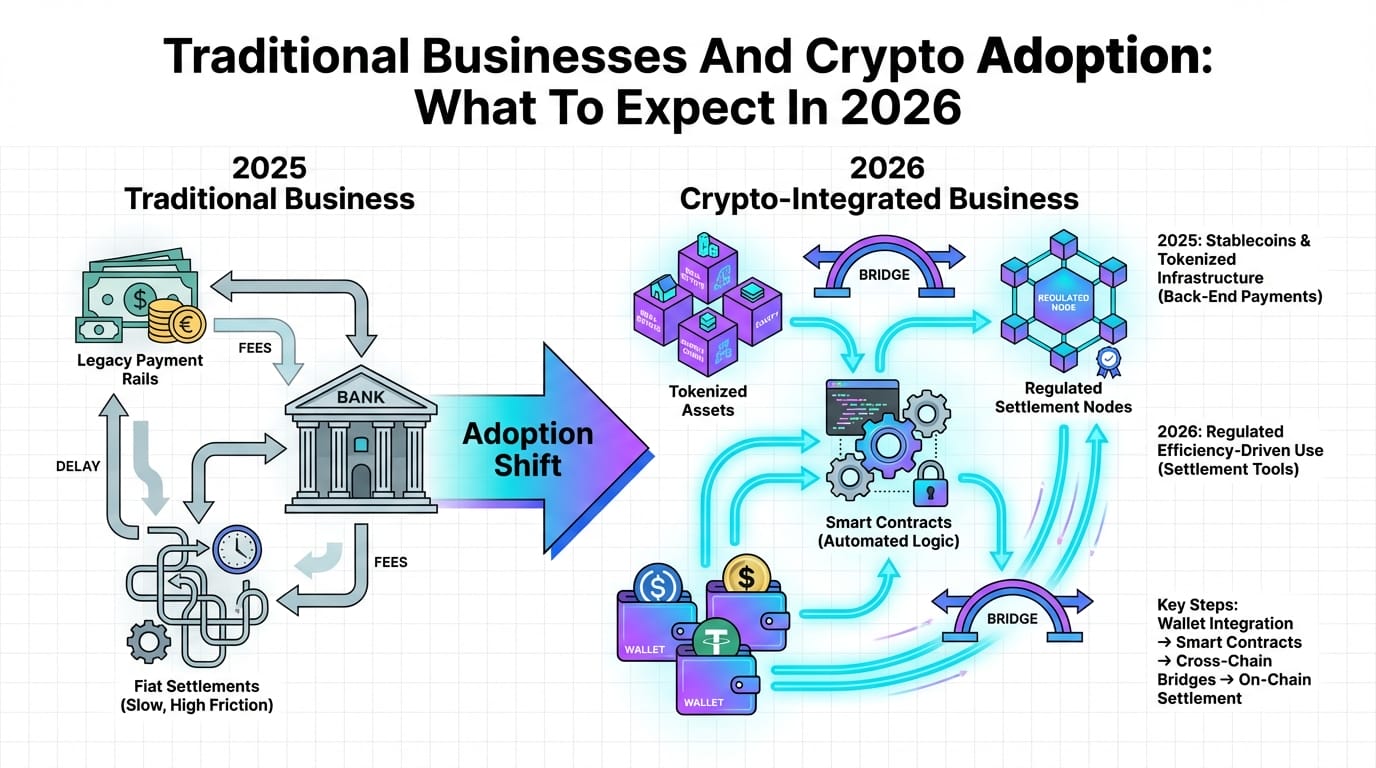

Jon: Absolutely, Lila. As we step into 2026, the crypto landscape is maturing beyond hype, driven by institutional adoption and regulatory frameworks like the CLARITY Act in the U.S. Decentralization here means distributing control across a network rather than central authorities, minimizing trust by relying on code and consensus mechanisms. For traditional businesses, this translates to reduced reliance on intermediaries, enabling more efficient operations in areas like cross-border payments and asset tokenization. Think of it as shifting from a single bank’s ledger to a shared, immutable blockchain where smart contracts automate trust through verifiable code.

From Web2 Centralization to Web3 Decentralization

Lila: That makes sense on a high level, but how does this evolution from Web2’s centralized systems to Web3’s decentralized ones specifically benefit traditional businesses? What about ownership and resistance to censorship?

