In my view, tokenized equities offer a practical path for modernizing asset ownership systems#TokenizedEquities #BlockScholes

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Decoding the Block Scholes Report: The Rapid Rise of Tokenized Equities and Bitget’s Market Influence

🎯 Difficulty: Advanced

💎 Core Value: Decentralized Ownership / Asset Tokenization / Market Liquidity

👍 Recommended For: Blockchain developers, financial analysts, Web3 investors exploring real-world asset integration

Lila: Jon, I’ve been reading about this Block Scholes report on the fast growth of tokenized equities, and it mentions Bitget’s expanding role in the market. As someone who’s dabbled in Web3 but wants a deeper dive, can you break down the macro trends here? How does this fit into the broader shift toward decentralized finance?

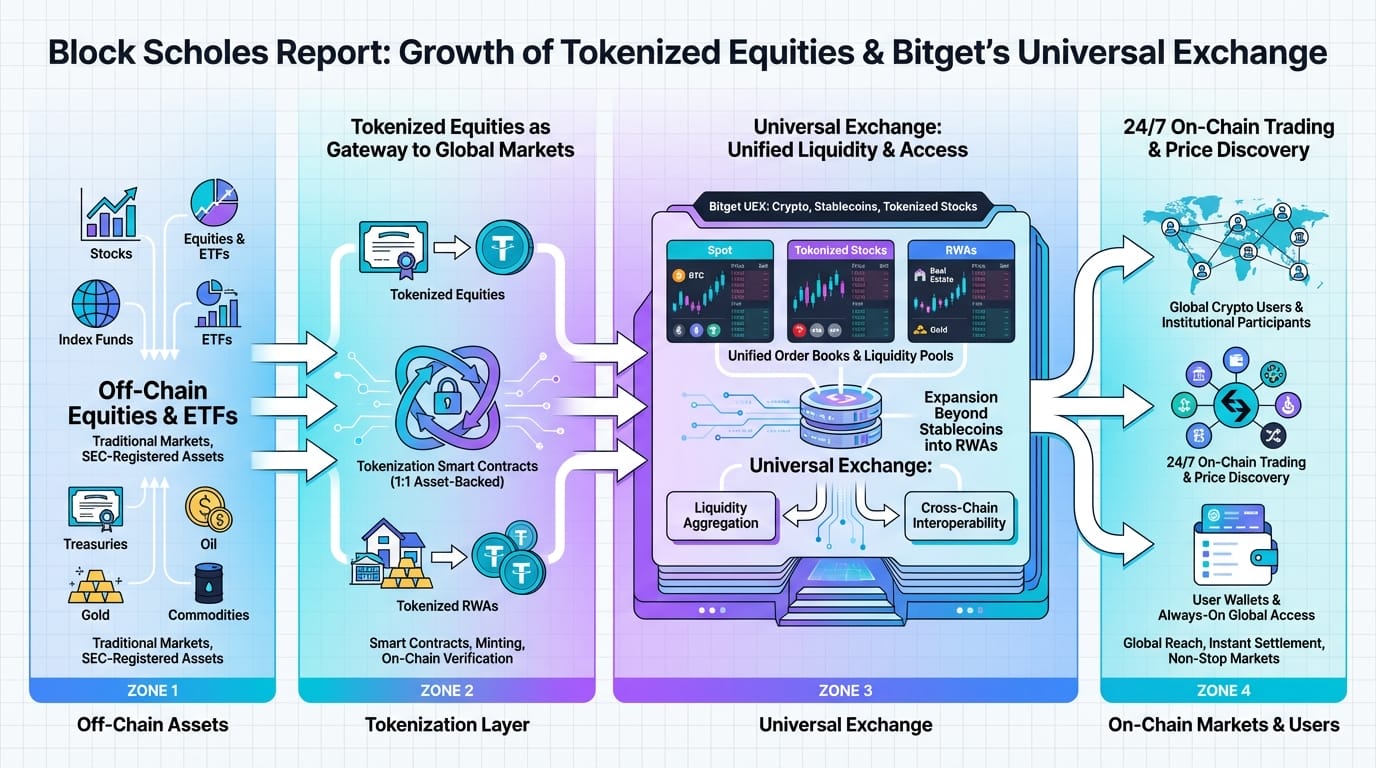

Jon: Absolutely, Lila. The Block Scholes report, as detailed in sources like Metaverse Post, underscores a pivotal trend in Web3: the tokenization of traditional equities. This isn’t just hype; it’s about restructuring financial architecture through blockchain. At its core, tokenization involves representing real-world assets—like stocks—as digital tokens on a blockchain, enabling fractional ownership, 24/7 trading, and enhanced liquidity. Macro trends show tokenized markets expanding rapidly, with projections indicating significant growth by 2026, driven by platforms like Bitget’s Universal Exchange model. This aligns with decentralization logic, where trust is minimized through smart contracts and distributed ledgers, reducing reliance on centralized intermediaries.

From Web2 Limitations to Web3 Evolution

Lila: That makes sense, but I’m curious about the evolution from Web2 to Web3 in this context. Traditional stock markets feel so rigid—limited hours, high barriers. How does tokenization address those, and what’s the decentralization angle?

