Personally, Prediction Markets relying on decentralized logic ensure greater data integrity.#Web3 #Blockchain

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Demystifying Crypto Event Prediction Markets: Top Platforms Shaping 2026

🎯 Difficulty: Advanced

💎 Core Value: Decentralized Forecasting / Trustless Betting / Composability

👍 Recommended For: Blockchain developers, financial analysts, and decentralized app enthusiasts

Lila: Jon, with all the buzz around prediction markets in crypto, especially as we look toward 2026, I’m curious about the macro trends. How are these platforms evolving in a decentralized ecosystem, and what role do they play in trust minimization?

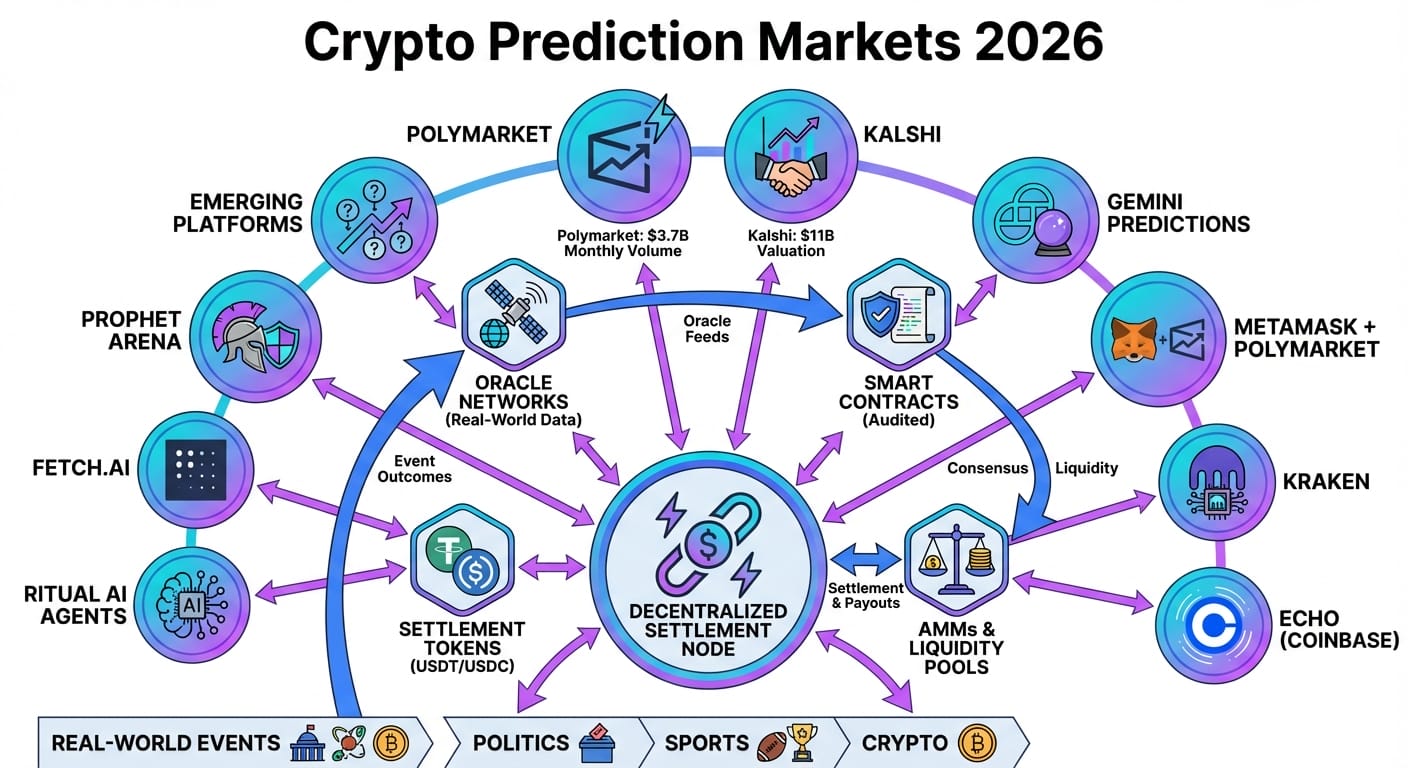

Jon: Absolutely, Lila. Prediction markets are a fascinating intersection of finance, data, and blockchain architecture. In the broader Web3 landscape, they’re shifting from centralized betting systems to decentralized protocols that minimize trust through smart contracts and token incentives. Macro trends point to increased adoption driven by regulatory clarity, like the EU’s MiCA framework, and integrations with AI for better forecasting. These platforms enable users to bet on event outcomes—think elections, sports, or crypto upgrades—using crypto assets, with outcomes resolved via oracles or community consensus. This reduces reliance on central authorities, enhancing transparency and reducing counterparty risk.

Lila: That makes sense for experienced Web3 users, but how does this evolution from Web2 to Web3 change things? In traditional betting, everything’s controlled by a company— what’s the decentralized twist here?

Jon: Great question. In Web2, prediction or betting platforms like traditional sportsbooks are centralized: a single entity controls odds, holds funds, and decides resolutions, which can lead to censorship, manipulation, or data silos. Web3 flips this with decentralized ledgers and smart contracts. Ownership shifts to users via cryptographic keys, ensuring assets are self-custodied. Censorship resistance comes from blockchain’s immutability—no single party can alter bets or outcomes. Composability allows these markets to integrate with other protocols, like DeFi lending for leveraged positions or NFTs for unique event tickets. This creates a more resilient system where trust is coded into the protocol, not a corporation.

