Personally the Digital Asset Outlook indicates a major shift where utility defines value#Tokenization #Web3

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

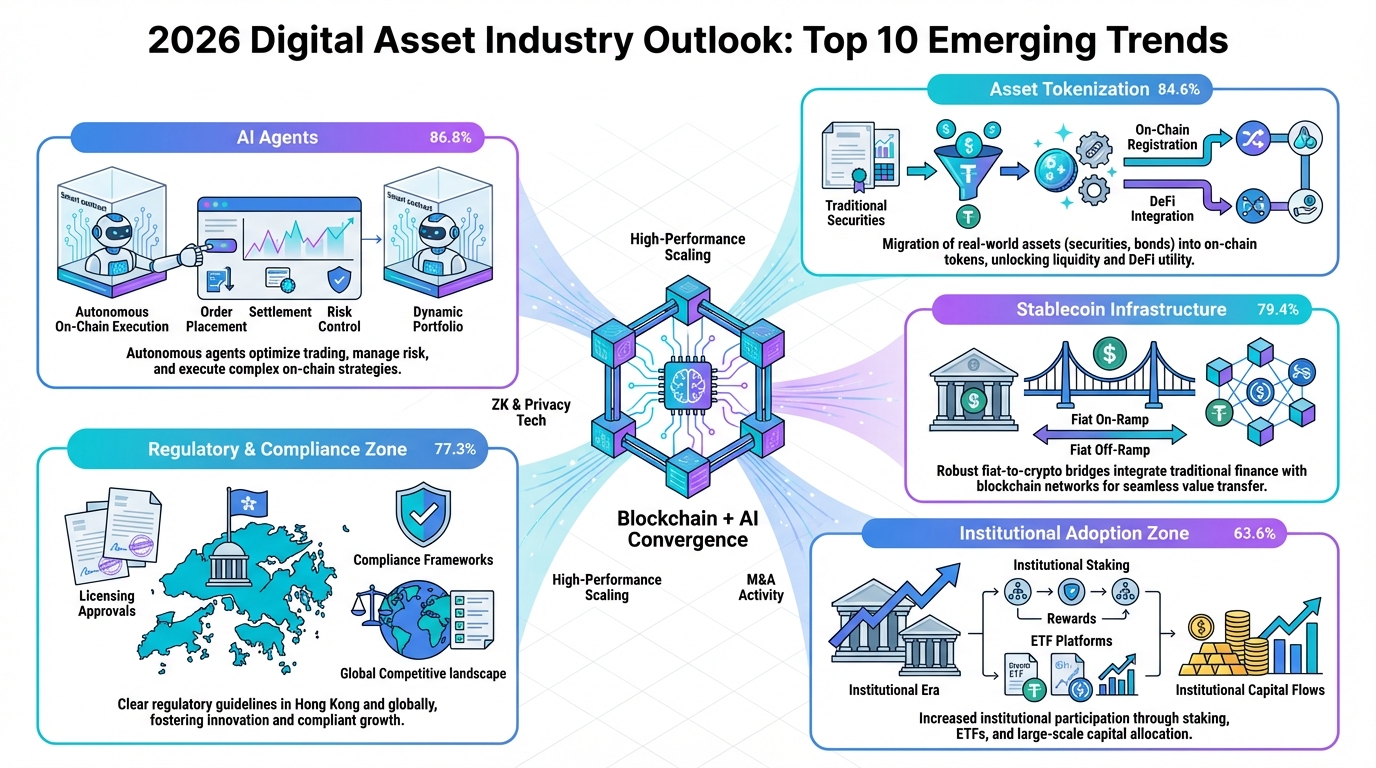

Decoding HashKey’s 2026 Digital Asset Outlook: AI, Tokenization, Stablecoins, and Institutional Growth

🎯 Difficulty: Advanced

💎 Core Value: Decentralization / Tokenized Assets / Institutional Integration

👍 Recommended For: Blockchain Developers, Crypto Investors, FinTech Professionals

Lila: Jon, I’ve been reading about HashKey’s 2026 Digital Asset Industry Outlook, and it’s highlighting AI, tokenization, stablecoins, and institutional growth as key focus areas. As someone experienced in Web3, what macro trends do you see driving these predictions, and how do they tie into decentralization and trust minimization?

