In my view, Regulatory Clarity finally bridged the gap for stable, long-term protocol utility.#Web3 #Regulation

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

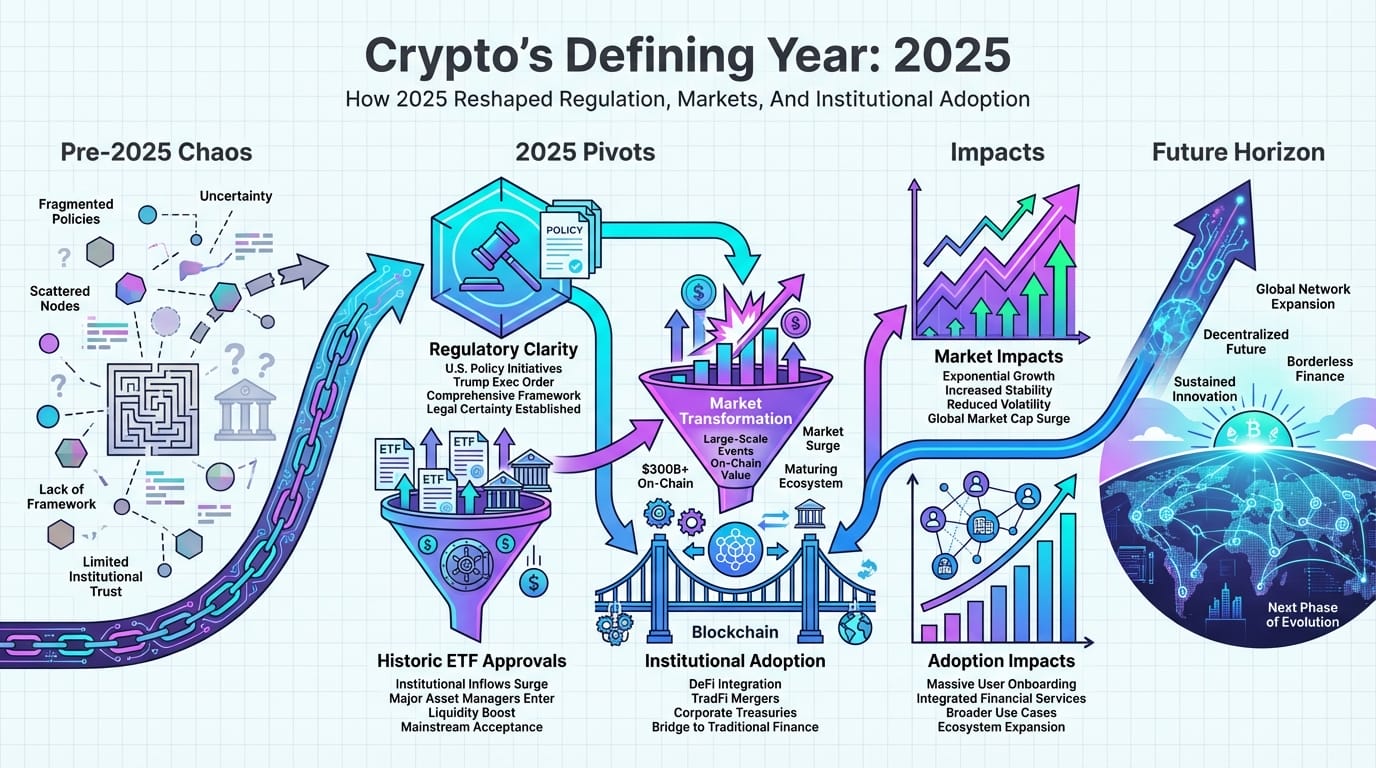

Crypto’s Defining Year: Unpacking 2025’s Regulatory Shifts, Market Evolution, and Institutional Surge

🎯 Difficulty: Advanced

💎 Core Value: Regulatory Clarity / Institutional Adoption / Decentralized Finance

👍 Recommended For: Crypto analysts, institutional investors, blockchain developers

Lila: Jon, I’ve been reading about how 2025 was a pivotal year for crypto, with major regulatory changes and a surge in institutional adoption. As someone who’s followed Web3 trends, what macro forces do you see driving this, and how does it tie into decentralization and trust minimization?