Jon: Great question. In Web2, centralized systems like stock exchanges control everything: data, transactions, and access. This leads to issues like censorship, single points of failure, and limited global participation. Web3 flips this with decentralized protocols. Tokenized equities, for instance, use blockchain to ensure true ownership—you hold the token in your wallet, not a custodian’s database. Censorship resistance means no single entity can halt trades, and composability allows these tokens to integrate with other DeFi tools, like lending protocols. The report highlights how Bitget facilitates this by providing liquidity for tokenized stocks, bridging traditional finance (TradFi) and crypto ecosystems.

Core Mechanisms of Tokenized Equities

Lila: Let’s get technical. What are the underlying mechanisms? How do token designs and architectures enable this growth, especially with platforms like Bitget mentioned in the report?

Jon: Tokenized equities typically leverage standards like ERC-20 for fungible tokens or ERC-721/1155 for more unique assets, but for equities, we’re often dealing with ERC-3643 or similar for compliant security tokens. The architecture involves oracles for real-time price feeds, ensuring the token mirrors the underlying asset’s value. Decentralization logic here minimizes trust: smart contracts handle issuance, transfer, and redemption without intermediaries. Bitget’s role, as per the report, is in providing a Universal Exchange (UEX) model that aggregates liquidity across chains, using layer-2 solutions for scalability. This reduces gas fees and enables cross-chain interoperability, key for ecosystem roles where tokenized assets can be collateralized in DeFi protocols.

Lila: I see— so it’s about building composable systems. But what about risks in the technical architecture? Like smart contract vulnerabilities?

Jon: Precisely. Architectural trade-offs include security vs. efficiency. Audits are crucial, as exploits can lead to losses. The report notes growth in tokenized gold trading spiking 4,900%, but this relies on robust oracle networks to prevent manipulation. Decentralization ensures no single point of failure, but it requires strong consensus mechanisms, like proof-of-stake in Ethereum, to maintain integrity.

Real-World Use Cases

Lila: Can you give me some concrete applications? How is this playing out in finance, and maybe beyond?

Jon: Sure. First, in decentralized finance (DeFi), tokenized equities allow users to trade stocks 24/7 without traditional brokers, as seen in Bitget’s spot volume crossing $1B. This democratizes access, especially in emerging markets. Second, for asset management, platforms enable fractional ownership—think owning a sliver of Apple stock via tokens, integrated with yield farming. Third, in cross-border payments, tokenized equities facilitate instant settlement, reducing the days-long clearing times in Web2 systems. The report emphasizes Bitget’s collaboration with Ondo for adding 98 US stocks and ETFs, expanding this to multi-asset trading.

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized exchanges with limited hours and KYC barriers | 24/7 decentralized trading with pseudonymity and global access |

| Custodial ownership; assets held by platforms | Self-custody via wallets; true digital ownership |

| High fees and slow settlements | Low-cost, instant transactions via smart contracts |

| Prone to censorship and downtime | Censorship-resistant with high uptime through distributed nodes |

| Limited interoperability between asset classes | Composability for integrating equities with DeFi tools |

Wrapping Up: Enables and Risks

Lila: This report paints an exciting picture of growth, but what’s the balanced view? What does this enable long-term, and what risks remain?

Jon: Tokenized equities enable a more inclusive financial system, with the report projecting blockchain as the foundation for institutional markets by 2026. It empowers users with ownership and liquidity, but unresolved risks include regulatory uncertainty—tokens must comply with securities laws—and scalability issues on base layers. Volatility in crypto markets can affect tokenized assets too. Overall, it advances decentralization, but users should focus on understanding protocols over speculation.

Lila: Thanks, Jon. It leaves me wondering: how can readers stay informed without getting lost in the noise?

Jon: Prioritize learning core concepts like smart contract auditing and token standards. Observe ecosystem developments through reputable analyses, and experiment safely with testnets to build literacy.

References & Further Reading

- Block Scholes Report Highlights Fast Growth Of Tokenized Equities And Bitget’s Expanding Market Role

- Block Scholes Report on Tokenized Stocks Growth

- Bitget UEX & Tokenized Stocks: Block Scholes Report

- Ethereum Glossary for Token Standards

- The Block Research on Blockchain Trends

▼ AI tools to streamline research and content production (free tiers may be available)

Free AI search & fact-checking

👉 Genspark

Recommended use: Quickly verify key claims and track down primary sources before publishing

Ultra-fast slides & pitch decks (free trial may be available)

👉 Gamma

Recommended use: Turn your article outline into a clean slide deck for sharing and repurposing

Auto-convert trending articles into short-form videos (free trial may be available)

👉 Revid.ai

Recommended use: Generate short-video scripts and visuals from your headline/section structure

Faceless explainer video generation (free creation may be available)

👉 Nolang

Recommended use: Create narrated explainer videos from bullet points or simple diagrams

Full task automation (start from a free plan)

👉 Make.com

Recommended use: Automate your workflow from publishing → social posting → logging → next-task creation

※Links may include affiliate tracking, and free tiers/features can change; please check each official site for the latest details.