Jon: Great question. In Web2, platforms like banks or tech giants own user data and control access, often leading to single points of failure or arbitrary censorship. Web3 flips this with user-owned assets via blockchain, where ownership is cryptographically proven and transferable without permission. For businesses, this means censorship resistance—transactions can’t be blocked by a central entity—and composability, where protocols can seamlessly integrate, like stacking Legos. In 2026, we’re seeing this in supply chains, where decentralized ledgers ensure transparency without a trusted third party.

Core Mechanisms Driving Adoption

Lila: Looking at that diagram, it shows layers like consensus and smart contracts. Can you break down these core mechanisms? How do they enable traditional businesses to adopt crypto without overhauling their entire architecture?

Jon: Sure. At the base is consensus mechanisms, like Proof-of-Stake in Ethereum, where nodes agree on transaction validity through staking tokens, ensuring security without central control. Smart contracts are self-executing code on the blockchain—think automated agreements that trigger on conditions, such as releasing funds upon delivery confirmation. Interoperability comes via standards like ERC-20 for tokens or cross-chain bridges, allowing assets to move between blockchains. For businesses in 2026, this means integrating via APIs or layer-2 solutions like Arbitrum, scaling operations while maintaining decentralization. It’s not about replacing everything; it’s about hybrid models where crypto handles trust-minimized aspects like payments or identity verification.

Real-World Use Cases for Businesses

Lila: Practically speaking, what are some concrete applications where traditional businesses might adopt these mechanisms by 2026? I’m thinking beyond speculation—real ecosystem roles.

Jon: Let’s examine three key areas. First, in finance, stablecoins like USDC enable instant, low-cost cross-border payments, reducing fees from traditional banks. Businesses can integrate them for supply chain financing, where smart contracts automate invoices and settlements. Second, tokenization of real-world assets (RWAs)—converting physical assets like real estate into digital tokens on blockchain—allows fractional ownership and liquidity. A company could tokenize inventory for easier funding. Third, decentralized identity systems, using protocols like DID (Decentralized Identifiers), give businesses verifiable, user-controlled credentials, enhancing privacy in customer interactions without central databases prone to breaches. These aren’t futuristic; reports from firms like BlackRock highlight their growth in 2026 amid regulatory tailwinds.

Comparing Traditional Web2 Services vs. Web3 Solutions

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized control by corporations, high intermediary fees | Decentralized networks, low-cost peer-to-peer transactions |

| Data owned by platforms, vulnerable to hacks and censorship | User-owned data via blockchain, resistant to censorship |

| Limited interoperability between services | High composability through open standards and protocols |

| Slow regulatory adaptation, reliant on legacy systems | Evolving regulations like CLARITY Act fostering institutional entry |

| Asset liquidity tied to market hours and intermediaries | 24/7 liquidity via tokenization and DeFi protocols |

Lila: The table really highlights the contrasts. But with trends pointing to strong growth in 2026, as seen in reports from CoinDesk and a16z, what risks should businesses watch for in this adoption?

Jon: Risks are inherent. Regulatory uncertainty persists globally, even with progress; a misstep could lead to compliance issues. Smart contract vulnerabilities, like reentrancy attacks, demand rigorous audits. Scalability challenges on base layers might require layer-2 solutions, and market volatility could affect tokenized assets. Businesses should focus on education, starting with pilot programs to understand these dynamics.

Wrapping Up: Enables and Risks

Jon: In summary, crypto adoption in 2026 enables traditional businesses to leverage decentralization for efficiency, ownership, and innovation in finance, supply chains, and beyond. Yet, unresolved risks like security and regulation require cautious integration. It’s about building resilient systems, not chasing trends.

Lila: That leaves me optimistic but thoughtful—how can readers stay informed without getting lost in the noise?

Jon: Observe protocol developments, follow reputable analyses, and experiment with open-source tools to build literacy. Focus on understanding over speculation.

References & Further Reading

- Traditional Businesses And Crypto Adoption: What To Expect In 2026

- 5 Crypto Trends Shaping 2026 – Bitrue

- Bitcoin Price Forecast for 2026 – CoinDesk

- Exclusive Report: Crypto Market Predictions 2026 – Coinpedia

- What BlackRock, Coinbase and Others Predict for Crypto in 2026 – DL News