Jon: Absolutely, Lila. 2025 marked a turning point where regulatory frameworks like the EU’s MiCA and the U.S. CLARITY Act provided much-needed clarity, reducing uncertainty for institutions. This isn’t just policy; it’s about minimizing trust in centralized entities. In decentralized systems, trust is distributed via protocols like proof-of-stake consensus, where validators secure networks without a single point of control. Macro trends, such as geopolitical shifts and inflation hedges, pushed institutions toward crypto as a reserve asset, echoing how Bitcoin’s architecture enables censorship-resistant value transfer.

Lila: That makes sense, but how does this evolution from Web2 to Web3 play out in terms of centralized versus decentralized systems? Institutions seem wary of losing control—what changes in 2025 addressed that?

Jon: Great question. Web2 relies on centralized servers controlled by corporations, vulnerable to hacks and censorship. Web3, powered by blockchain, distributes data across nodes, ensuring censorship resistance through immutable ledgers. In 2025, regulations like the GENIUS Act emphasized tokenized assets, allowing institutions to own digital assets directly via smart contracts—self-executing code on chains like Ethereum. This composability lets protocols build on each other, unlike Web2 silos. Ownership shifts from platform-dependent to user-sovereign, with wallets acting as keys to on-chain identities.

Lila: Speaking of mechanisms, can you break down the core technical architecture that enabled this institutional wave? How do things like smart contracts and interoperability factor in?

Jon: Certainly. At the heart is the smart contract—code deployed on blockchains like Ethereum or layer-2 solutions such as Arbitrum, enforcing rules without intermediaries. Consensus mechanisms, like proof-of-stake in Ethereum 2.0, ensure network agreement on transactions, minimizing trust. Interoperability protocols, such as Polkadot’s parachains or Cosmos’ IBC, connected ecosystems, allowing seamless asset transfers. In 2025, this architecture supported institutional tools like tokenized treasuries, where firms used stablecoins for cross-border settlements, driven by regulations that clarified tax reporting under frameworks like the OECD’s CARF.

Lila: Interesting. With that foundation, what are some concrete use cases where these changes in 2025 really shone through? I’m thinking beyond hype—real applications in finance or other sectors.

Jon: Let’s examine three key applications. First, in decentralized finance (DeFi), institutions adopted stablecoins for treasury management. By mid-2025, assets under management in stablecoins hit $350 billion, per market analyses, enabled by regulations like MiCA that standardized issuance. This allowed for efficient, low-cost cross-border payments without traditional banks. Second, in tokenized real-world assets (RWAs), firms like Goldman Sachs tokenized bonds and deposits, using blockchain for fractional ownership and instant settlement. This was catalyzed by U.S. bills redefining digital commodities, reducing SEC overreach. Third, in prediction markets, platforms like those on Polygon leveraged oracle networks for real-time data, with institutional participation growing due to clearer tax transparency rules, fostering data-driven decision-making in volatile markets.

Lila: To visualize the differences, how would you compare traditional Web2 services to these Web3 solutions, especially post-2025 regulations?

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized banking for settlements, prone to delays and fees. | Stablecoin-based cross-border transfers via smart contracts, instant and low-cost. |

| Platform-owned data in social media, vulnerable to censorship. | Decentralized identities with user-controlled data on blockchains, resistant to single-point control. |

| Traditional asset management with intermediaries and high barriers. | Tokenized RWAs enabling fractional ownership and composable finance ecosystems. |

| Regulated by fragmented national laws, slowing innovation. | Harmonized frameworks like MiCA and CLARITY Act, accelerating institutional entry. |

Lila: That’s a helpful comparison. As we look back, what unresolved risks remain, and how should readers approach this evolving space?

Jon: In summary, 2025’s regulations enabled Web3 to scale through trust-minimized architectures, empowering institutional adoption in DeFi, RWAs, and beyond. However, risks like smart contract vulnerabilities—think reentrancy attacks—and regulatory inconsistencies persist. Scalability issues in layer-1 chains could lead to congestion, and geopolitical factors might introduce volatility. The key is understanding: these technologies enable true digital sovereignty, but they demand vigilance against centralization creep in supposedly decentralized systems.

Lila: True—it’s exciting, but grounded learning is essential. What one question should readers ask themselves as they observe 2026’s developments?

Author Profile: Jon is a Web3 & AI researcher focused on blockchain architecture. Lila represents the curious reader, bridging gaps in understanding.

References & Further Reading

- Crypto’s Defining Year: How 2025 Reshaped Regulation, Markets, And Institutional Adoption

- Goldman Sachs Sees Regulation Driving Next Wave of Institutional Crypto Adoption

- Regulatory Clarity as the Catalyst for Institutional Crypto Adoption in 2026

- 2025 Crypto Regulatory Round-Up