In my view, the rise in late-stage crypto funding signals a focus on real utility.#Web3 #Decentralization

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Decoding the Crypto Funding Rebound: Gate Ventures’ Insights on Late-Stage and Core Infrastructure Shifts

🎯 Difficulty: Advanced

💎 Core Value: Decentralized Infrastructure / Ecosystem Maturation / Investment Discipline

👍 Recommended For: Web3 investors, blockchain developers, VC analysts

Lila: Jon, I’ve been reading about this Gate Ventures report on crypto venture funding rebounding through 2025, with capital shifting toward late-stage deals and core infrastructure. As someone who’s followed Web3 trends, what macro shifts does this indicate in the broader decentralization landscape?

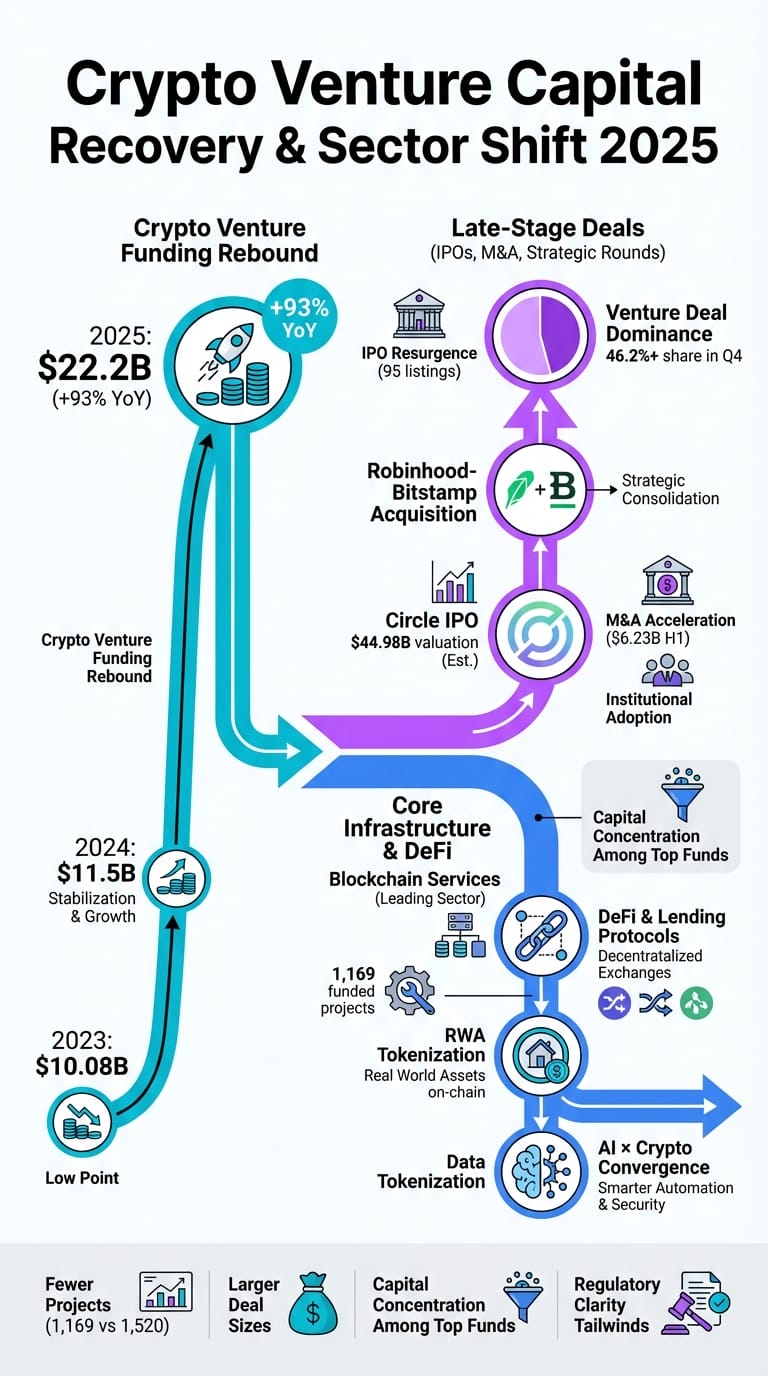

Jon: Absolutely, Lila. This report highlights a maturation in the crypto VC space, where after a period of hype-driven investments, we’re seeing a pivot to more disciplined capital allocation. In terms of decentralization logic, it underscores trust minimization at scale—focusing on robust, late-stage protocols that can handle real-world adoption without central points of failure. Think of it as the ecosystem evolving from speculative token launches to battle-tested infrastructure that supports composable, permissionless systems.

