Personally, clearer crypto regulation seems to finally prioritize robust architecture over hype.#Web3 #Regulation

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

How 2025 Redefined Crypto Regulation and Set the Agenda for 2026

🎯 Difficulty: Advanced

💎 Core Value: Decentralization Logic / Regulatory Clarity / Ecosystem Roles

👍 Recommended For: Web3 developers, policy analysts, institutional investors

Lila: Jon, with all the macro trends in crypto regulation shifting so dramatically in 2025, how do you see these changes influencing the core principles of decentralization and trust minimization in Web3 ecosystems heading into 2026?

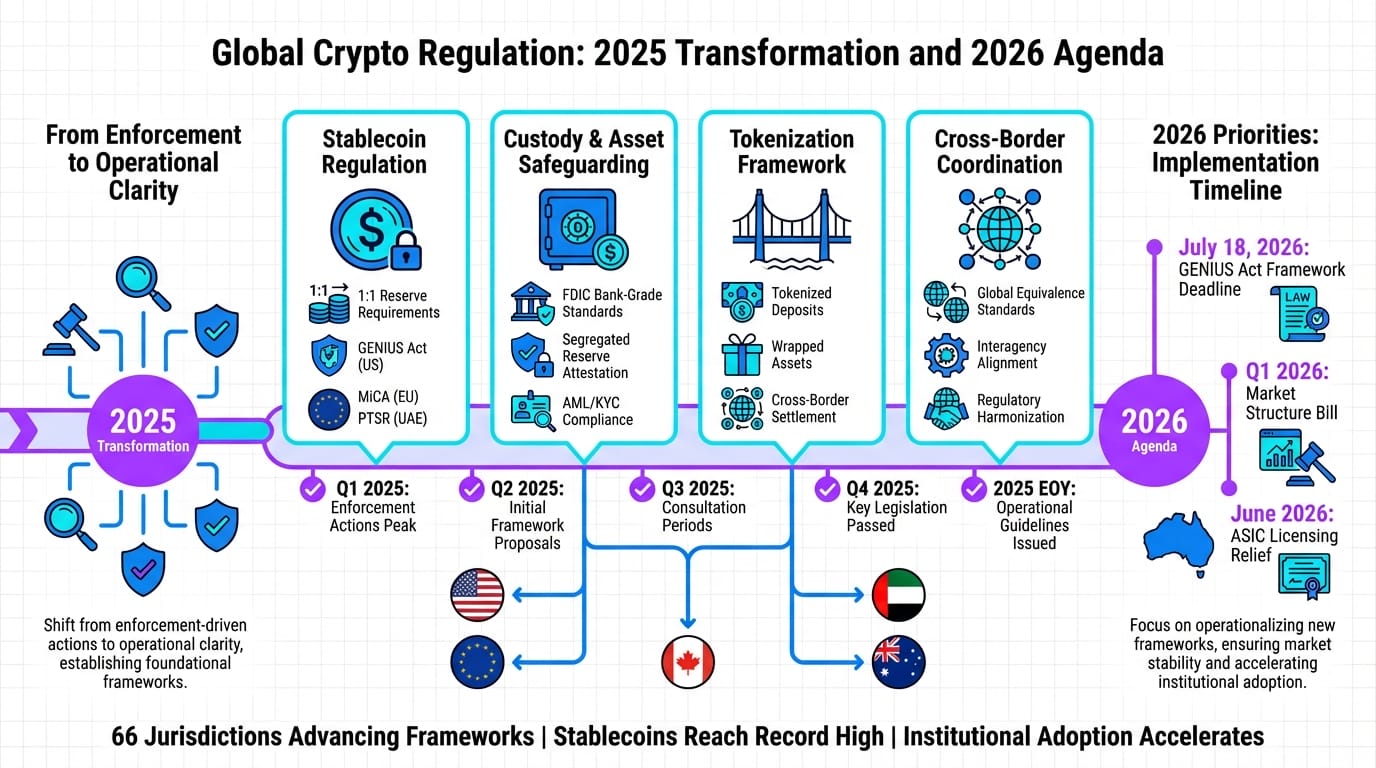

Jon: Excellent question, Lila. Let’s break it down analytically. In 2025, regulations like the CLARITY Act fundamentally redefined the landscape by clarifying jurisdictional boundaries between agencies such as the SEC and CFTC. This isn’t just policy jargon—it’s about minimizing trust in centralized entities. Decentralization logic relies on protocols where trust is distributed across nodes via consensus mechanisms, like proof-of-stake in Ethereum. The 2025 reforms reduced regulatory ambiguity, allowing token designs to focus more on utility rather than navigating security classifications. For 2026, this sets an agenda where trust minimization—achieved through smart contracts that execute without intermediaries—becomes even more robust, potentially accelerating adoption in DeFi and beyond.

Lila: That makes sense, but can you elaborate on how these regulatory shifts evolve from Web2’s centralized models to Web3’s decentralized ones? What about ownership and censorship resistance?

Jon: Absolutely. In Web2, systems are centralized: think of platforms like Facebook or traditional banks controlling data and transactions, making them vulnerable to censorship or single points of failure. Web3 flips this with blockchain-based decentralization, where ownership is user-centric via cryptographic keys. The 2025 regulations, such as the Genius Act’s implementation, emphasized censorship resistance by legally recognizing decentralized networks as distinct from centralized finance. This enhances composability—protocols interlocking like Lego blocks, as seen in ERC-20 tokens on Ethereum. For 2026, the agenda includes stablecoin oversight, which could standardize token designs to ensure interoperability without sacrificing decentralization, reducing reliance on central authorities.

Lila: Interesting. Diving deeper into the core mechanisms, how did 2025’s changes affect technical architectures, like consensus and smart contracts?

