Imagine owning your social finance. GrantiX combines AI and blockchain for impact investing and true user control.#GrantiX #SocialFi #Web3

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Decoding GrantiX: AI-Powered SocialFi and the $GRANT Token Launch

🎯 Difficulty: Advanced

💎 Core Value: Decentralized Social Finance / AI-Driven Impact Investing / Tokenized Ecosystem Participation

👍 Recommended For: Web3 investors exploring SocialFi, AI enthusiasts in blockchain, impact-driven developers building on-chain communities

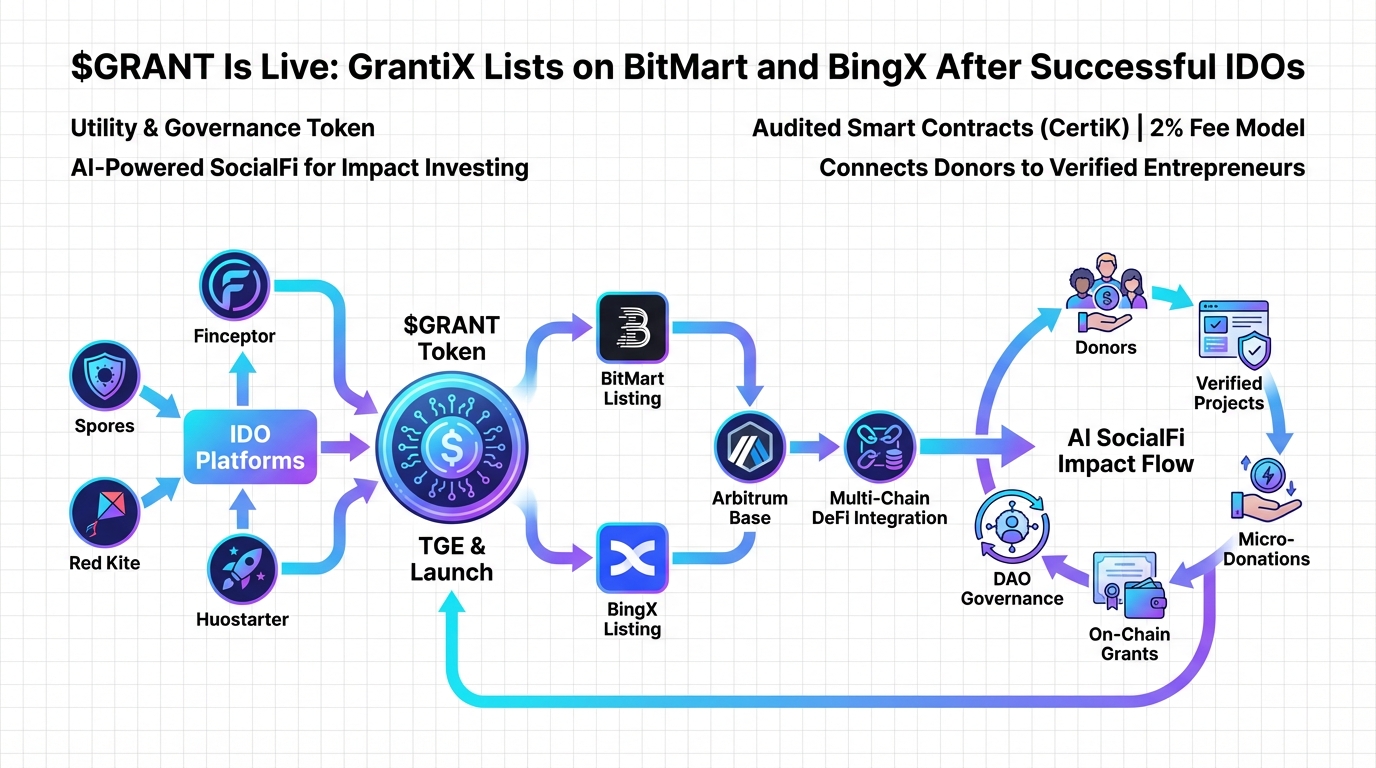

Lila: Jon, with all the buzz around GrantiX and its $GRANT token listing on BitMart and BingX after successful IDOs, I’m curious about the broader macro trends here. How does this fit into the evolving landscape of decentralization in social finance?