Jon: Absolutely, Lila. HashKey’s outlook, as detailed in their report, points to a maturing digital asset ecosystem where practical utility takes center stage. From a macro perspective, we’re seeing regulatory clarity—especially in the US with initiatives like the Crypto Strategic Reserve—fostering institutional involvement. This ties directly into decentralization by reducing reliance on centralized intermediaries. Trust minimization, a core tenet of blockchain architecture, is amplified here: protocols like those enabling tokenization use smart contracts to enforce rules without human oversight, ensuring verifiability through consensus mechanisms such as Proof-of-Stake in networks like Ethereum.

Lila: That makes sense, but let’s contrast this with Web2. How does the evolution from centralized systems to decentralized ones manifest in these 2026 trends?

Jon: Great question. In Web2, platforms like traditional banks or social media giants control data and transactions, leading to single points of failure and censorship vulnerabilities. Web3 evolves this by distributing control across networks. For instance, tokenization in 2026, as per HashKey, accelerates real-world asset (RWA) integration, where assets like real estate are represented as tokens on blockchains, enabling fractional ownership and composability. This censorship resistance comes from immutable ledgers, and composability allows protocols to interoperate seamlessly, like Lego blocks, via standards such as ERC-20 for fungible tokens or ERC-721 for NFTs. Institutional growth further solidifies this by bringing traditional finance into decentralized ecosystems, minimizing trust through audited smart contracts.

Lila: Speaking of core mechanisms, can you break down the technical architecture behind AI, tokenization, and stablecoins in this context? I’m thinking about how they fit into broader ecosystem roles.

Jon: Certainly. Starting with AI: HashKey predicts autonomous AI trading agents, built on decentralized protocols. These leverage smart contracts—self-executing code on blockchains like Ethereum—to automate decisions based on oracle data feeds for real-time inputs. Tokenization involves creating digital representations of assets via protocols like those on Polygon or Solana, using standards such as ERC-1155 for hybrid fungible/non-fungible tokens. This architecture ensures decentralization through layer-2 scaling solutions for efficiency. Stablecoins, evolving in 2026, maintain pegs via over-collateralization (e.g., DAI) or algorithmic mechanisms, playing ecosystem roles in liquidity provision and cross-chain interoperability via bridges. Institutional growth relies on these for compliant, scalable DeFi architectures, with trust minimized through zero-knowledge proofs for privacy-preserving transactions.

Lila: What about practical use cases? Could you outline three concrete applications emerging from these trends?

Jon: Yes, let’s dive in. First, in finance: Tokenized RWAs allow institutions to trade illiquid assets like bonds on-chain, as seen in predictions for accelerated tokenization. This uses smart contracts for automated settlements, reducing intermediaries. Second, AI-driven decentralized identity: Protocols integrating AI for verification enable self-sovereign identities, where users control data via wallets, fitting into metaverse ecosystems for secure, interoperable access. Third, stablecoin-powered global payments: With institutional adoption, stablecoins like USDC facilitate instant, low-cost cross-border transactions, integrated into DAOs for governance, where token holders vote on proposals via on-chain mechanisms.

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized data storage, vulnerable to hacks and censorship by platform owners. | Decentralized ledgers ensuring user ownership and immutability, resistant to single-point failures. |

| Intermediaries control transactions, leading to high fees and delays. | Smart contracts automate peer-to-peer exchanges, enabling composability and low-cost efficiency. |

| Limited interoperability between siloed platforms. | Standards like ERC tokens allow seamless integration across ecosystems, fostering innovation. |

| User data monetized without consent. | Trust-minimized systems where users retain control via cryptographic proofs. |

Lila: These comparisons highlight the shifts clearly. Wrapping up, what does this outlook enable overall, and what risks remain unresolved?

Jon: In summary, HashKey’s 2026 vision enables a more utility-focused Web3, where AI optimizes trading, tokenization unlocks liquidity for RWAs, stablecoins drive mainstream payments, and institutions provide stability through regulated entry. This architectural evolution promotes true decentralization, but risks like smart contract vulnerabilities, regulatory inconsistencies, and scalability bottlenecks persist. Protocols must continue evolving with advancements in layer-2 solutions and zero-knowledge tech to mitigate these.

Lila: Thanks, Jon. It leaves me wondering: how can readers stay informed on these trends without getting lost in the hype?

Jon: Focus on reputable sources and hands-on exploration of protocols. Observe ecosystem developments critically, prioritize learning about underlying architectures, and engage with communities to build literacy over time.

References & Further Reading

- HashKey‘s 2026 Digital Asset Industry Outlook Reveals AI, Tokenization, Stablecoins, And Institutional Growth As Major Focus Areas

- Executives say macro conditions, regulation and new infrastructure will define crypto in 2026 | The Block

- Why Ethereum Could Emerge as the New King of Crypto in 2026