Personally, tokenized securities seem to solve the inefficiency of traditional market hours.#Web3 #Blockchain

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Decoding NYSE’s Tokenized Securities Platform: A Web3 Revolution in Traditional Finance

🎯 Difficulty: Beginner Friendly

💎 Core Value: Digital Ownership / Interoperability

👍 Recommended For: New investors curious about blockchain in stocks, traditional finance enthusiasts exploring Web3, and beginners interested in decentralized trading

Lila: Jon, I’ve been reading about this NYSE tokenized securities platform, and it’s exciting but confusing. In traditional stock trading, markets close at night and on weekends—why can’t we just trade anytime like with cryptocurrencies? What are the limitations of our current Web2 financial systems that make something like this necessary?

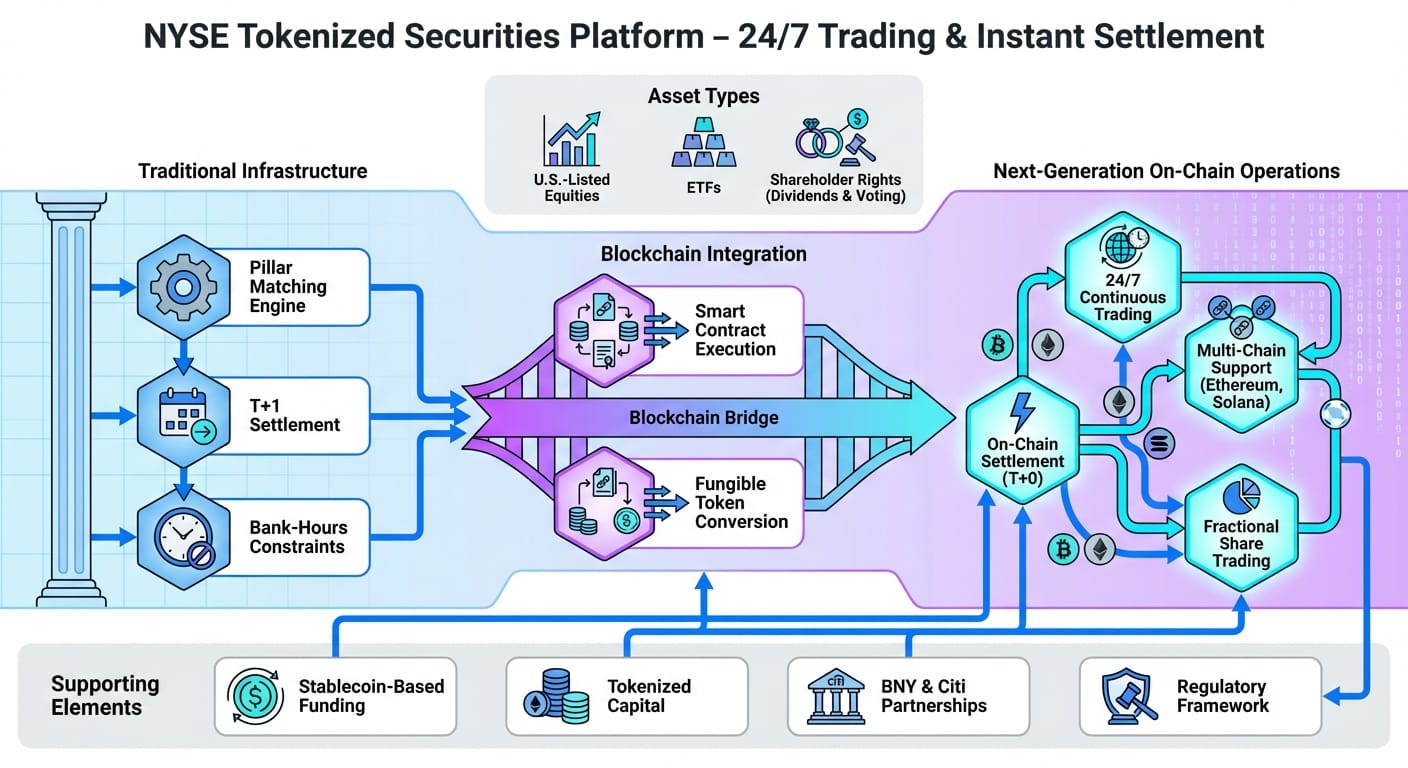

Jon: Great question, Lila. Let’s start with the basics. Think of traditional Web2 finance like a bank that’s only open during business hours. You deposit money, but the bank controls when you can access it, how you use it, and even charges fees for everything. The limitations stem from centralization: everything runs through middlemen like brokers and clearinghouses, which need time to verify transactions, leading to delays in settlement—sometimes days. This new NYSE platform uses tokenization on blockchain to address that, enabling 24/7 trading, fractional shares, and instant settlement. It’s like turning a physical stock certificate into a digital token you can trade anytime, anywhere, without waiting for the “bank” to open.