Lila: Okay, diving deeper: what are the core mechanisms? For someone familiar with Web3, how do token designs and architectures support these prediction markets?

Jon: At the heart are smart contracts, often built on Ethereum or layer-2 solutions like Arbitrum for scalability. A typical architecture involves ERC-20 tokens for betting liquidity and ERC-721 for unique market positions. Decentralization logic relies on oracles (e.g., Chainlink) for real-world data feeds to resolve outcomes trustlessly. Token design might include governance tokens for DAO voting on market parameters, or utility tokens that reward accurate predictions, aligning incentives via game theory. For instance, prediction resolution uses automated scripts to distribute winnings based on consensus, minimizing disputes. Ecosystem roles include liquidity providers who earn fees, and integrators who compose with other dApps for hybrid finance tools.

Lila: Can you break down some use cases? I’d like to hear about three concrete applications where these platforms shine in 2026.

Jon: Certainly. First, in finance: Platforms enable hedging against market events, like Bitcoin price predictions, where users lock tokens in smart contracts for automated payouts—think of it as decentralized options trading. Second, in governance and events: Crypto communities use them for protocol upgrade forecasts, with tokens voting on outcomes, fostering collective intelligence. Third, in real-world predictions: Sports or political events, where AI integrations analyze data for better odds, and tokenomics reward participants for accurate crowd-sourced insights. These applications leverage Web3’s interoperability, allowing seamless cross-chain bets via bridges.

| Web2 | Web3 / Metaverse |

|---|---|

| Centralized betting sites control user funds and resolutions, prone to hacks or shutdowns. | Decentralized protocols with self-custody and smart contract automation ensure trustless execution. |

| Limited to fiat, with high fees and geographic restrictions. | Crypto-native, borderless access with low fees via layer-2 scaling. |

| Data silos; users can’t port bets or integrate with other services. | Composability allows integration with DeFi, NFTs, and metaverse economies. |

| Relies on company trust for fair odds and payouts. | Game-theoretic incentives and oracles for verifiable, manipulation-resistant outcomes. |

Lila: Now, tying this back to the article— “10 Platforms Powering Crypto Event Prediction Markets In 2026.” What are these platforms, and how do their architectures stand out?

Jon: Based on current trends, here are ten key platforms shaping this space in 2026, each with unique technical architectures. 1. Polymarket: Built on Polygon for low-cost transactions, it uses USDC for stable betting and Chainlink oracles for resolution, emphasizing scalability with layer-2 rollups. 2. Kalshi: A hybrid model with CFTC regulation, integrating blockchain for event contracts and focusing on fiat-crypto bridges. 3. Augur: An early Ethereum-based pioneer with REP tokens for reporting outcomes, relying on decentralized dispute resolution. 4. Gnosis: Leverages OWL tokens for governance and conditional tokens for complex markets, excelling in composability with DeFi. 5. Omen: A DEX for predictions on xDAI chain, using reality.eth oracles for trustless settlements. 6. Hedgehog Markets: Focuses on Solana for high-speed trades, with token designs rewarding liquidity providers. 7. Azuro: Protocol for sports betting on EVM chains, with layered incentives for bookmakers and bettors. 8. Zeitgeist: Built on Polkadot, it offers parachain interoperability for cross-chain predictions. 9. Flux: AI-enhanced markets on Songbird network, integrating machine learning for dynamic odds. 10. TotemFi: Uses TOTM tokens for prediction pools, with staking mechanisms to penalize inaccurate forecasts. These platforms vary in tokenomics—some use veTokens for locked governance, others LP tokens for fees—but all prioritize decentralization to outpace traditional models.

Lila: Impressive list. Are there any risks or challenges these platforms might face as we head into 2026?

Jon: Definitely. While they enable efficient, trust-minimized forecasting, risks include oracle failures leading to incorrect resolutions, regulatory hurdles like varying global laws on crypto betting, and scalability issues during high-volatility events. Smart contract vulnerabilities could expose funds, so audits and formal verification are crucial. On the positive side, they democratize access to predictive intelligence, potentially rivaling traditional polls in accuracy through market incentives.

Lila: Wrapping up, what should readers take away? Is this the future of forecasting, or just another trend?

Jon: In summary, these platforms empower decentralized, composable prediction ecosystems that minimize trust and maximize user sovereignty. They enable novel applications in finance, governance, and events, but come with risks like volatility and regulation. The key is understanding the underlying architecture—focus on learning protocols, not speculation. Observe how they evolve, experiment with testnets, and contribute to open-source if you’re inclined.

Lila: That leaves me pondering: How might everyday users start engaging without getting overwhelmed by the tech?

References & Further Reading

- 10 Platforms Powering Crypto Event Prediction Markets In 2026

- Prediction markets explode in 2025: Inside the Kalshi-Polymarket duopoly and challengers | The Block

- Tokenization and AI: Sport and prediction markets betting

- Decentralized Prediction Markets Platform Kalshi Could Challenge Traditional Inflation Forecasting Models | Crowdfund Insider