In my view, Veera simplifies complex cross-chain interactions for everyday users.#Veera #Interoperability

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “MetaverseTrendsHub,” which delivers daily news.

https://www.youtube.com/@MetaverseTrendsHub

Read this article in your native language (10+ supported) 👉

[Read in your language]

Decoding Veera’s Push into Cross-Chain Finance: Technical Insights on Interoperability and DeFi Scaling

🎯 Difficulty: Advanced

💎 Core Value: Interoperability / Decentralization / Financial Inclusion

👍 Recommended For: DeFi developers, blockchain architects, Web3 investors seeking protocol-level analysis

Lila: Jon, with all the macro trends in Web3 like increasing regulatory scrutiny and the push for scalable DeFi, how does something like Veera’s recent funding and tech stack fit into the broader picture of decentralization and trust minimization?

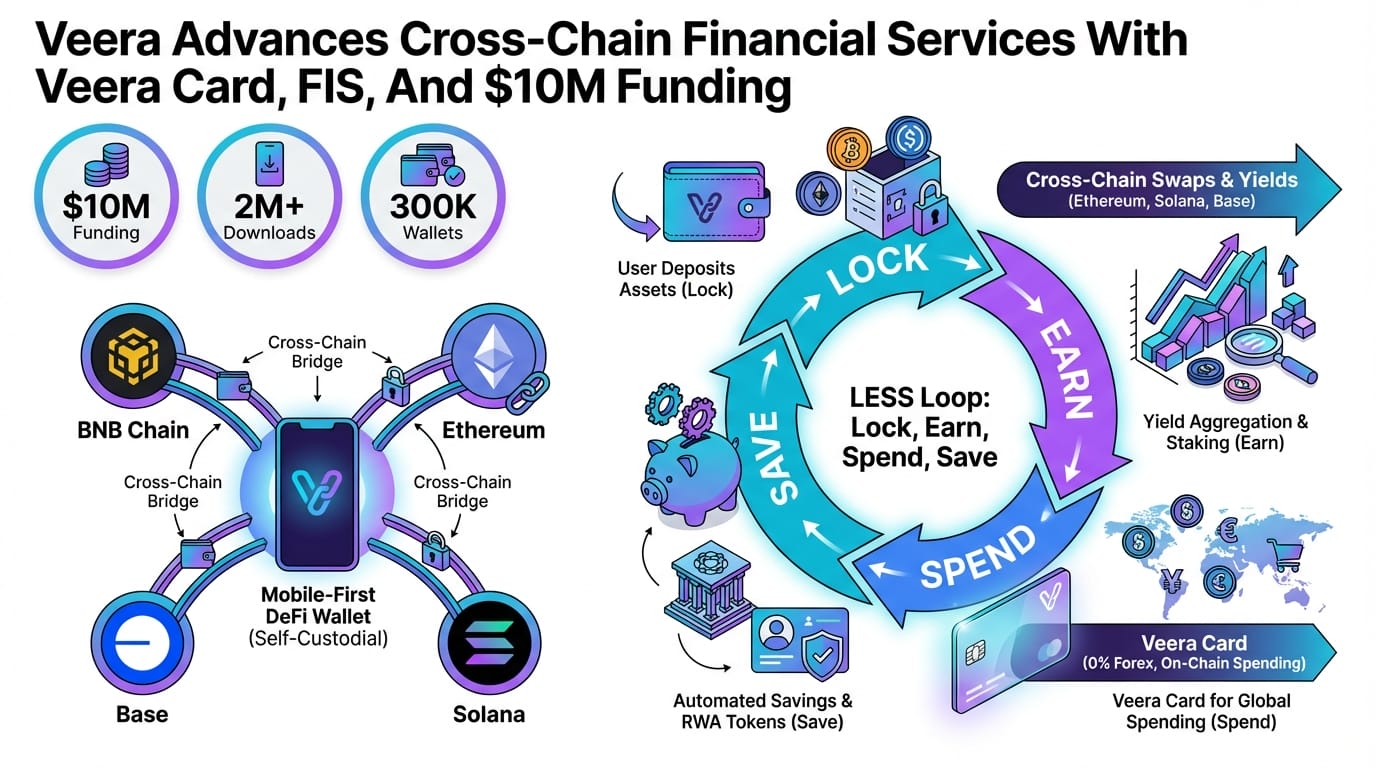

Jon: That’s a sharp entry point, Lila. Veera positions itself as an on-chain neobank, essentially bridging traditional finance with decentralized protocols. From a macro perspective, we’re seeing a shift toward trust-minimized systems, where users don’t rely on centralized intermediaries for custody or transactions. Veera’s $10M funding, backed by firms like Sigma Capital and CMCC Titan Fund, signals investor confidence in scaling cross-chain services. This reduces trust in single points of failure by leveraging blockchain’s immutable ledgers and smart contracts, enabling global access without traditional banking gatekeepers.

Lila: Interesting. But let’s contrast this with Web2. How does Veera’s approach evolve from centralized financial systems to something more decentralized?

Jon: Absolutely, the evolution is key. In Web2, financial services are centralized—think banks controlling your funds, with censorship risks like account freezes or data breaches. Veera embodies Web3’s principles: user ownership via self-custodial wallets, censorship resistance through distributed ledgers, and composability, where protocols can interoperate seamlessly. For instance, Veera’s cross-chain capabilities allow assets to move between blockchains without centralized exchanges, minimizing counterparty risk and enhancing liquidity. This isn’t just theoretical; it’s about architectural shifts from siloed databases to permissionless networks.