Lila: That metaphor helps. So, how does this shift from Web2 to Web3 actually work? I’ve heard about blockchain, but I’m not sure how it applies to something as established as the NYSE.

Jon: Absolutely, let’s build on that. In Web2, your assets are entries in a company’s database—centralized and vulnerable to hacks or shutdowns. Web3 flips this with decentralization: imagine a public ledger where everyone can see and verify transactions without a single boss in charge. For the NYSE platform, tokenization means representing real securities (like stocks) as digital tokens on a blockchain. This provides true ownership—you hold the token in your digital wallet, not just a promise from a broker. It resists censorship because no single entity can freeze your assets, and it enables composability, where these tokens can interact seamlessly with other Web3 tools, like decentralized finance apps.

Visualizing the Web3 Architecture

Lila: The diagram makes it clearer—it’s like a network of connected blocks. But break it down for me: what’s the core mechanism here? How does tokenization make trading instant and fractional?

Jon: Sure, let’s use simple metaphors. Imagine your wallet as a digital backpack—secure, portable, and yours alone. Tokenized securities are like digital deeds to fractions of a house; you don’t need to buy the whole thing, just a piece, enabling fractional shares. The blockchain acts as a tamper-proof vending machine: when you trade, smart contracts (self-executing code) handle the exchange instantly, settling in seconds via on-chain verification. No more waiting for banks to clear funds. For safety, always use reputable wallets and double-check addresses to avoid scams—think of it as locking your backpack.

Lila: That backpack idea resonates. Now, how does this evolve from Web2? I worry about losing control in centralized apps, like when a platform bans users arbitrarily.

Jon: Precisely. In Web2, companies own your data and can censor or deplatform you. Web3 emphasizes user sovereignty: with tokenized assets, you control them via private keys, not permissions from a central authority. This brings censorship resistance—no one can arbitrarily seize your tokens. Plus, composability means these tokens can plug into other systems, like lending protocols, creating new opportunities. It’s a shift from rented access to true ownership.

Lila: Fascinating. Can you give me some real-world use cases? How might this apply beyond just trading stocks?

Jon: Let’s explore three concrete applications. First, in finance: retail investors can now trade U.S. equities 24/7, buying fractional shares of high-value stocks like they’re slicing a pizza—democratizing access without needing huge capital. Second, in global markets: imagine seamless cross-border trading without time zone barriers, where instant settlement reduces risks like counterparty default. Third, in asset management: tokenized securities could integrate with decentralized identity systems, allowing verified users to manage portfolios across metaverses or virtual economies, blending real-world finance with digital worlds.

Lila: Those examples ground it. To compare, how does this stack up against traditional Web2 services?

Jon: Here’s a clear comparison to highlight the differences.

| Web2 | Web3 / Metaverse |

|---|---|

| Trading limited to market hours (e.g., 9:30 AM – 4 PM ET) | 24/7 trading availability |

| Settlement takes 1-3 business days | Instant on-chain settlement |

| Whole shares only, high barriers for small investors | Fractional shares for broader accessibility |

| Centralized control, potential for censorship | Decentralized ownership, censorship-resistant |

| Intermediaries add fees and delays | Smart contracts reduce middlemen |

Lila: The table really drives it home—Web3 seems more empowering. But are there risks? Like, what if the blockchain gets hacked or regulations change?

Jon: Valid concerns. This technology enables unprecedented access and efficiency, bridging traditional finance with Web3’s transparency. However, unresolved risks include blockchain vulnerabilities (though rare with robust networks), regulatory hurdles—the NYSE needs approvals—and volatility in crypto-backed systems. Always prioritize education over rushing in; observe how it unfolds.

Lila: Thanks, Jon. This makes me want to learn more about Web3 without jumping into investments. What’s the best way to stay informed?

Jon: Focus on reputable sources, experiment with free simulations, and follow developments critically. It’s about building literacy for the future of finance.

References & Further Reading

- NYSE Launches Tokenized Securities Platform To Enable 24/7 Trading, Fractional Shares, And Instant Settlement

- NYSE-parent Intercontinental Exchange develops platform for 24/7 tokenized securities trading | Reuters

- What are tokenized securities? Risks and what to know as stock exchange NYSE embraces the blockchain

▼ AI tools to streamline research and content production (free tiers may be available)

Free AI search & fact-checking

👉 Genspark

Recommended use: Quickly verify key claims and track down primary sources before publishing

Ultra-fast slides & pitch decks (free trial may be available)

👉 Gamma

Recommended use: Turn your article outline into a clean slide deck for sharing and repurposing

Auto-convert trending articles into short-form videos (free trial may be available)

👉 Revid.ai

Recommended use: Generate short-video scripts and visuals from your headline/section structure

Faceless explainer video generation (free creation may be available)

👉 Nolang

Recommended use: Create narrated explainer videos from bullet points or simple diagrams

Full task automation (start from a free plan)

👉 Make.com

Recommended use: Automate your workflow from publishing → social posting → logging → next-task creation

※Links may include affiliate tracking, and free tiers/features can change; please check each official site for the latest details.