Jon: Absolutely, Lila. Let’s break it down objectively. GrantiX positions itself as an AI-powered SocialFi platform focused on impact investing on-chain. In the macro context, we’re seeing a shift toward trust-minimized systems where social interactions and financial mechanisms are intertwined without central intermediaries. Decentralization here means using blockchain to enable peer-to-peer value transfer, with AI handling curation and decision-making. The $GRANT token, post-IDO and listing, acts as a governance and utility asset, but remember, this is about architectural design—not hype. It minimizes trust by leveraging smart contracts for transparent fund allocation in impact projects, reducing reliance on traditional gatekeepers like banks or VCs.

From Web2 Limitations to Web3 Possibilities

Lila: That makes sense, but many readers might still be anchored in Web2 social platforms. What are the key pain points there, and how does something like GrantiX address them through decentralization?

Jon: Great point. In Web2, platforms like Facebook or Twitter centralize data and control, leading to issues like censorship, data exploitation, and limited user ownership. Users generate value but don’t own it—it’s siloed and monetized by corporations. Web3, via protocols like GrantiX, flips this with decentralized ownership, where tokens represent verifiable rights. For GrantiX, $GRANT enables users to own stakes in impact investments, resistant to censorship through blockchain immutability. Composability is key: tokens can interact across ecosystems, like integrating with DeFi protocols for yield on social investments. This isn’t just theory; it’s about programmable money and data that users control via private keys.

Core Mechanisms: Token Design and Architecture

Lila: Diving deeper, can you explain the technical backbone? How does GrantiX’s token design work with smart contracts and AI integration?

Jon: Sure. At its core, $GRANT likely follows ERC-20 standards on a blockchain like Ethereum or a layer-2 for scalability—though specifics aren’t public, assume it’s optimized for low fees. Token design includes utility for staking, voting in DAOs for impact projects, and rewards for social participation. Decentralization logic relies on smart contracts: self-executing code that automates fund distribution based on predefined rules, minimizing human intervention. AI integration could involve oracles feeding real-world data (e.g., impact metrics) into these contracts, ensuring trustless verification. Architecturally, this uses consensus mechanisms like Proof-of-Stake for security, with interoperability via standards like ERC-721 for any NFT-based assets in the ecosystem. Trade-offs include gas fees versus speed, but it enables a composable SocialFi layer where users build upon existing protocols.

Real-World Use Cases in Action

Lila: Practically speaking, what are some concrete applications? Beyond the listings, how might this play out in everyday Web3 scenarios?

Jon: Let’s outline three key ones. First, in decentralized finance (DeFi), GrantiX could allow users to pool $GRANT for impact loans—smart contracts handle lending to verified causes, with AI analyzing risk. Second, for community governance, token holders vote on project funding via DAOs, fostering collective decision-making without central boards. Third, in social networking, AI curates content and matches investors with causes, with tokens rewarding engagement—think tokenized social graphs where interactions yield verifiable value. These aren’t isolated; they compos with broader ecosystems, like integrating with metaverse platforms for virtual impact events.

Web2 vs. Web3: A Side-by-Side Comparison

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized social platforms control user data and monetization. | User-owned data via blockchain, with tokens enabling direct value capture in SocialFi. |

| Impact investing through banks or apps with high fees and opacity. | On-chain transparency with AI-driven allocation, low-intermediary costs. |

| Censorship and platform bans common. | Censorship-resistant through decentralized networks and immutable ledgers. |

| Limited interoperability; data siloed. | Composability across protocols, e.g., $GRANT integrating with DeFi or NFTs. |

| Trust in corporations for security. | Trust-minimized via cryptography and consensus algorithms. |

Lila: This comparison highlights the shifts clearly. But with token listings like this, are there risks we should flag for readers?

Jon: Precisely. While the architecture enables true ownership and innovation, unresolved risks include smart contract vulnerabilities—audits are crucial but not foolproof. Market volatility post-IDO can lead to rugs if governance is weak. AI integration raises oracle manipulation concerns, where bad data could skew decisions. Scalability on blockchains might cause high fees during hype. Always prioritize understanding the protocol over speculation.

Wrapping Up: The Bigger Picture

Lila: So, in summary, what does a project like GrantiX enable in the long term, and how should readers approach this space?

Jon: It enables a paradigm where social finance is democratized—users directly fund and govern impact via decentralized tools. Yet, risks like regulatory uncertainty and tech immaturity persist. Focus on learning the architecture: study smart contracts, explore open-source repos, and observe without rushing in.

Lila: That leaves me thinking—how can we balance innovation with caution in this evolving ecosystem?

References & Further Reading

- $GRANT Is Live: GrantiX Lists on BitMart and BingX After Successful IDOs

- Ethereum Glossary: Key Web3 Terms

- CoinDesk: What is SocialFi?

- Consensys: Introduction to Smart Contracts