Lila: That makes sense structurally. Can you break down the core mechanisms behind Veera’s tech, like the Veera Card and cross-chain integration? I’m thinking about the technical architecture here.

Jon: Sure, let’s dive into the architecture. Veera operates as a mobile-first DeFi platform, using cross-chain bridges and protocols for interoperability—likely building on standards like those from LayerZero or Axelar for secure asset transfers across ecosystems. The Veera Card, integrated with FIS (a fintech provider for payment processing), acts as a debit-like tool for spending crypto in fiat environments, abstracting away complexities like gas fees via account abstraction (EIP-4337 inspired). Technically, this involves smart contracts for on-chain settlements, ensuring decentralization while interfacing with off-chain rails. Funding-wise, the $10M accelerates this, focusing on scalability through optimizations like rollups for lower costs and higher throughput.

Visualizing the Architecture

Lila: The diagram helps visualize the layers. Now, from an ecosystem role perspective, what token design or decentralization logic does Veera employ to ensure sustainability?

Jon: Veera’s design likely incorporates utility tokens for governance or rewards, aligning with DAO-like structures for community input on protocol upgrades. Decentralization logic here minimizes trust by using consensus mechanisms like proof-of-stake across supported chains, ensuring no single entity controls the network. Technically, this could involve zero-knowledge proofs for private cross-chain transactions, enhancing privacy without sacrificing verifiability. The ecosystem role is as an aggregator, composing DeFi primitives like lending protocols or DEXs into a unified interface, reducing fragmentation in Web3 finance.

Lila: Speaking of applications, what are some concrete use cases where Veera’s tech shines, especially in finance and beyond?

Jon: Let’s outline three. First, in decentralized finance: Veera enables seamless cross-chain lending, where users borrow against assets on Ethereum and repay via Solana, leveraging oracles for price feeds and automated smart contracts for execution. This expands liquidity pools without centralized custodians. Second, for digital identity: The platform could integrate self-sovereign identities, allowing users to verify credentials on-chain without revealing personal data, using standards like DID (Decentralized Identifiers). Third, in global remittances: With the Veera Card, users in underbanked regions convert crypto earnings to fiat spendables, bypassing high-fee intermediaries and promoting financial inclusion through low-cost, borderless transfers.

Lila: To make this tangible, how does this stack up against traditional Web2 services in a direct comparison?

Jon: A comparison highlights the paradigm shift. Here’s a structured breakdown:

| Aspect | Traditional Web2 Services | Web3 / Metaverse Solutions (e.g., Veera) |

|---|---|---|

| Data Ownership | Controlled by platforms like banks, vulnerable to breaches. | User-owned via wallets and private keys, with on-chain immutability. |

| Transaction Costs | High fees for cross-border transfers, intermediary-dependent. | Optimized via layer-2 solutions, often near-zero for micro-transactions. |

| Interoperability | Siloed systems requiring multiple apps or conversions. | Cross-chain bridges enable seamless asset movement and composability. |

| Censorship Resistance | Subject to regulatory shutdowns or account restrictions. | Distributed nodes ensure no single point of failure or control. |

| Scalability | Limited by server capacity and geographic constraints. | Horizontal scaling through sharding and rollups for high throughput. |

Lila: This table really clarifies the advantages. Wrapping up, what does Veera ultimately enable in the Web3 landscape, and what risks remain unresolved?

Jon: Veera enables a more inclusive financial ecosystem by democratizing access to DeFi tools, fostering innovation in cross-chain applications, and reducing reliance on traditional finance. It empowers users with true ownership and interoperability. However, risks like smart contract vulnerabilities, oracle manipulations, and regulatory uncertainties persist—architects must prioritize audits and decentralized oracles. The key is ongoing evolution toward robust, trustless systems.

Lila: So, for readers diving deeper, what’s the best mindset—to experiment or just observe these developments?

Jon: Observe and learn first. Understand the protocols, audit the code if possible, and engage with communities to grasp real-world implications. Web3 is about literacy, not rushed participation.

References & Further Reading

- Veera Advances Cross-Chain Financial Services With Veera Card, FIS, And $10M Funding

- Veera Raises $10M for On-Chain Neobank Development

- Ethereum Glossary on Smart Contracts and Decentralization

- Hyperledger Resources on Cross-Chain Interoperability

▼ AI tools to streamline research and content production (free tiers may be available)

Free AI search & fact-checking

👉 Genspark

Recommended use: Quickly verify key claims and track down primary sources before publishing

Ultra-fast slides & pitch decks (free trial may be available)

👉 Gamma

Recommended use: Turn your article outline into a clean slide deck for sharing and repurposing

Auto-convert trending articles into short-form videos (free trial may be available)

👉 Revid.ai

Recommended use: Generate short-video scripts and visuals from your headline/section structure

Faceless explainer video generation (free creation may be available)

👉 Nolang

Recommended use: Create narrated explainer videos from bullet points or simple diagrams

Full task automation (start from a free plan)

👉 Make.com

Recommended use: Automate your workflow from publishing → social posting → logging → next-task creation

※Links may include affiliate tracking, and free tiers/features can change; please check each official site for the latest details.