Jon: From a technical standpoint, 2025’s regulatory clarity, particularly with the CLARITY Act, resolved ambiguities in token classification, impacting smart contract design. Smart contracts are self-executing code on blockchains, governed by standards like ERC-721 for NFTs. Pre-2025, uncertainty forced projects to over-engineer for compliance, diluting decentralization. Now, with clearer rules on what constitutes a security versus a commodity, architects can optimize for efficiency—using layer-2 solutions like rollups for scalability while maintaining trustless execution. Looking to 2026, trends point to enhanced interoperability protocols, such as cross-chain bridges, influenced by tax transparency rules that encourage auditable, decentralized ledgers.

Lila: Let’s talk use cases. How do these regulatory developments play out in specific Web3 applications, say in finance, identity, and governance?

Jon: Certainly. First, in decentralized finance (DeFi), 2025’s market structure bills like CLARITY enabled clearer paths for stablecoins, boosting institutional adoption. This means protocols can design tokens with built-in compliance hooks, like automated tax reporting via oracles, without central control. Second, for digital identity, regulations pushed for self-sovereign models—users control their data via decentralized identifiers (DIDs), resistant to censorship. The 2026 agenda might standardize this, integrating with metaverse platforms for seamless, privacy-preserving verification. Third, in DAO governance, the Genius Act’s focus on ecosystem roles clarified voting mechanisms in decentralized autonomous organizations, where token holders govern via on-chain proposals. This reduces centralization risks, fostering true community-driven decisions, with 2026 likely seeing more regulatory support for tokenized assets in real-world applications.

Lila: To make this clearer, could you compare traditional Web2 services against these Web3 solutions, especially in light of the 2025-2026 regulatory shifts?

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized finance platforms (e.g., banks) with regulatory oversight by single agencies, prone to data breaches and censorship. | DeFi protocols with distributed regulation via CLARITY Act, enabling trustless lending and borrowing through smart contracts. |

| Platform-controlled identities (e.g., social media logins) vulnerable to deplatforming and privacy invasions. | Self-sovereign identities in metaverses, bolstered by 2026 privacy-focused agendas, using blockchain for verifiable credentials. |

| Hierarchical governance in corporations, subject to fluctuating national laws. | DAO-based governance with token-weighted voting, clarified by 2025 acts for global, decentralized decision-making. |

| Limited interoperability; data silos across apps. | Composability across chains, enhanced by 2026 stablecoin and tax bills for seamless asset transfers. |

Lila: Building on that, what about the evolution from Web2 to Web3 in terms of composability and how regulations are shaping it for 2026?

Jon: Composability is a hallmark of Web3 architecture—protocols building on each other without permission, unlike Web2’s walled gardens. The 2025 crypto surge and subsequent crash highlighted vulnerabilities, but regulations like the proposed tax bills stabilized this by mandating transparency in tokenomics. For instance, real-world asset (RWA) tokenization gained traction, where physical assets are represented as tokens on-chain. Heading into 2026, the agenda includes cybersecurity enhancements for protocols, influencing designs that incorporate zero-knowledge proofs for privacy. This evolution ensures ecosystems remain resilient, with decentralization logic prioritizing user sovereignty over centralized control.

Lila: Jon, how do these changes affect token design specifically? Are there new architectural considerations for developers?

Jon: Token design has become more sophisticated post-2025. Previously, ambiguity led to conservative approaches, but now, with CLARITY’s DeFi carve-outs, designers can innovate with utility tokens that embed governance or staking rewards directly into the protocol. Consider ERC-1155 standards, which allow multi-fungible tokens—ideal for metaverse assets. For 2026, trends like AI integration in digital commerce will require architectures that minimize trust, using oracles for off-chain data. Developers must now factor in regulatory sandboxes, ensuring smart contracts are audit-ready and compliant with global tax transparency, ultimately strengthening the ecosystem’s roles.

Lila: One more thing: with institutional adoption on the rise, as per recent reports, how does this tie into the broader 2026 agenda?

Jon: Institutional participation, driven by firms like Goldman Sachs, is propelled by 2025’s regulatory clarity. This means deeper integration of crypto into traditional finance, with architectures supporting scalable solutions like layer-1 blockchains or sidechains. The 2026 outlook includes stablecoin growth and RWA tokenization, where technical designs must balance innovation with accountability. However, risks like front-end manipulation remain, as noted in some critiques of the CLARITY Act. Overall, it enables protocols to thrive in a regulated yet decentralized framework.

Lila: Wrapping this up, what does all this enable in the long term, and what risks should we still watch for?

Jon: In summary, 2025’s redefinition through acts like CLARITY and Genius has paved the way for a 2026 agenda focused on market structure, stablecoins, and taxation, empowering decentralized architectures to scale globally. This enables true digital ownership, interoperable ecosystems, and minimized trust, fostering innovation in finance, identity, and governance. Unresolved risks include potential over-regulation stifling startups, cybersecurity threats to protocols, and market volatility—as seen in the 2025 crash. The key is balanced evolution, where technical integrity meets policy support.

Lila: That gives a lot to think about. How can readers stay informed without jumping into speculation?

Jon: Focus on observing protocol developments and regulatory updates from reputable sources. Engage with open-source communities to understand the architecture firsthand, prioritizing literacy over any financial moves.

References & Further Reading

- How 2025 Redefined Crypto Regulation And Set The Agenda For 2026

- U.S Crypto Regulation in Focus as CLARITY Act Shapes Market Outlook for 2026

- Key dates for US crypto regulation in 2026

- Crypto soared in 2025 — and then crashed. Now what? : NPR

- 2025 Crypto Regulatory Round-Up