Lila: That makes sense, but how does this funding trend tie into the evolution from Web2 to Web3? Centralized platforms have dominated for so long—what’s changing?

Jon: Great question. In Web2, centralized systems like social media giants control data and value flows, creating silos where users have little ownership or censorship resistance. Web3 flips this by emphasizing user sovereignty through blockchain-led architectures. Ownership means assets are truly portable via cryptographic proofs, censorship resistance comes from distributed networks, and composability allows protocols to interoperate seamlessly, like Lego blocks. The Gate Ventures data shows VCs betting on this shift, pouring funds into late-stage infra to scale these decentralized models.

Lila: So, if we’re talking core mechanisms, can you break down what ‘core infrastructure’ means here? And how does late-stage funding play into the technical architecture?

Jon: Core infrastructure refers to the foundational layers of Web3, such as layer-1 blockchains, scaling solutions like rollups, and interoperability protocols. Late-stage funding targets projects that have proven product-market fit, focusing on technical refinements like optimizing consensus mechanisms (e.g., Proof-of-Stake for efficiency) or enhancing smart contract security. This reduces risks in decentralization, ensuring trustless execution across ecosystems.

Lila: The diagram helps visualize that layered structure. Now, in terms of token design, how are these funded projects incorporating economics to sustain decentralization?

Jon: Token design is crucial here. Late-stage projects often refine models like staking rewards or governance tokens to align incentives. For instance, in core infra like layer-2 solutions, tokens might facilitate fee capture or voting in DAOs, ensuring decentralization through economic game theory. This minimizes trust by distributing power, but it requires careful architecture to avoid centralization pitfalls, such as large holders dominating decisions.

Lila: Interesting. What about real-world use cases? Can you give examples of how this funding shift is enabling specific applications in the ecosystem?

Jon: Sure. First, in decentralized finance (DeFi), funding is bolstering late-stage protocols for cross-chain lending, where core infra like bridges enables seamless asset transfers without intermediaries. Second, in identity solutions, projects are building verifiable credentials on blockchain, allowing users to control their data across metaverses—funded heavily to scale for enterprise adoption. Third, in gaming ecosystems, core infra investments support interoperable assets, letting players own and trade items across virtual worlds, powered by standards like ERC-721 for NFTs.

Lila: Those sound practical. To contrast, how do these Web3 approaches stack up against traditional Web2 services in these areas?

Jon: Let’s compare them systematically.

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized finance platforms control user funds and data, prone to hacks or shutdowns. | DeFi protocols enable trustless lending via smart contracts, with users retaining custody. |

| Identity managed by silos like social logins, vulnerable to breaches and vendor lock-in. | Decentralized identity uses blockchain for portable, self-sovereign verification. |

| Gaming assets locked to platforms, non-transferable and platform-dependent. | NFT-based assets allow true ownership and cross-game interoperability. |

| Funding skewed toward early hype, leading to high failure rates. | Shift to late-stage infra ensures scalable, sustainable decentralization. |

Lila: The table really highlights the advantages. But with this rebound in funding, what unresolved risks should we be aware of in these late-stage investments?

Jon: This funding enables scalable decentralization, fostering innovation in trust-minimized systems and broader ecosystem composability. However, risks remain: regulatory uncertainties could impact token models, scalability bottlenecks in core infra might lead to network congestion, and over-concentration in late-stage deals could sideline early innovation. It’s about balancing growth with robust architecture.

Lila: That gives a balanced view. So, where should readers start to deepen their understanding of these trends?

Jon: Focus on observing protocol developments and reading technical whitepapers—it’s the best way to grasp the architectural realities without getting caught in hype.

References & Further Reading

- Gate Ventures Shows Crypto Venture Funding Rebounds Through 2025, With Capital Shifting Toward Late-Stage And Core Infra

- Top crypto VCs share 2026 funding and token sales outlook | The Block

- Crypto venture capital funding surges by 433.2% to $49.75 billion in 2025 – Cryptopolitan